Lihat juga

04.04.2025 10:21 AM

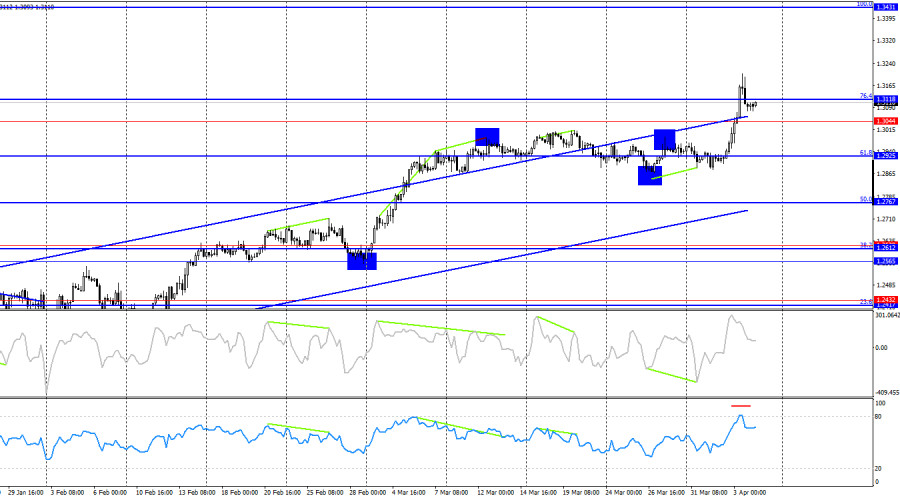

04.04.2025 10:21 AMOn the hourly chart, the GBP/USD pair once again soared on Thursday, breaking through several levels. Consolidation below the 1.3151 level allows for expectations of a slight decline toward the 127.2% Fibonacci level at 1.3003; however, even a 100-point rebound for the dollar now seems extremely unlikely. Any escalation in the trade war—on either side—will likely be seen by traders as a signal to resume dollar selling.

The last completed downward wave failed to break the previous low, while the new upward wave easily broke the last high. Thus, the formation of a bullish trend continues. Most traders still refuse to buy the dollar regardless of the economic data, as Donald Trump continues to introduce new tariffs, which will eventually hurt U.S. economic growth—as well as that of many other countries. For this bullish trend to shift into a bearish one, the price would need to consolidate below the 1.2865 level.

The news background for the British pound on Thursday held no value. All reports were ignored, as the market remains fully focused on the trade war theme. Today, the U.S. will release important data on labor market conditions and unemployment, which should, in theory, affect the FOMC's sentiment and thus impact the dollar. However, at the moment, the dollar is plunging due to Donald Trump, and no Nonfarm Payrolls or unemployment stats are likely to save it. Even Jerome Powell's speech on Friday evening has very little chance of turning the tide. What can the Fed Chair say under the current circumstances? Powell may speak only of growing economic uncertainty, the threat of recession, and rising inflation. But even before the trade war, the Fed maintained a relatively hawkish stance, and the dollar is now reacting only to Trump. A stronger hawkish tone from the Fed is unlikely. Even if the dollar rises slightly on Friday, the next tariff package will quickly bring it back down.

On the 4-hour chart, the pair maintains its bullish trend. I do not expect a strong decline in the pound until the price closes below the ascending channel. A rebound from the 76.4% Fibonacci level at 1.3118 could work in the dollar's favor, but in my view, the dollar currently has no chances. A bullish divergence on the CCI indicator warned of a new upward movement, though that wasn't the cause of the pound's rise or the dollar's fall. The RSI is overbought, but it is unlikely to cause a significant drop.

