USDHKD (US Dollar vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

28 Mar 2025 23:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

«US Dollar vs Hong Kong Dollar» or «USDHKD»

USD/HKD is a popular currency pair on Forex. The rate of this financial instrument depends considerably on the US economic situation. For this reason, a trader should primarily focus on the economic indicators of the United States of America. At the moment the rate of the Hong Kong dollar is pegged to the US dollar. This financial instrument trading is carried in the range 7.75-7.85 HKD per USD.

Hong Kong has one of the largest stock exchanges. On many indicators Hong Kong Stock Exchange (SEHK) leaves behind a number of major European and American stock exchanges. Nowadays, Hong Kong is one of the world's leading financial centers.

Hong Kong's economy is based on the principle of free market, low taxation, and the policy of neutrality, as the government does not interfere in the region's economy. There are insufficient mineral and food resources in the region, for this reason its economy is heavily dependent on these factors. The majority of Hong Kong's income is received from service industries, as well as re-exports from China. In addition, the tourism sector is well developed.

If you trade with currency pair USD/HKD, you need to pay attention to the behavior of the other most important trading instruments such as: EUR/USD, GBP/USD, and USD/JPY. These trading instruments are indicators of price movement of USD/HKD, since they greatly influence on the rate of national currency of Hong Kong Special Administrative Region.

See Also

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1063

Bears are trying to break through the bulls' defensesAuthor: Samir Klishi

11:36 2025-03-28 UTC+2

1003

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

988

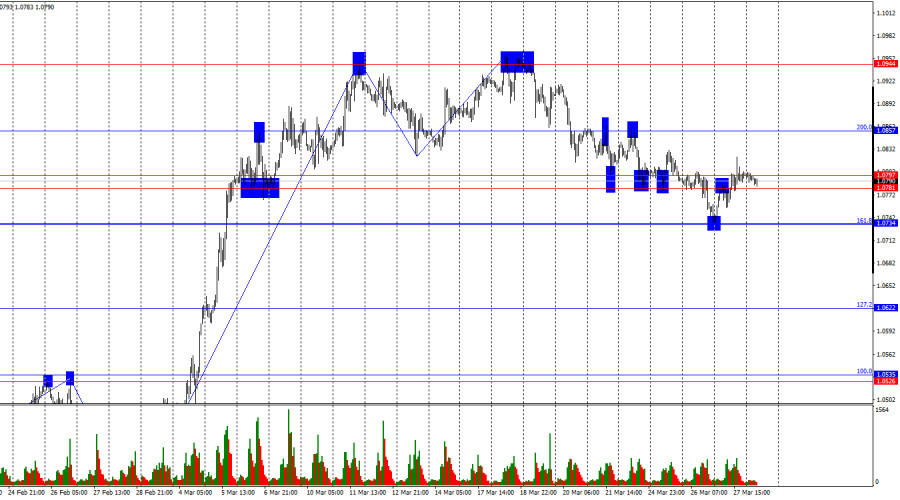

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

973

AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price IndexAuthor: Irina Yanina

12:16 2025-03-28 UTC+2

973

Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensifyAuthor: Irina Maksimova

12:24 2025-03-28 UTC+2

943

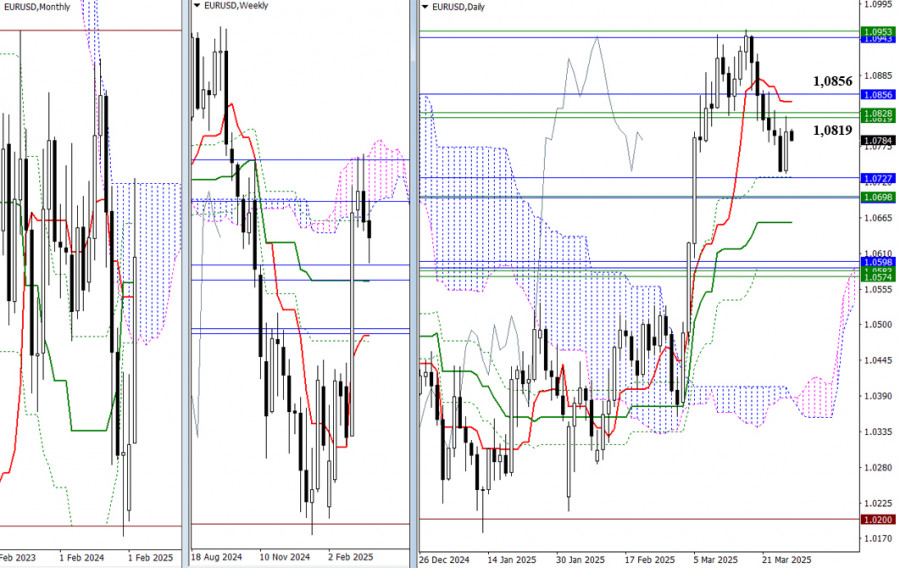

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

928

Stock Market on March 28th: S&P 500 and NASDAQ in a Difficult PositionAuthor: Jakub Novak

11:29 2025-03-28 UTC+2

928

Technical analysis / Video analyticsForex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

898

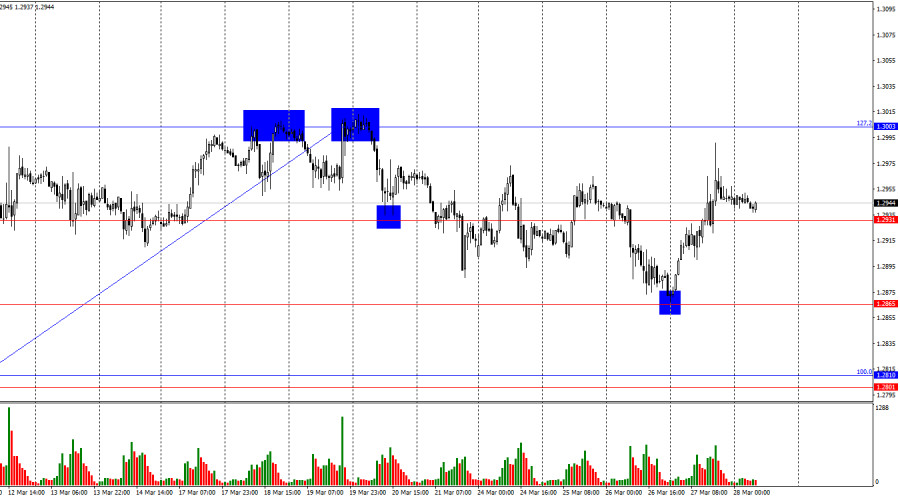

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1063

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

1003

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

988

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

973

- AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price Index

Author: Irina Yanina

12:16 2025-03-28 UTC+2

973

- Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensify

Author: Irina Maksimova

12:24 2025-03-28 UTC+2

943

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

928

- Stock Market on March 28th: S&P 500 and NASDAQ in a Difficult Position

Author: Jakub Novak

11:29 2025-03-28 UTC+2

928

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

898