Vea también

10.04.2025 12:19 PM

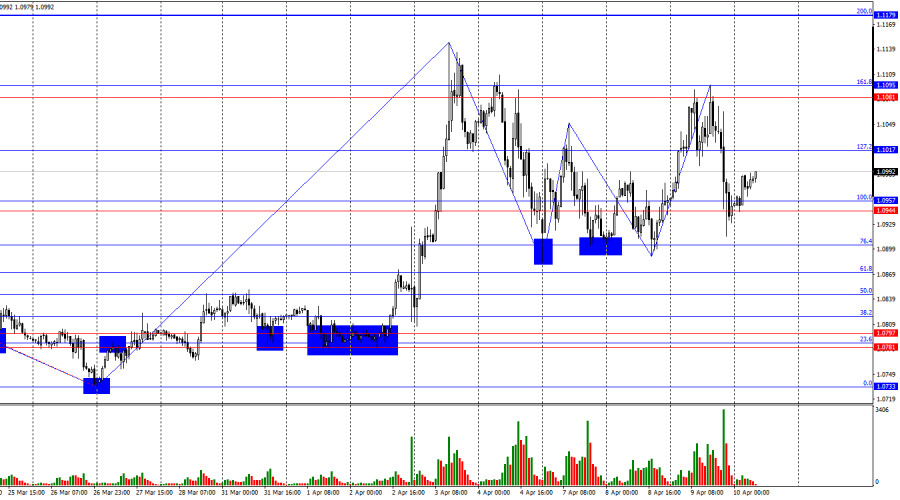

10.04.2025 12:19 PMOn Wednesday, the EUR/USD pair made two rebounds from the resistance zone of 1.1081–1.1095, turned in favor of the U.S. dollar, and declined toward the support zone of 1.0944–1.0957. A rebound from this zone will favor the euro and could trigger a resumption of growth toward the 1.1081–1.1095 level. For now, I do not anticipate a deeper decline, although much depends on the informational background, which, thanks to Trump, remains highly volatile.

The wave pattern on the hourly chart has changed. The last completed downward wave did not break the previous low, while the new upward wave broke the previous peak. Therefore, the waves now suggest a reversal to a bullish trend. Donald Trump continues to impose new import tariffs, and panic and chaos persist in the markets. Bulls became more active again last week, but at the moment, it is hard to say who truly has the initiative—conditions are changing too rapidly.

The news background on Wednesday again had a direct impact on trader sentiment. There was a flood of headlines, and traders at times didn't know what to react to. First, Donald Trump raised tariffs on Chinese imports to 125% in response to China's decision to raise tariffs on U.S. goods to 84%. Later in the evening, it was announced that Trump decided to implement a three-month negotiation pause for all countries except China. The pause is mostly symbolic, as tariffs will still remain in effect, albeit at a reduced "preferential" rate of 10%. For the dollar, which has lacked positive news lately, even this development was welcomed. Still, the bears were unable to mount sustained pressure, as the broader situation remains unchanged. Trump's goodwill on Wednesday evening does not mean the trade war is over, nor that peace and friendship have been restored. Knowing Trump, he could cancel the preferential period and raise all tariffs again as soon as next week.

