#HSI (Hang Seng Index). Exchange rate and online charts.

Currency converter

11 Apr 2025 22:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Hang Seng Index (abbreviated HSI) is a benchmark stock market index of the Hong Kong Stock Exchange. It comprises 34 largest companies in Hong Kong which account for almost 65% of capitalization of the Hong Kong financial hub. HSI was introduced in 1969 by HSI Services Limited which is still dealing with analysis of information and compilation of ratings. The index records and monitors daily changes of stock prices of these companies. So, HSI is the main barometer of the overall market performance in Hong Kong. HSI embraces four sectors of the economy such as commerce and industry, finance, utilities, and land properties.

Besides, Hang Seng Index is a convenient instrument to invest in Hong Kong’s stock market which is one of major financial hubs not only in Asia, but on the global scale. Importantly, the economies of Hong Kong and China are closely connected as Hong Kong has the status of the special administrative region of the People’s Republic of China. So this indicator of Hong Kong’s stock market enables investors to put up capital for China’s economy which is considered to be one of the booming economies in the world. Last but not least, high liquidity of HSI makes it possible to use it for speculative trading.

Trading Hang Seng Index is available through different financial instruments including Exchange-Traded Funds (ETF), contracts for differences (CFDs), and futures contracts. Futures are the most convenient and liquid means of implementing medium- and long-term strategies as well as speculative trading.

See Also

- The EUR/USD exchange rate rose by 250 basis points on Thursday, and added another 170 today.

Author: Chin Zhao

18:33 2025-04-11 UTC+2

1018

On April 11, the US stock market saw sharp declines, with the S&P 500 and Nasdaq both plunging significantly.Author: Jakub Novak

13:41 2025-04-11 UTC+2

1003

Technical analysisTrading Signals for GOLD (XAU/USD) for April 11-13, 2025: sell below $3,235 (+1/8 Murray - overbought)

We could expect a strong technical correction toward the 8/8 Murray at 3,125 in the coming days. The metal could even reach the 21st SMA located at 3,089.Author: Dimitrios Zappas

16:04 2025-04-11 UTC+2

958

- Fundamental analysis

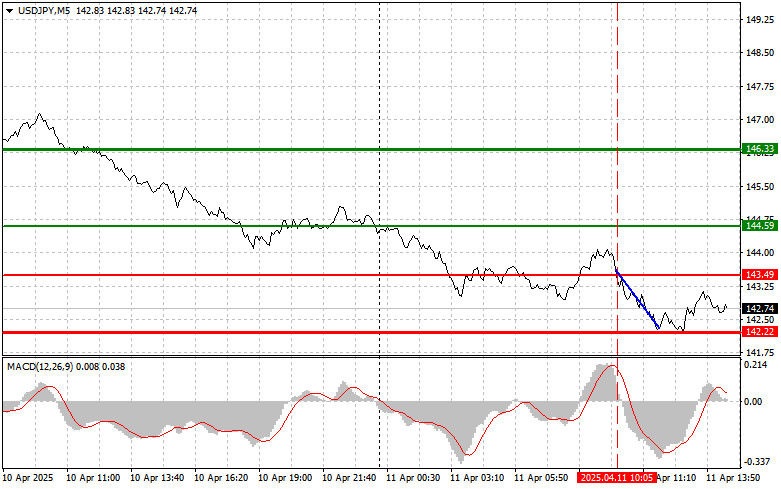

Markets Face a Prolonged Period of Instability (USD/JPY and USD/CHF Likely to Continue Falling)

On Thursday, investors realized there is currently no such thing as stability. High market volatility remains and will continue to dominate for some time. The ongoing cause of this remains the theme of trade wars, which are now increasingly seen not as conflicts between the U.S. and Europe or other.Author: Pati Gani

09:11 2025-04-11 UTC+2

928

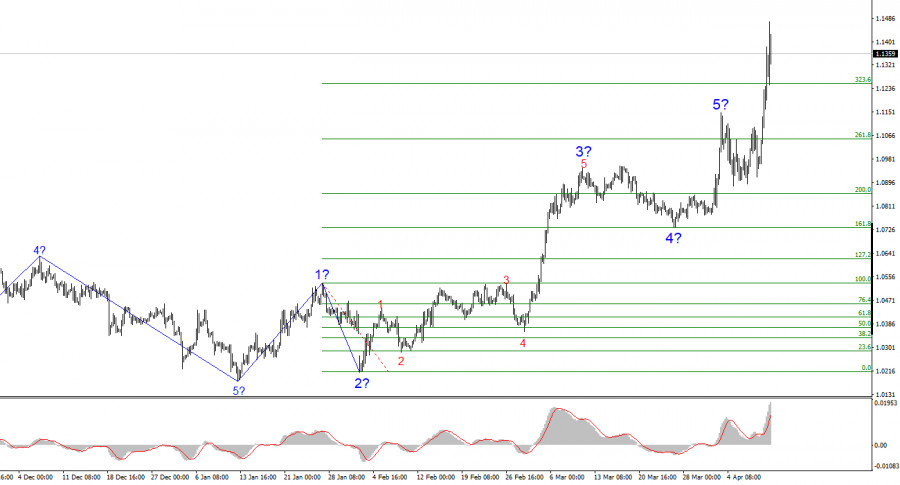

The euro is showing a sharp rally against the U.S. dollar. The EUR/USD pair has already reached a three-year high and shows no signs of slowing down.Author: Jakub Novak

