NZDCZK (New Zealand Dollar vs Czech Koruna). Exchange rate and online charts.

Currency converter

01 Sep 2025 17:41

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

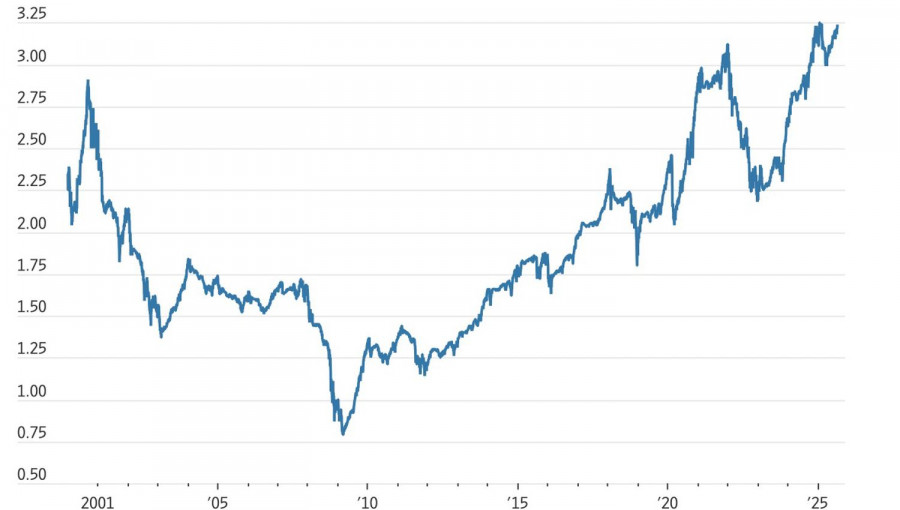

The NZD/CZK pair is not very popular in the forex market. It is a cross rate against the US dollar, which means that the two currencies in the pair are valued against USD.

Although the US dollar is not present in this trading instrument, it has a significant impact on the pair. This can be seen by combining the trading charts of the two currency pairs, NZD/USD and USD/CZK.

Principal features

New Zealand is known for its stable economy. Its strong point is agriculture, which is considered one of the most efficient and highly-developed in the world. Most of the country's industrial products are exported. Therefore, the state of this island nation's economy depends directly on export volumes.

The main trading partners of the country are the United States, Australia, and the Asia-Pacific region. Therefore, when analyzing the NZD/CZK pair, do not forget to monitor the economic indicators of these areas.

The Czech Republic ranks among the most industrialized economies in Central Europe characterized by prosperity and stability. High incomes of its population can be attributed to the fast pace of the country’s economic growth.

The main industrial sectors of the state are vehicle manufacturing (the Czech Republic is one of the world automotive leaders in terms of per-capita output), iron and steel production, as well as agriculture. In addition, the Czech Republic is a leading exporter of beer and footwear.

How to trade NZD/CZK

First of all, when trading cross rates, you need to remember that brokers tend to set higher spreads on them (when compared to major currency pairs). Therefore, before starting to work with cross rates, you should thoroughly review all the terms and conditions a broker offers.

In addition, unlike such currency pairs as EUR/USD, USD/CHF, GBP/USD, and USD/JPY, this trading instrument is relatively illiquid. Therefore, when making projections, you should primarily focus on currency pairs that include the US dollar along with each currency under consideration.

Besides, trading NZD/CZK requires taking into account a number of New Zealand economic indicators such as GDP, interest rates, business activity, and trade with other countries.

Moreover, the pair is affected by factors that influence the value of the US dollar. Hence, when predicting the pair’s further dynamics, it is also necessary to consider the main US economic indicators, including interest rates, GDP growth, unemployment rate, job openings, and so on.

See Also

- Technical analysis / Video analytics

Forex forecast 01/09/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and BitcoinAuthor: Sebastian Seliga

15:13 2025-09-01 UTC+2

2113

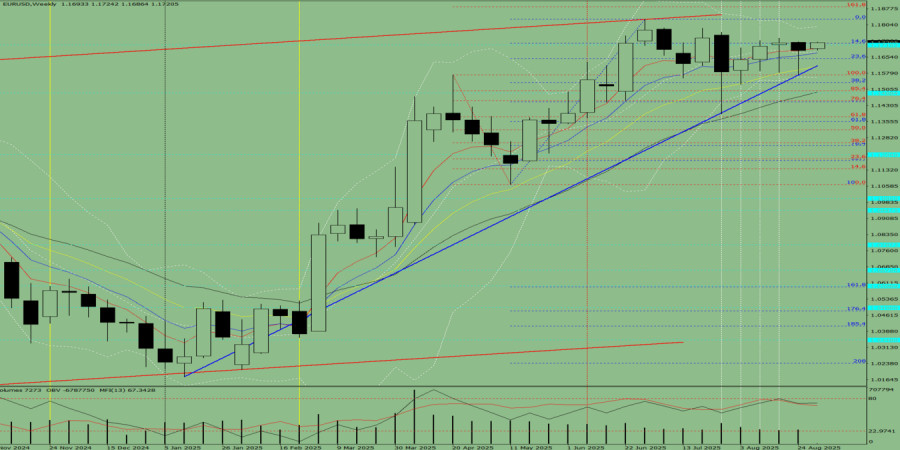

In August, the pair, moving upward, tested the historical resistance level of 1.1710 (blue dotted line) and then pulled back slightly, closing the monthly candle at 1.1685. In September, the price is expected to move downward.Author: Stefan Doll

