यह भी देखें

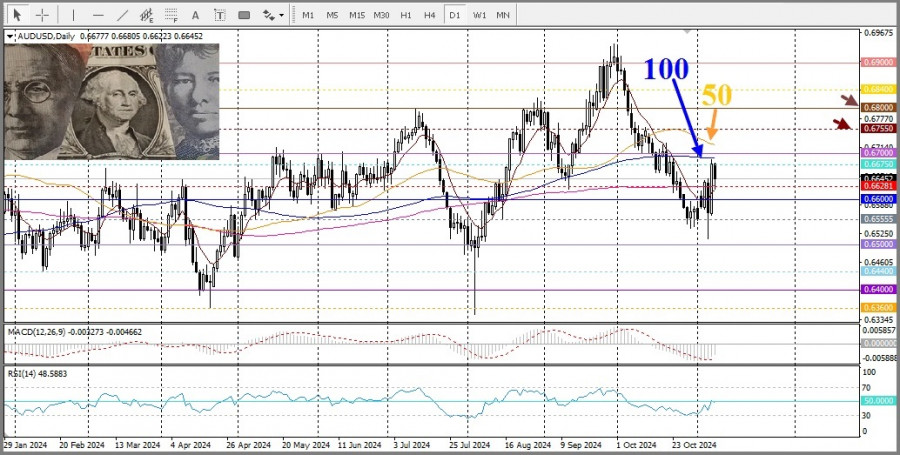

The AUD/USD pair is pulling back from the resistance zone near the 100-day SMA. Expectations that U.S. economic policies will stimulate growth and limit the Federal Reserve's ability to aggressively cut interest rates are helping the U.S. dollar halt its pullback from a four-month high observed the previous day.

This is the primary factor putting downward pressure on the AUD/USD pair. Meanwhile, AUD/USD bulls seem unaffected by the news that the Standing Committee of the National People's Congress of China approved plans to raise the local debt ceiling. Even the Reserve Bank of Australia's hawkish stance failed to provide support for the Australian dollar.

A decline and consolidation below the critical 200-day SMA would indicate that the short-covering rally has run its course. Daily chart oscillators are recovering but have not yet fully entered positive territory. Further declines could pull the AUD/USD pair down to the psychological level of 0.6600, with the next support at 0.6555. The downward trajectory could extend further toward 0.6510 or a multi-month low before the exchange rate eventually drops even lower.

On the other hand, bulls need to wait for a sustained breakout above the 100-day SMA resistance, currently just below the psychological level of 0.6700, before initiating new trades. Beyond that, the 50-day SMA near 0.6717 serves as the next resistance level, above which the AUD/USD pair may attempt to rise toward the intermediate resistance of 0.6755, targeting the psychological level of 0.6800.

A subsequent move higher would indicate that the recent decline has exhausted itself, shifting the short-term bias in favor of the bulls.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |