Vea también

On Friday, the EUR/USD currency pair continued to trade within the horizontal channel, where it has been consolidating for about three weeks. From a technical perspective, nothing has changed for the EUR/USD pair. Last week, only two events had the potential to impact the pair's movement significantly, but both turned out to be rather lackluster. November's U.S. inflation report showed exactly the figures the market expected, and the European Central Bank meeting delivered the anticipated outcomes.

We consider Christine Lagarde's and the entire ECB's tone to be dovish. As such, we continue to expect further declines in the euro. This upcoming week will feature plenty of macroeconomic and fundamental events, but it's important to note that significant events do not guarantee trend movements. The pair remains in a flat range, and the price must first exit the horizontal channel before any trend continuation or correction can be determined.

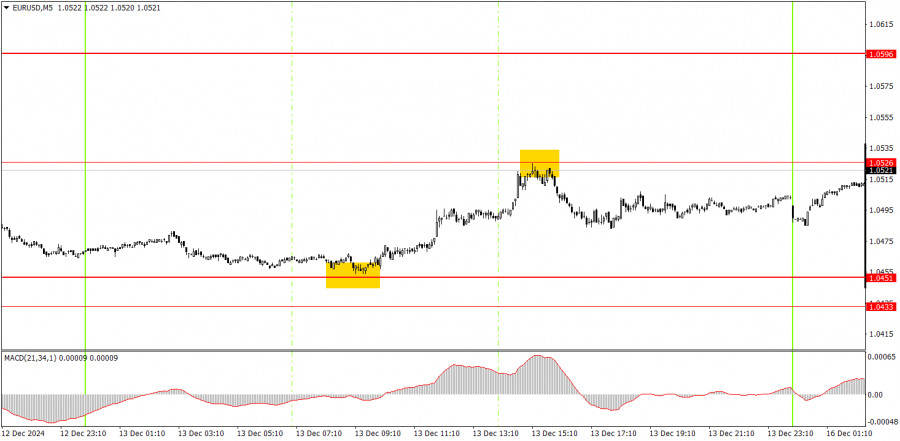

Two excellent trading signals were generated on Friday in the 5-minute timeframe. First, the price rebounded from the 1.0451 level to the 1.0526 level. A long position could have earned novice traders around 40 pips, while a short position could have added another 20 pips. The macroeconomic backdrop on Friday was weak and had little to no influence on the pair's movements.

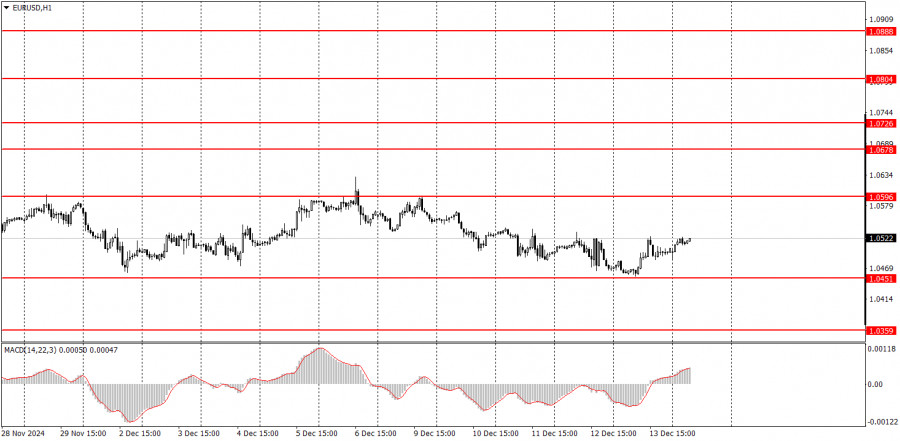

On the hourly timeframe, the EUR/USD pair remains in a corrective phase, continuing to trade within the 1.0451–1.0596 horizontal channel. After two months of declines, no one is rushing to buy the euro. This week, the price might break out of this channel through its lower boundary, signaling a resumption of the downtrend that began three months ago. However, much will depend on macroeconomic and fundamental factors.

It is difficult to anticipate any specific movements from the pair on Monday. Numerous events will occur today, and traders were unable to break through the lower boundary of the channel on Friday. A continuation of the euro's upward movement is possible.

On the 5-minute timeframe, key levels to consider are: 1.0269–1.0277, 1.0334–1.0359, 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0845–1.0851, and 1.0888–1.0896.

Services and manufacturing activity indices will be published on Monday in the Eurozone, Germany, and the U.S. It's worth noting that the U.S. has its internal ISM indices, which are much more significant for the market.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.