12:42 2025-04-11 UTC+2

913

Technical analysis / Video analyticsForex forecast 11/04/2025: EUR/USD, GBP/USD, SP500, NASDAQ, and Bitcoin

Technical analysis of EUR/USD, GBP/USD, SP500, NASDAQ, and BitcoinAuthor: Sebastian Seliga

09:52 2025-04-11 UTC+2

898

- USD/JPY: Simple Trading Tips for Beginner Traders on April 11th (U.S. Session)

Author: Jakub Novak

18:26 2025-04-11 UTC+2

868

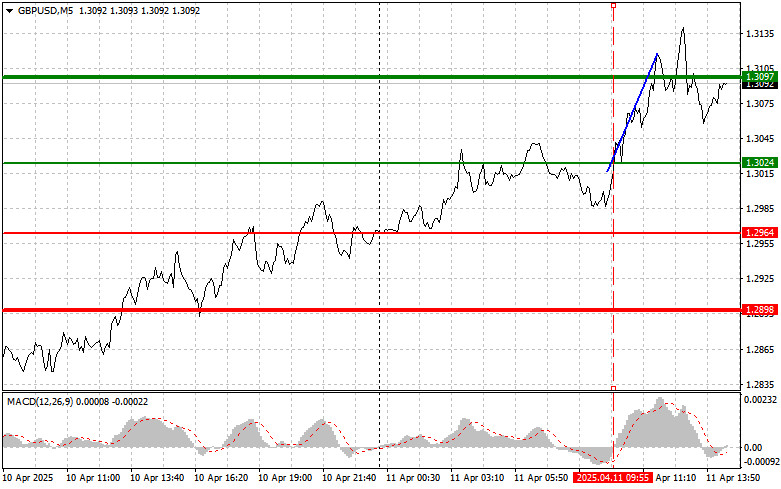

GBP/USD: Simple Trading Tips for Beginner Traders on April 11th (U.S. Session)Author: Jakub Novak

18:22 2025-04-11 UTC+2

823

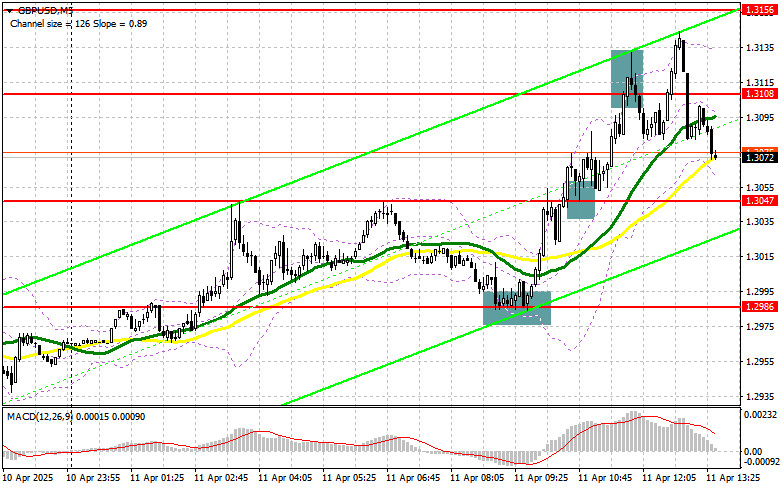

Trading planGBP/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)

GBP/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)Author: Miroslaw Bawulski

18:18 2025-04-11 UTC+2

793

- The EUR/USD exchange rate rose by 250 basis points on Thursday, and added another 170 today.

Author: Chin Zhao

18:33 2025-04-11 UTC+2

1018

- On April 11, the US stock market saw sharp declines, with the S&P 500 and Nasdaq both plunging significantly.

Author: Jakub Novak

13:41 2025-04-11 UTC+2

1003

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 11-13, 2025: sell below $3,235 (+1/8 Murray - overbought)

We could expect a strong technical correction toward the 8/8 Murray at 3,125 in the coming days. The metal could even reach the 21st SMA located at 3,089.Author: Dimitrios Zappas

16:04 2025-04-11 UTC+2

958

- Fundamental analysis

Markets Face a Prolonged Period of Instability (USD/JPY and USD/CHF Likely to Continue Falling)

On Thursday, investors realized there is currently no such thing as stability. High market volatility remains and will continue to dominate for some time. The ongoing cause of this remains the theme of trade wars, which are now increasingly seen not as conflicts between the U.S. and Europe or other.Author: Pati Gani

09:11 2025-04-11 UTC+2

928

- The euro is showing a sharp rally against the U.S. dollar. The EUR/USD pair has already reached a three-year high and shows no signs of slowing down.

Author: Jakub Novak

12:42 2025-04-11 UTC+2

913

- Technical analysis / Video analytics

Forex forecast 11/04/2025: EUR/USD, GBP/USD, SP500, NASDAQ, and Bitcoin

Technical analysis of EUR/USD, GBP/USD, SP500, NASDAQ, and BitcoinAuthor: Sebastian Seliga

09:52 2025-04-11 UTC+2

898

- USD/JPY: Simple Trading Tips for Beginner Traders on April 11th (U.S. Session)

Author: Jakub Novak

18:26 2025-04-11 UTC+2

868

- GBP/USD: Simple Trading Tips for Beginner Traders on April 11th (U.S. Session)

Author: Jakub Novak

18:22 2025-04-11 UTC+2

823

- Trading plan

GBP/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)

GBP/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)Author: Miroslaw Bawulski

18:18 2025-04-11 UTC+2

793