Lihat juga

03.04.2025 06:25 PM

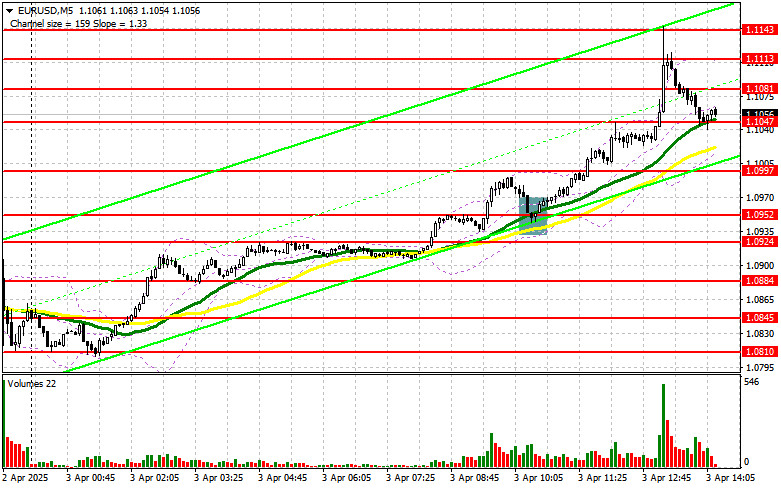

03.04.2025 06:25 PMIn my morning forecast, I highlighted the 1.0952 level and planned to make entry decisions from there. Let's look at the 5-minute chart and analyze what happened. A drop followed by a false breakout at that level created a strong long entry point, which resulted in a 100-point rally for the euro. The technical picture was revised for the second half of the day.

Active buying of the euro has led to an intraday strengthening of the EUR/USD pair by over 300 points — something we haven't seen in more than 10 years. Many banks have already revised their short-term forecasts, targeting the 1.15 area, which triggered even more aggressive buying. It's likely that stop orders above the psychological level of 1.10 also fueled the surge during the European session.

During the U.S. session, several reports will be released, including weekly jobless claims and the trade balance. ISM services PMI data is also expected. Only exceptionally strong figures from the U.S. — possibly the last of their kind due to Trump's new tariffs — could help the dollar rebound.

If the euro dips after the reports, a false breakout around the 1.1043 support will be a signal to buy EUR/USD again, aiming to maintain bullish momentum with a target at 1.1113. A breakout and retest of this area from above will confirm a proper entry into long positions, with the next target at 1.1143. The ultimate target will be 1.1179, where I will lock in profits.

If EUR/USD drops and there's no bullish activity near 1.1043, euro pressure will intensify. In that case, bears could push the pair down to 1.0997. Only a false breakout there would justify new long positions. Otherwise, I plan to buy on a rebound from 1.0946, targeting a 30–35 point intraday correction.

Sellers are in shock, so jumping into short positions today against such a strong bull market is not advisable. In the event of a negative market reaction to the U.S. ISM data, only a false breakout near the 1.1143 resistance would allow a short entry, targeting support at 1.1081. A breakout and consolidation below this level would open the door for a further drop to 1.1043. The final target would be 1.0997, where I plan to take profit.

If EUR/USD continues rising in the second half of the day — which is more likely — and bears show no resistance at 1.1143, buyers may drive the pair even higher. In that case, I'll postpone shorts until a test of the next resistance at 1.1179. I will consider selling only after a failed breakout there. If no downward movement appears at that level either, I'll look for a bounce short entry at 1.1213, targeting a 30–35 point downward correction.

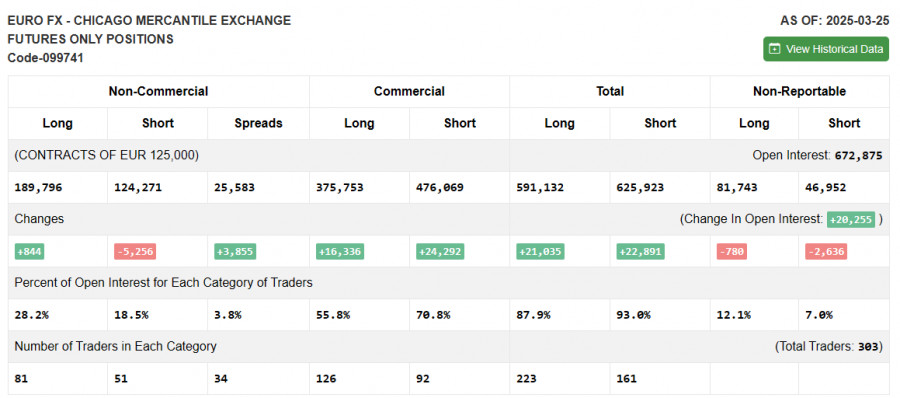

COT (Commitment of Traders) Report – March 25:

The report showed a slight increase in long positions and a strong reduction in shorts. There are not significantly more euro buyers, but sellers continue exiting the market. Based on recent inflation data in the eurozone and ECB officials' comments, the central bank is likely to keep its current policy unchanged in April, which could temporarily support the euro.