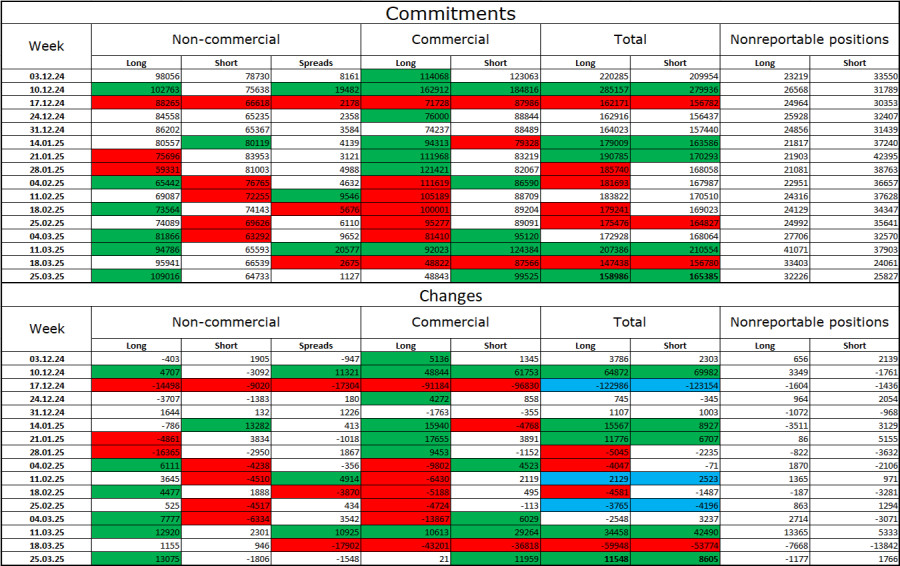

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader group became more bullish over the last reporting week. The number of long positions held by speculators increased by 13,075, while short positions decreased by 1,806. Bears have lost their market advantage. The gap between long and short positions now stands at nearly 44,000 in favor of the bulls: 109,000 vs. 65,000.

In my view, the pound still has downward potential, but recent events may force the market to reverse in the long term. Over the past 3 months, the number of long positions has risen from 98,000 to 109,000, while shorts have declined from 78,000 to 65,000. More significantly, over the last 8 weeks, longs have risen from 59,000 to 109,000, and shorts have dropped from 81,000 to 65,000.

News Calendar for the U.S. and U.K.:

Friday's economic calendar contains several important releases. However, in my view, all of these major data points are unlikely to have any meaningful impact on the dollar. They may slightly influence market sentiment—but not by much.

GBP/USD Forecast and Trading Tips:

I would only recommend selling the pair after a clear rebound from a key level. But yesterday, there were no such signals, and it's unlikely any will form today. Right now, it's hard to even define levels from which a decline might begin. Buying opportunities are possible on a rebound from the 1.3003 level on the hourly chart, targeting 1.3151 and 1.3249.

Fibonacci grids are drawn from 1.2809–1.2100 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada sesi Amerika awal, pasangan EUR/USD diperdagangkan di sekitar 1,1358 dalam saluran tren turun yang terbentuk pada 18 April. Pasangan ini berada di bawah tekanan bearish. Kami percaya instrumen

Harga emas belakangan ini mengalami koreksi yang signifikan di tengah ekspektasi pasar akan dimulainya negosiasi nyata antara AS dan Tiongkok mengenai tarif dan perdagangan secara keseluruhan. Pernyataan Menteri Keuangan

Meski di chart 4 jamnya indeks Nasdaq 100 tengah Sideways, namun kisarannya cukup besar sehingga masih ada peluang yang cukup menjanjikan di indeks tersebut. Saat ini indikator Stochastic Oscillator tengah

Pada chart 4 jamnya, instrument komoditi Perak nampak terlihat meski kondisinya tengah menguat di mana hal ini terkonfirmasi oleh pergerakan harga Perak yang bergerak diatas WMA (30 Shift 2) yang

Rencana trading kami untuk beberapa jam ke depan adalah menjual emas di bawah $3.333, dengan target di $3.313 dan $3.291. Kami dapat membeli di atas $3.280 dengan target jangka pendek

Dengan munculnya Divergence antara pergerakan harga pasangan mata uang silang AUD/JPY dengan indikator Stochastic Oscillator serta pergerakan harga AUD/JPY yang berada diatas WMA (30 Shift 2) yang juga memiliki kemiringan

Bila Kita perhatikan pada chart 4 jamnya, instrumen komoditi Emas nampak terlihat masih bergerak dalam bias yang Bullish, namun dengan kemunculan Divergence antara pergerakan harga Emas dengan indikator Stochastic Oscillator

Dengan pergerakan harga pasangan mata uang silang AUD/CAD yang bergerak diatas WMA (21) yang memiliki kemiringan yang menukik keatas serta munculnya Convergence antara pergerakan harga AUD/CAD dengan indikator Stochastic Oscillator

Bila Kita perhatikan chart 4 jam dari pasangan mata uang silang GBP/CHF, maka nampak ada beberapa fakta-fakta yang menari. Pertama, munculnya pola Triangle yang diikuti oleh pergerakan EMA (21)-nya yang

Indikator eagle telah mencapai level overbought. Namun, logam ini masih bisa mencapai level tinggi di sekitar 8/8 Murray, yang merupakan penghalang kuat bagi emas. Di bawah area ini, kita bisa

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.