09:53 2025-09-01 UTC+2

1528

The most expensive companies within the S&P 500 are the large caps.Author: Marek Petkovich

09:27 2025-09-01 UTC+2

1393

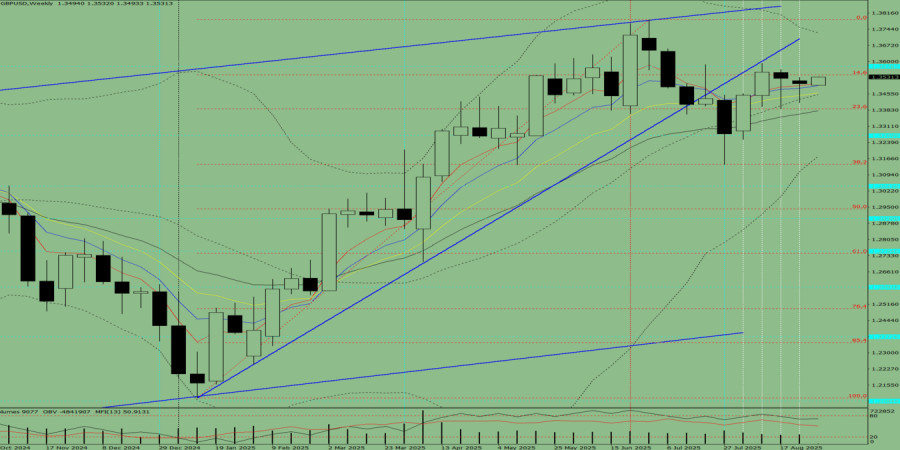

- Last week, the pair moved downward, tested the 21-period simple moving average at 1.3428 (black dotted line), and then turned upward, closing the weekly candle at 1.3502. In the upcoming week, the price may continue moving downward.

Author: Stefan Doll

09:50 2025-09-01 UTC+2

1393

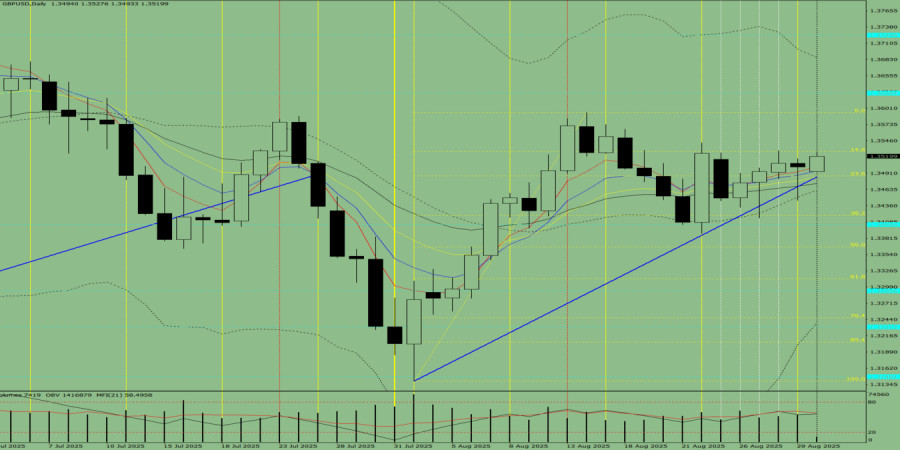

On Friday, the pair moved downward, tested the 21-period simple moving average at 1.3449 (black dotted line), and then turned upward, closing the daily candle at 1.3502. Today, the price may attempt to continue its upward movement. No major calendar news is expected on Monday.Author: Stefan Doll