However, the real impact depends on how severely U.S. tariffs affect other countries. The greater the threat of a global economic slowdown, the stronger the pressure will be on risk assets — including the euro. The COT report shows that non-commercial long positions rose by 844 to 189,796, while short positions fell by 5,256 to 124,271. As a result, the net gap increased by 3,855.

Indicator Signals:

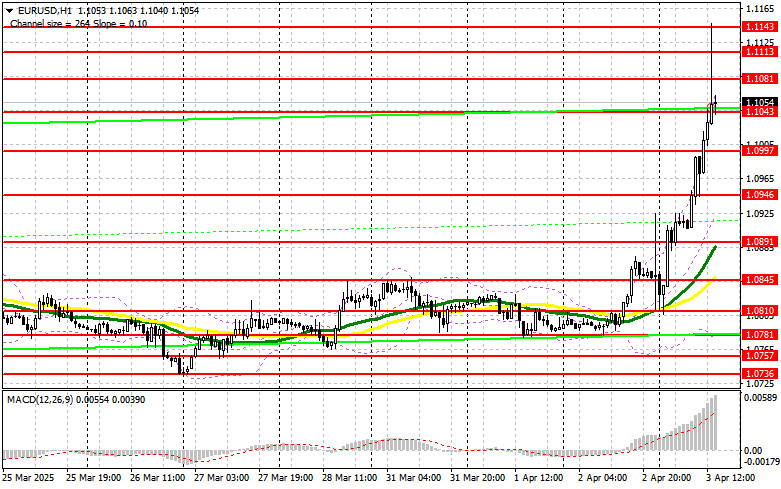

Moving Averages: Trading is above the 30- and 50-day moving averages, signaling the emergence of a new bull market for the euro.

Note: The author uses H1 hourly chart MAs, which may differ from classic daily chart definitions.

Bollinger Bands: If the pair declines, the lower band around 1.0891 will act as support.

Indicator Definitions:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dalam 24 jam terakhir, pasangan GBP/USD naik sebanyak 170 pip. Pada malam menjelang Jumat, pound sterling terus menguat. Beberapa hari yang lalu, kami mencatat bahwa dolar telah menguat secara signifikan

Pada hari Kamis, pasangan mata uang EUR/USD melanjutkan pergerakan naiknya dan mencatat kenaikan lebih dari 300 pip. Saat hari Jumat dimulai, pasangan ini terus mengalami pertumbuhan tanpa henti. Alasan

Pada hari Kamis, pasangan mata uang EUR/USD menunjukkan pertumbuhan yang sangat kuat—sebuah pergerakan yang mungkin tidak mengejutkan siapa pun saat ini. Tepat ketika kami melaporkan bahwa tarif terhadap Tiongkok telah

Dalam prediksi pagi saya, saya menyoroti level 1,2871 dan merencanakan untuk membuat keputusan masuk pasar berdasarkan level tersebut. Mari kita lihat grafik 5 menit dan lihat apa yang terjadi. Kenaikan

Dalam prediksi pagi, saya menyoroti level 1,1019 dan merencanakan untuk membuat keputusan masuk pasar berdasarkan level tersebut. Mari kita lihat grafik 5 menit untuk memahami apa yang terjadi. Harga memang

Pada pasangan GBP/USD, selama 24 jam terakhir, terjadi kenaikan, kemudian penurunan, dan kemudian kembali naik. Seperti sebelumnya, sulit untuk mengidentifikasi tren yang jelas pada kerangka waktu per jam. Berita tentang

Pada hari Rabu, pasangan mata uang EUR/USD menunjukkan pertumbuhan dan penurunan yang kuat. Belakangan ini, kedua pergerakan tersebut dipicu oleh Donald Trump. Pertama, muncul berita bahwa AS memberlakukan tarif tambahan

Pada hari Rabu, pasangan mata uang GBP/USD menunjukkan pergerakan campuran sepanjang hari tetapi umumnya mempertahankan tren penurunan — jika kita bahkan bisa menyebut perilaku saat ini sebagai "tren." Tidak

Pada hari Rabu, pasangan mata uang EUR/USD bergerak persis seperti yang diharapkan — dalam beberapa aspek. Pertama, mari kita mulai dengan pola "segitiga" yang kita bahas kemarin. Kami memperingatkan bahwa

Pada hari Selasa, pasangan GBP/USD trading dengan sedikit kecenderungan naik. Tidak ada berita besar sepanjang hari, dan hanya pada malam hari muncul berita tentang peningkatan tarif pada China, yang memicu

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.