USDDKK (US Dollar vs Danish Krone). Exchange rate and online charts.

Currency converter

18 Mar 2025 07:23

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/DKK is an exchange rate of the Danish krone against the US national currency.

The currency pair’s history dates back to 1992.

Fundamental analysis of the pair depends on the US dollar position on the market. The latest tendencies testify that the level of confidence in the US dollar has considerably decreased. As a result, the main fundamental factors point at the further decline of the currency pair popularity. Since 2012 there has been a strong tendency toward depreciation of the pair. The price is steadily falling. Trading USD/DKK has calm and smooth character. The pair’s forecast is usually based on technical analysis.

During the last decade the Danish krone has been continuously gaining ground against the US dollar. As an example it can be noted that in 2001 the Danish krone traded at 8.5 against the US dollar and in 2003 it already traded in the range of kr6.5 to kr5.1 for $1.Deals with the Danish krone are quite common on the foreign exchange market; however the total trading volume is still small.

Interest in the Danish currency is connected with its high correlation to the euro. Despite the fact that Denmark is a member of the European Union, it was decided to maintain the national currency and not to introduce the euro. Nevertheless, the Danish krone trend is highly dependent on the general direction of the single European currency. The Danish krone is mainly affected by different events in the eurozone and by prices for agricultural products on the world market. However, an active trend can be seen even when there is a change in the US dollar exchange rate.

The US dollar fluctuations mostly depend on the macroeconomic factors of the US economy, which are released by the United States Department of Commerce. Consequently, according to the US official statistics data the US dollar exchange rate can be forecasted for this or that period.

See Also

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1003

Wall Street updateAuthor: Andreeva Natalya

15:04 2025-03-17 UTC+2

943

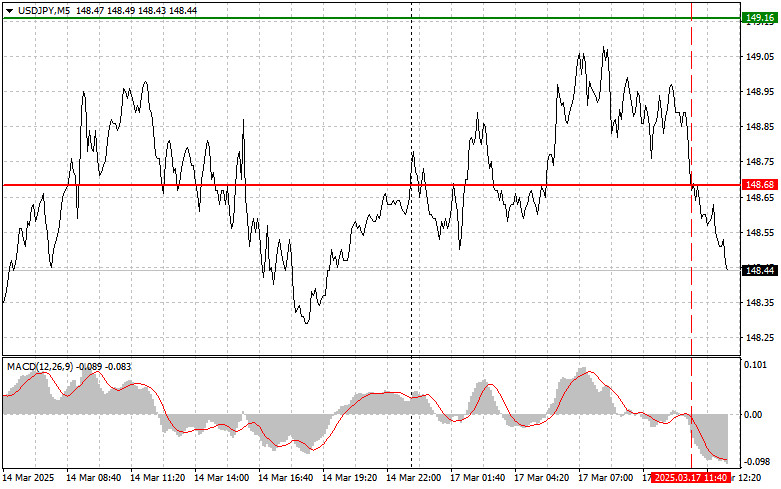

The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero markAuthor: Jakub Novak

