AUDDKK (Australian Dollar vs Danish Krone). Exchange rate and online charts.

Currency converter

18 Mar 2025 07:52

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The AUD/DKK pair is not on the list of the most traded pairs on Forex. This is a cross-rate pair. It means that the exchange rate of the AUD/DKK pair is calculated by the reference to a third currency, namely the US dollar. Therefore, even if both currencies are not quoted against the US dollar, it still has a significant impact on its rate.

Main features

Denmark stands out from many other countries with its high economic indicators (low inflation and unemployment, sufficient oil and gas inventories, focus on high tech development). Yet, it also has some weak points, e.g. high taxes as well as a low level of competitiveness in foreign markets. These factors may adversely affect its national currency.

Nevertheless, the Danish economy is one of the most stable in the world, so its national currency firmly holds its position versus other major forex currencies.

AUD/DKK is a nonvolatile pair (mostly because of its counter currency, the Aussie). The Australian economy is quite stable. On top of that, the Australian dollar is the sixth most traded currency worldwide.

The pair is distinguished by low volatility (the price swings within a narrow corridor). So, it is highly unlikely to make a quick profit on such assets but the medium and long- term positions may bring high returns. Besides, one should remember that even nonvolatile pairs may jump sharply, especially during the publication of crucial economic reports.

How to trade AUD/DKK

When trading AUD/DKK, speculators should take into account the economic indicators of Denmark as well as the cost of oil and other commodities imported by the country to maintain the manufacturing production.

Always keep in mind that the US dollar also affects both currencies in the pair. For this reason, when predicting the further trajectory of the price, pay attention to the main economic indicators of the United States (GDP, the benchmark rate, the unemployment rate, labor market figures (the NFP report), etc.

AUD/DKK is a low-liquid pair compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, before making any predictions, it is necessary to focus on those instruments that are quoted against the US dollar.

When trading cross-rates, remember that brokers usually set a higher spread on such pairs than on the most popular currency pairs. So, before starting to work with cross-rate pairs, you should carefully study the trading conditions of the broker.

See Also

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1048

Wall Street updateAuthor: Andreeva Natalya

15:04 2025-03-17 UTC+2

988

The euro is aiming for 1.1027 ahead of the Fed meeting.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

733

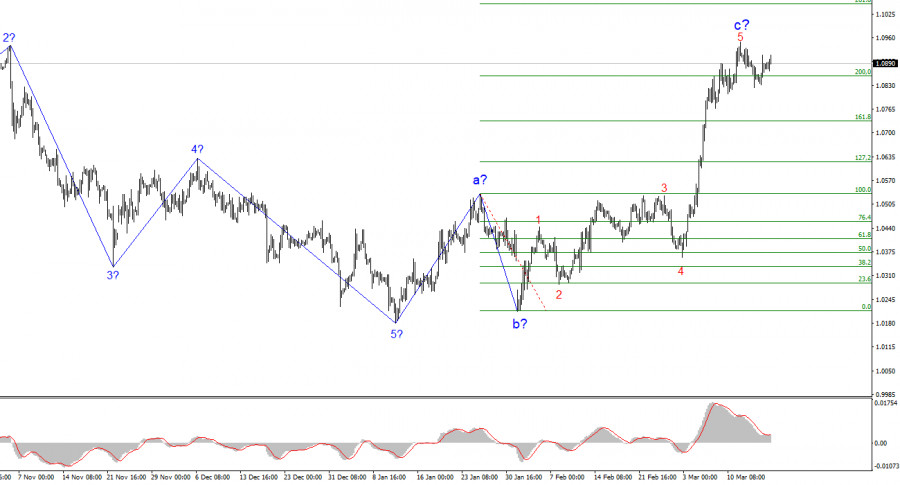

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

718

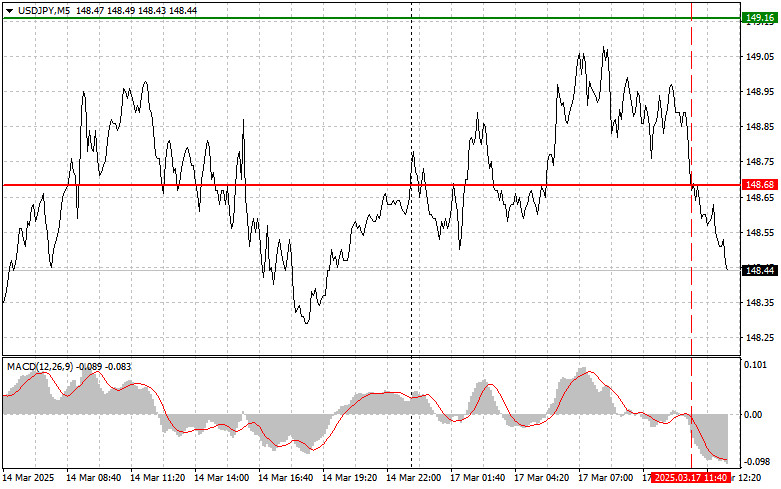

The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero markAuthor: Jakub Novak

18:32 2025-03-17 UTC+2

718

The pound's target is 1.3101.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

- The yen's target is 151.30.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

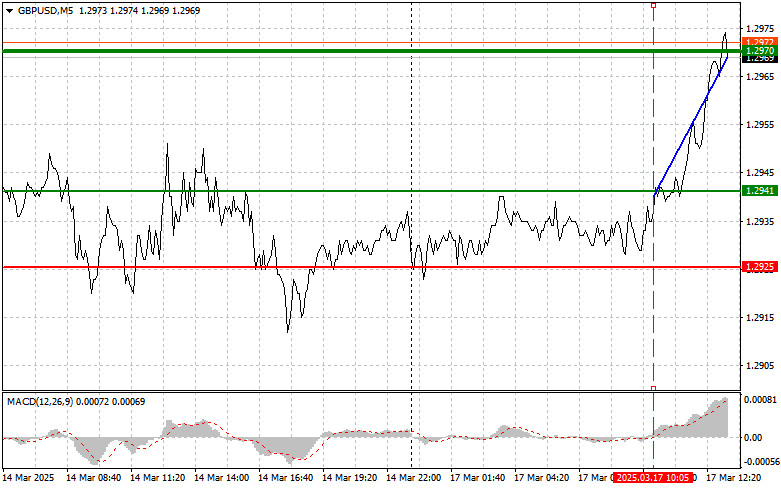

The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero markAuthor: Jakub Novak

18:27 2025-03-17 UTC+2

703

Trading planTrading Recommendations and Analysis for EUR/USD on March 18: A New Increase, But Within Reasonable Limits

The EUR/USD currency pair continued to trade higher on Monday but within a confined range that can be considered a sideways channelAuthor: Paolo Greco

03:35 2025-03-18 UTC+2

688

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1048

- The euro is aiming for 1.1027 ahead of the Fed meeting.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

733

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

718

- The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero mark

Author: Jakub Novak

18:32 2025-03-17 UTC+2

718

- The pound's target is 1.3101.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

- The yen's target is 151.30.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

- The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark

Author: Jakub Novak

18:27 2025-03-17 UTC+2

703

- Trading plan

Trading Recommendations and Analysis for EUR/USD on March 18: A New Increase, But Within Reasonable Limits

The EUR/USD currency pair continued to trade higher on Monday but within a confined range that can be considered a sideways channelAuthor: Paolo Greco

03:35 2025-03-18 UTC+2

688