Vea también

11.04.2025 06:15 PM

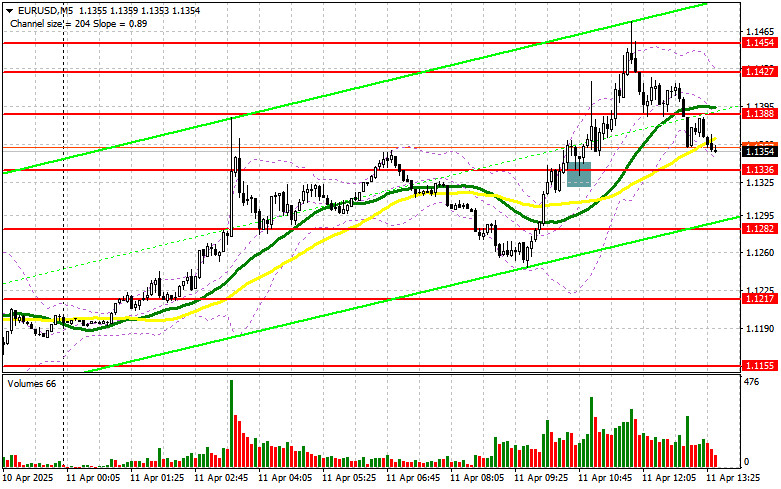

11.04.2025 06:15 PMIn my morning forecast, I focused on the 1.1336 level and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened. A breakout and subsequent retest of this range provided a strong buy signal for the euro, continuing the bullish trend observed since yesterday, which resulted in the pair rising by more than 100 points. The technical picture was revised for the second half of the day.

To Open Long Positions on EUR/USD:

During the U.S. session, data is expected on the Producer Price Index (PPI) for March, the University of Michigan Consumer Sentiment Index, and inflation expectations. FOMC member John Williams is also scheduled to speak. A decline in inflation will further weaken the dollar, boosting risk assets including the euro. However, if inflation rises, pressure will shift to the euro, potentially pushing the pair lower.

In that case, only a false breakout near the support at 1.1322 will serve as a reason to buy EUR/USD in anticipation of a continuation of the bullish market with a target of updating 1.1393. A breakout and retest of this range will confirm a proper entry point for long positions, targeting 1.1467, which is the yearly high. The ultimate target will be 1.1562, where I will take profit.

If EUR/USD declines and there is no activity around 1.1322, pressure on the euro may intensify by the end of the week. In this scenario, bears may push the pair down to 1.1253. I will only consider buying after a false breakout forms at that level. I also plan to open long positions on a rebound from 1.1167, targeting an intraday upward correction of 30–35 points.

To Open Short Positions on EUR/USD:

If U.S. inflation data indicates easing price pressures, sellers—just like yesterday—will struggle. Only a false breakout around 1.1393 will offer an opportunity for short positions with a target of pulling the pair down to the support at 1.1322, which was formed earlier today. A breakout and consolidation below this range would be a valid signal for selling, targeting 1.1253. The ultimate downward target will be 1.1167, where I plan to lock in profits.

If EUR/USD makes another move up during the second half of the day and bears remain inactive near 1.1393, buyers may return to weekly highs. In this case, I'll wait for the next resistance at 1.1467 to be tested. I'll only sell there after an unsuccessful consolidation. If there's no downward movement even at that level, I'll look for short entries at 1.1562, expecting a 30–35 point intraday correction.

COT (Commitment of Traders) Report:

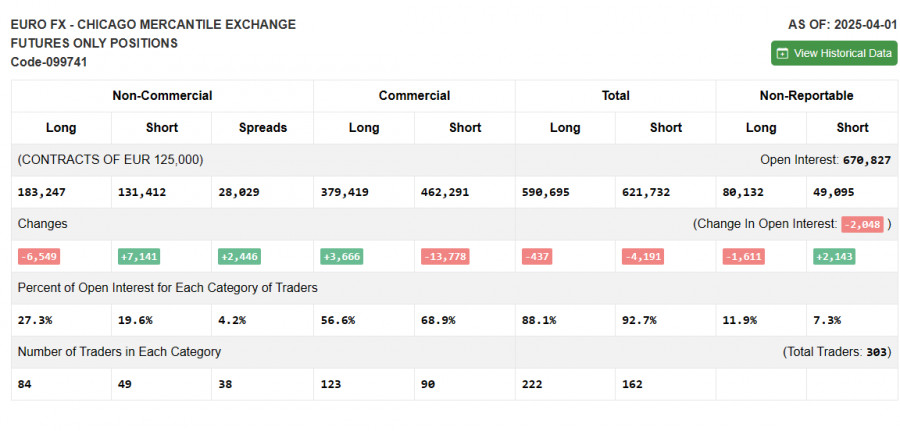

The COT report for April 1 showed a slight increase in short positions and a decrease in long positions. However, this report doesn't take into account the new U.S. trade tariffs on key partners or the latest March U.S. labor market data. Therefore, detailed analysis of the changes in positions is not very meaningful, as it does not reflect the current reality.

According to the report, long non-commercial positions fell by 6,549 to 183,247 and short non-commercial positions rose by 7,141 to 131,412. The gap between long and short positions widened by 2,466.

Indicator Signals:

Moving Averages:

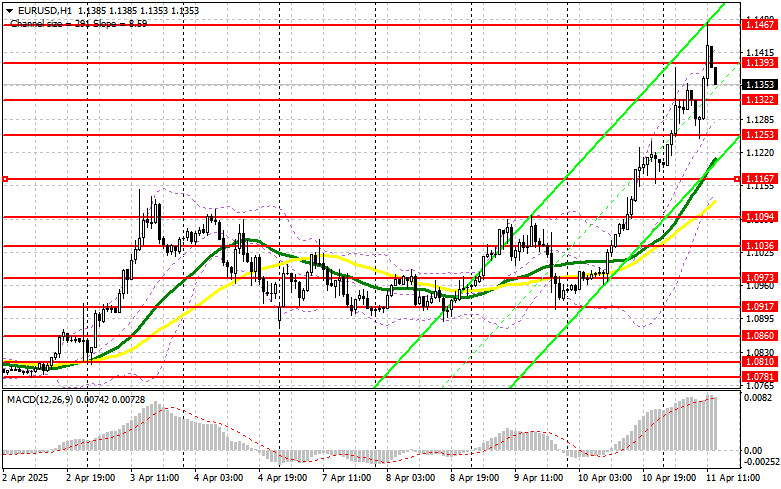

Trading is taking place above the 30- and 50-day moving averages, indicating euro buyers remain in control.

Note: The author analyzes moving averages on the H1 (hourly) chart, which differs from traditional definitions on the D1 (daily) chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator near 1.1167 will serve as support.

Indicator Descriptions:

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

GBP/USD: plan para la sesión europea del 22 de abril. Informes Commitment of Traders (COT) (análisis de las operaciones de ayer). La libra no pierde la esperanza de un nuevo

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos qué sucedió. En mi pronóstico de la mañana presté atención al nivel

Ayer no se formaron puntos de entrada normales al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino llamé la atención sobre

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que sucedió. En mi pronóstico matutino llamé la atención sobre el nivel

Ayer no se formaron puntos de entrada normales al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel de 1.1341

Ayer no se formaron puntos normales de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que sucedió. En mi pronóstico matutino presté atención al nivel

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que sucedió. En mi pronóstico matutino presté atención al nivel de 1.1377

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel de 1.2842

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel de 1.1086

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.