18:32 2025-03-17 UTC+2

703

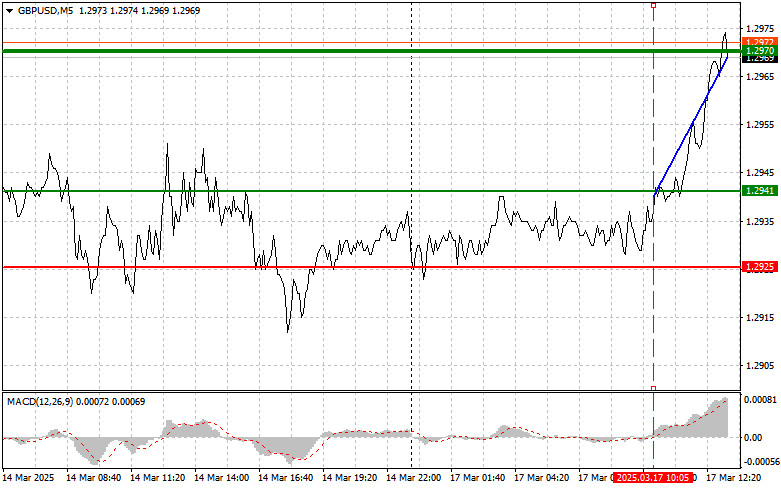

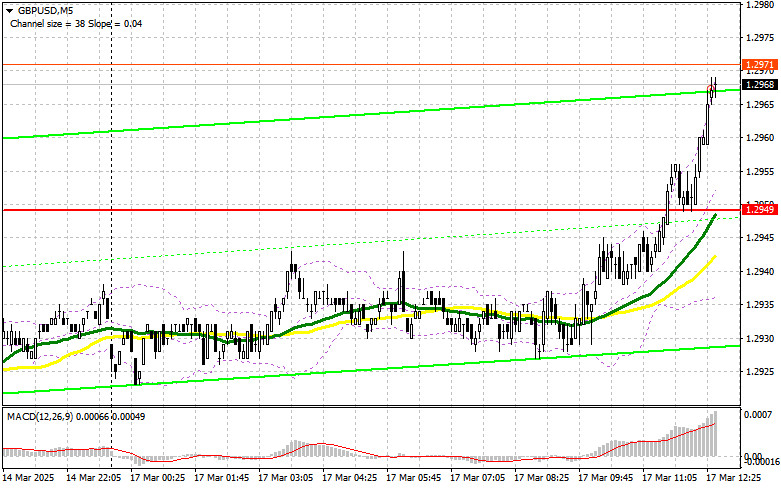

- The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark

Author: Jakub Novak

18:27 2025-03-17 UTC+2

688

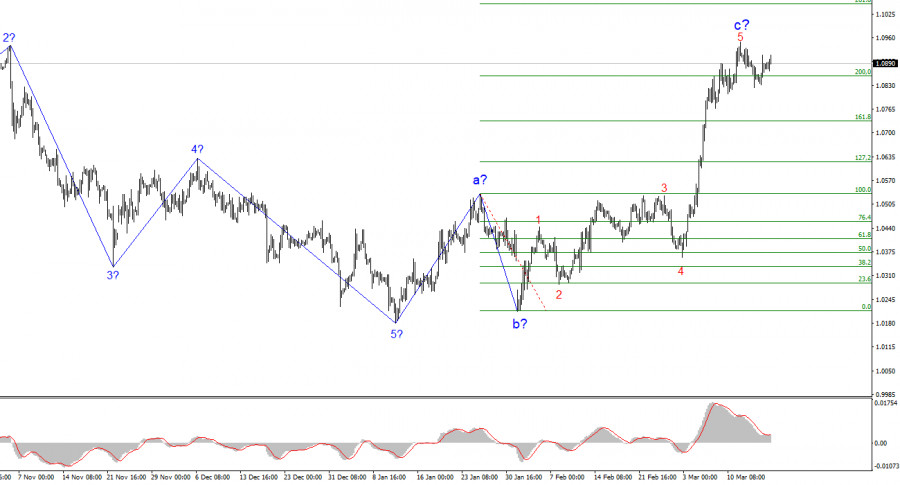

The euro is aiming for 1.1027 ahead of the Fed meeting.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

The yen's target is 151.30.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

688

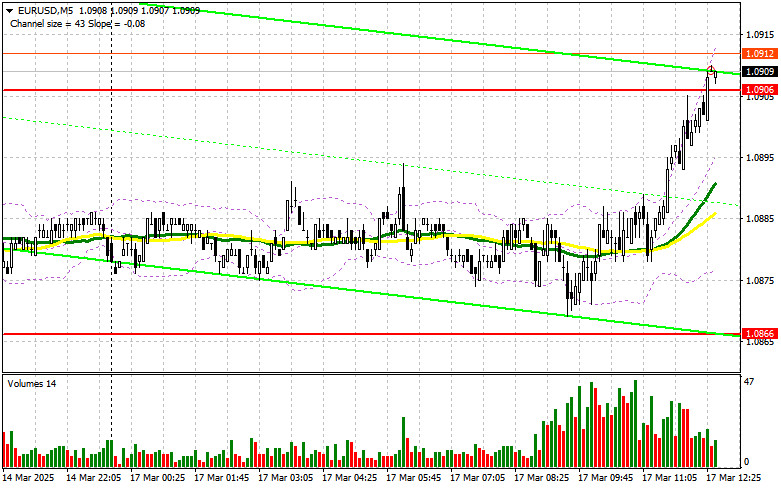

In my morning forecast, I highlighted the 1.0866 level as a key point for making entry decisionsAuthor: Miroslaw Bawulski

18:17 2025-03-17 UTC+2

673

In my morning forecast, I highlighted 1.2949 as a key level for making market entry decisionsAuthor: Miroslaw Bawulski

18:20 2025-03-17 UTC+2

673

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1003

- The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero mark

Author: Jakub Novak

18:32 2025-03-17 UTC+2

703

- The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark

Author: Jakub Novak

18:27 2025-03-17 UTC+2

688

- The euro is aiming for 1.1027 ahead of the Fed meeting.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

- The yen's target is 151.30.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

688

- In my morning forecast, I highlighted the 1.0866 level as a key point for making entry decisions

Author: Miroslaw Bawulski

18:17 2025-03-17 UTC+2

673

- In my morning forecast, I highlighted 1.2949 as a key level for making market entry decisions

Author: Miroslaw Bawulski

18:20 2025-03-17 UTC+2

673