Vea también

26.09.2024 03:52 PM

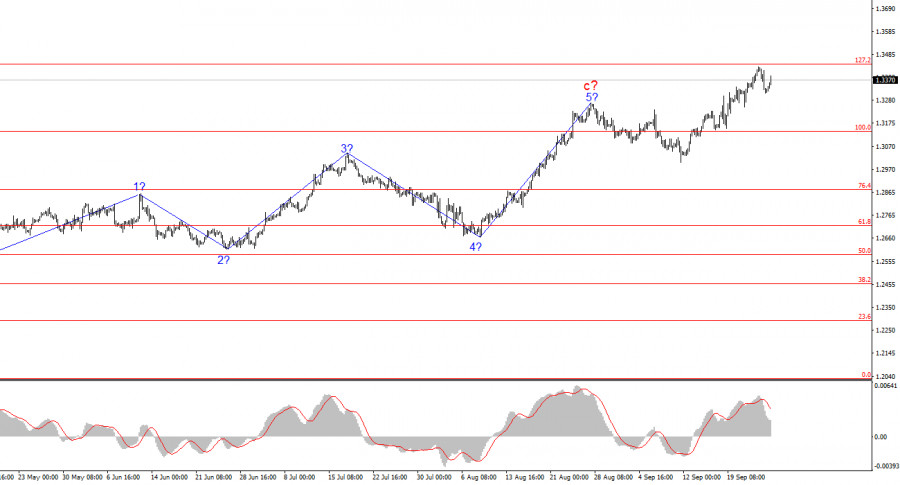

26.09.2024 03:52 PMThe wave structure for GBP/USD remains quite complex and continues to become even more intricate. For a while, the wave pattern looked convincing, suggesting a downward wave sequence with targets below the 1.2300 level. However, in practice, demand for the pound continues to grow, which disrupts any wave patterns. The market continues to build up long positions tirelessly.

Currently, I can only assume a significant complication of the upward trend that began on April 22. Some corrective waves might have shifted to a smaller scale (substructure), increasing the number of higher upward waves. Assuming the current movement is impulsive, it suggests that we are in a major third wave that started forming on August 8. If this assumption is correct, we have already seen waves 1 and 2 within it, meaning there is vast potential for further gains in the pound.

The GBP/USD pair rose by 50 basis points on Thursday. There were no significant events in the UK in the morning, which led to a retracement after yesterday's decline. At the start of the U.S. session, reports on GDP and durable goods orders supported dollar buyers. Unfortunately, despite the genuinely strong statistics, I still don't see any significant strengthening of the U.S. dollar. By the end of the day, the dollar may strengthen further, but the market is awaiting Jerome Powell's speech and that of his colleagues before making a final decision.

Several FOMC members have already stated this week that they support a 50-basis-point rate cut in November. Naturally, such statements do not enhance market demand for the dollar. The demand is already low, but the Fed's officials are adding fuel to the fire. Today, if Powell confirms his colleagues' stance on the appropriateness of a 50-point rate cut at the next meeting, demand for the U.S. dollar may decline sharply. Currently, the wave pattern suggests the continuation of the upward trend. There are no signals indicating a potential reversal. Therefore, discussing any substantial strengthening of the U.S. dollar is futile at this time. We need to wait for the Fed Chair's speech and observe the market reaction.

The dollar needs strong reasons to grow. If the market doesn't receive them, it will likely continue its sluggish decline in insignificant increments. Next week, important statistics will be released in the U.S., and the market might postpone making critical decisions until then. If the data disappoints again, the probability of a 50-basis-point rate cut by the Fed in November could rise to 70-80%, providing another reason for the U.S. dollar to weaken.

The wave structure for GBP/USD continues to complicate. If the upward trend began on April 22, it has already taken on a five-wave form but could become significantly more extended. I still find selling the pair more attractive, but signals are needed for this. At present, I have no doubt that a new upward wave has begun. The nearest target for this wave is 1.3440, which corresponds to the 127.2% Fibonacci level. A successful attempt to break through this mark could see the market aiming for the 1.3800 figure.

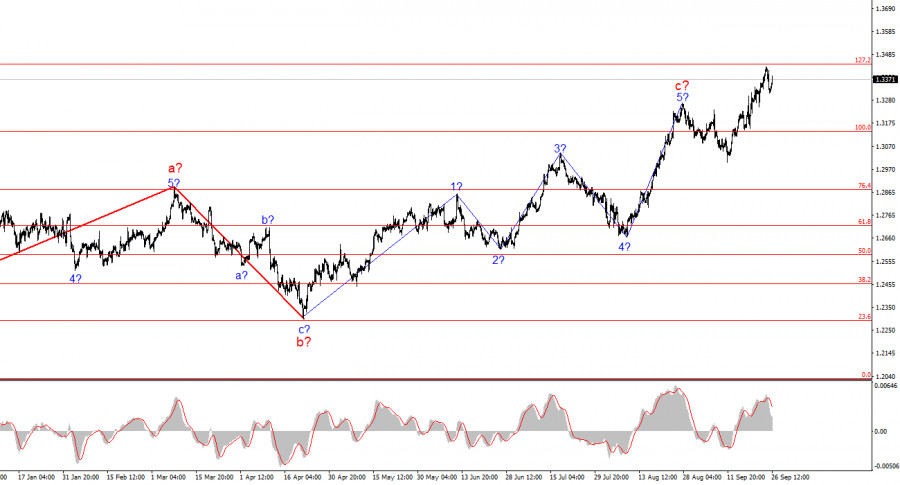

On a larger wave scale, the wave structure has transformed. Now, we can expect the development of a complex and extended upward corrective structure. At this moment, it's a three-wave pattern, but it could evolve into a five-wave structure, which could take several more months to complete.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Lo más probable es que se esté formando una tendencia alcista mayor en el panorama global del SP500, cuya estructura es similar a la del impulso. Si nos fijamos

La estructura de ondas del instrumento GBP/USD sigue siendo bastante complicada y muy confusa. Alrededor del nivel de 1.2822, que corresponde al 23.6% de Fibonacci y está cerca del pico

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado y confuso. Un intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado. El intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó que el mercado está

El patrón de onda del gráfico de 4 horas para el instrumento EUR/USD se mantiene sin cambios. En este momento, estamos observando la construcción de la onda esperada

El análisis de ondas del gráfico de 4 horas para el par euro/dólar sigue siendo bastante claro. Durante el año pasado, solo hemos visto tres estructuras onduladas que se alternan

Gráfico Forex

versión web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.