09:42 2025-09-01 UTC+2

1378

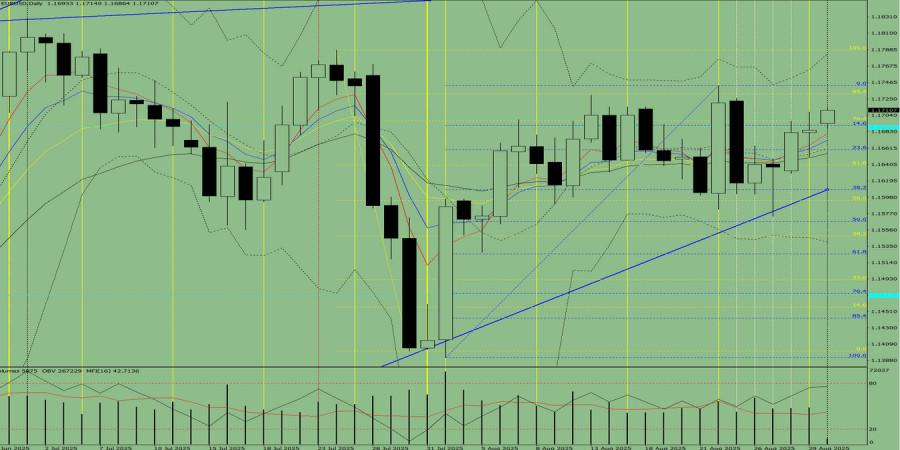

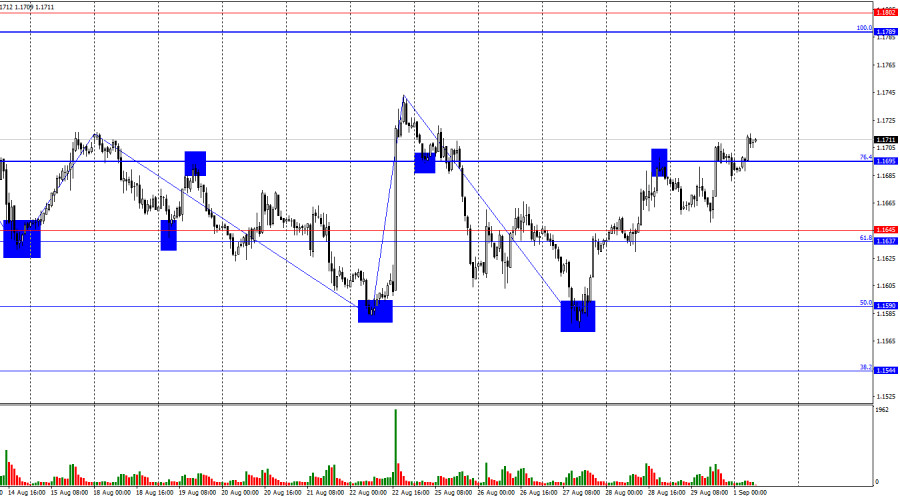

On Friday, the pair, moving downward, tested the retracement level of 23.6% – 1.1659 (blue dotted line) and then turned upward, closing the daily candle at 1.1685. Today, the price may attempt to continue its upward movement. No major calendar news is expected on Monday.Author: Stefan Doll

09:38 2025-09-01 UTC+2

1363

- Last week, the pair moved downward, tested the upper fractal at 1.1571 (red dotted line), and then turned upward, closing the weekly candle at 1.1685. In the upcoming week, the price may continue moving downward.

Author: Stefan Doll

09:46 2025-09-01 UTC+2

1348

In August, the pair, moving upward, tested the historical resistance level at 1.3579 (blue dotted line) and then pulled back slightly, closing the monthly candle at 1.3502. In September, the price is expected to move downward.Author: Stefan Doll

11:15 2025-09-01 UTC+2

1318

EUR/USD. September 1st. The Week Begins with Lagarde's SpeechAuthor: Samir Klishi

12:17 2025-09-01 UTC+2

1288

- Technical analysis / Video analytics

Forex forecast 01/09/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and BitcoinAuthor: Sebastian Seliga

15:13 2025-09-01 UTC+2

2113

- In August, the pair, moving upward, tested the historical resistance level of 1.1710 (blue dotted line) and then pulled back slightly, closing the monthly candle at 1.1685. In September, the price is expected to move downward.

Author: Stefan Doll

09:53 2025-09-01 UTC+2

1528

- The most expensive companies within the S&P 500 are the large caps.

Author: Marek Petkovich

09:27 2025-09-01 UTC+2

1393

- Last week, the pair moved downward, tested the 21-period simple moving average at 1.3428 (black dotted line), and then turned upward, closing the weekly candle at 1.3502. In the upcoming week, the price may continue moving downward.

Author: Stefan Doll

09:50 2025-09-01 UTC+2

1393

- On Friday, the pair moved downward, tested the 21-period simple moving average at 1.3449 (black dotted line), and then turned upward, closing the daily candle at 1.3502. Today, the price may attempt to continue its upward movement. No major calendar news is expected on Monday.

Author: Stefan Doll

09:42 2025-09-01 UTC+2

1378

- On Friday, the pair, moving downward, tested the retracement level of 23.6% – 1.1659 (blue dotted line) and then turned upward, closing the daily candle at 1.1685. Today, the price may attempt to continue its upward movement. No major calendar news is expected on Monday.

Author: Stefan Doll

09:38 2025-09-01 UTC+2

1363

- Last week, the pair moved downward, tested the upper fractal at 1.1571 (red dotted line), and then turned upward, closing the weekly candle at 1.1685. In the upcoming week, the price may continue moving downward.

Author: Stefan Doll

09:46 2025-09-01 UTC+2

1348

- In August, the pair, moving upward, tested the historical resistance level at 1.3579 (blue dotted line) and then pulled back slightly, closing the monthly candle at 1.3502. In September, the price is expected to move downward.

Author: Stefan Doll

11:15 2025-09-01 UTC+2

1318

- EUR/USD. September 1st. The Week Begins with Lagarde's Speech

Author: Samir Klishi

12:17 2025-09-01 UTC+2

1288