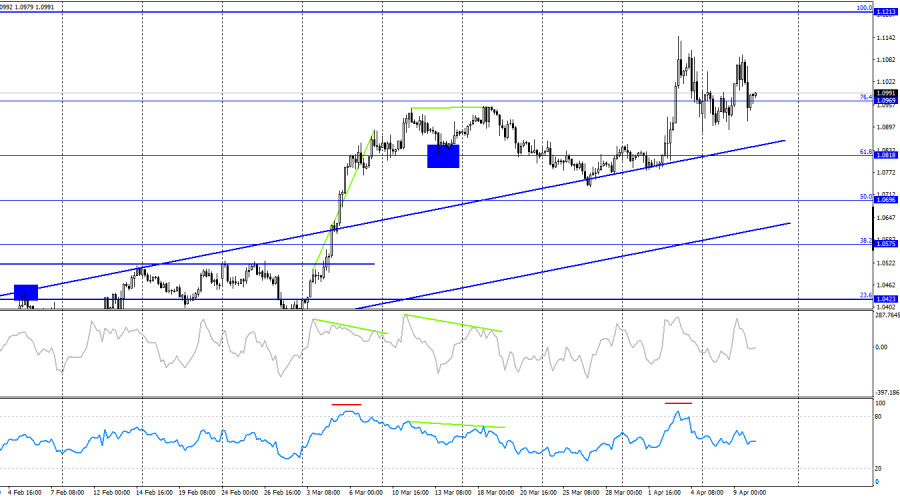

On the 4-hour chart, the pair reversed in favor of the U.S. dollar, but the future direction will depend on how global events unfold. The trade war, in the full sense of the term, has only just begun. Therefore, I cannot base expectations for the pair's growth or decline solely on existing information. Market movements will be dictated exclusively by the incoming news flow. However, the bullish trend remains intact.

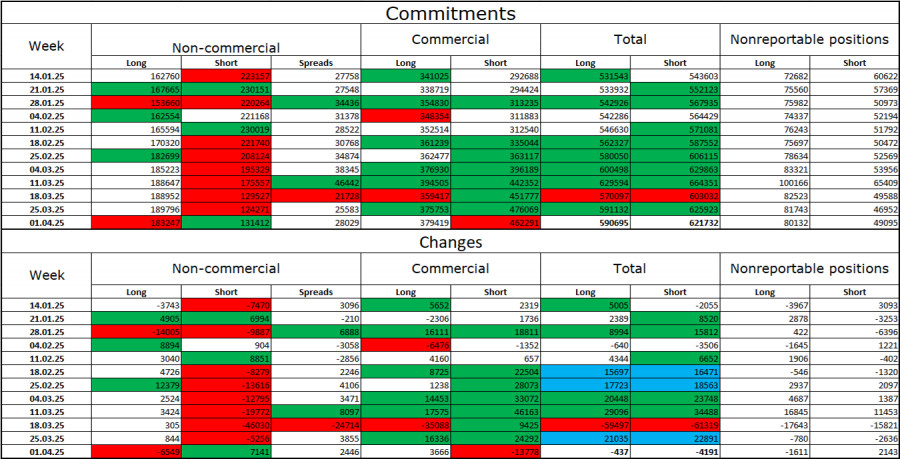

Commitments of Traders (COT) Report:

Over the past reporting week, professional traders closed 6,549 long positions and opened 7,141 short positions. Sentiment in the "Non-commercial" category has recently turned bullish again—thanks to Donald Trump. The total number of long positions held by speculators now stands at 183,000, while short positions are at 131,000.

For twenty consecutive weeks, large players had been selling off the euro, but now for eight weeks straight, they have been reducing short positions and increasing long ones. The divergence in monetary policy approaches between the ECB and the Fed continues to support the U.S. dollar, but Trump's policy has become a more significant factor for traders, as it may exert dovish pressure on the Fed's stance and even trigger a recession in the U.S. economy.

Economic Calendar for the U.S. and the EU:

On April 10, the economic calendar includes two U.S. reports, one of which is relatively important. Thus, the informational background may strongly influence market sentiment on Thursday, but any news about tariffs will remain the primary driver. On Wednesday, China announced an 84% tariff on imports from the U.S., and the U.S. responded with a 125% hike. Tensions continue to escalate.

EUR/USD Forecast and Trading Tips:

Consider buying or selling the pair today only if clear signals appear near key levels on the hourly chart. However, I would once again emphasize that movements will depend more on the news cycle than on chart patterns.

Fibonacci levels are drawn from 1.0957–1.0733 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Gráfico Forex

versión web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.