Lihat juga

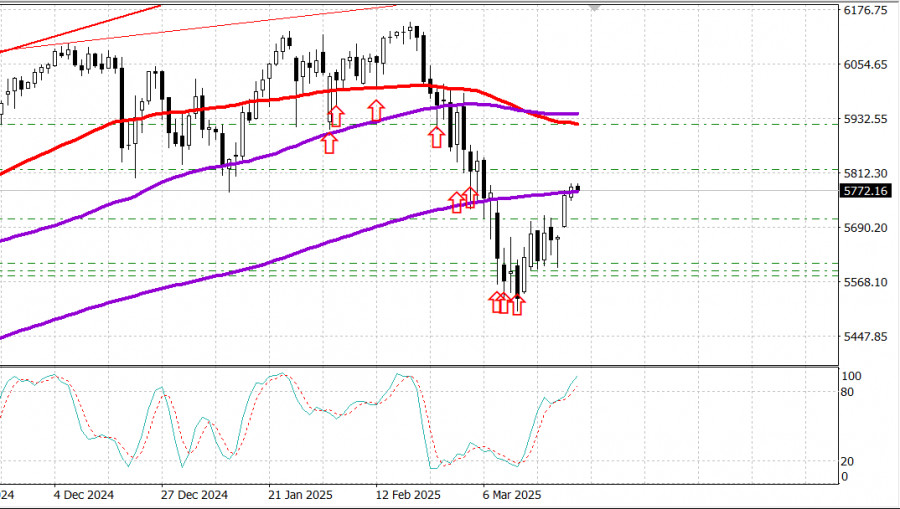

S&P500

Stock market update on March 26

Snapshot of the US stock indices on Tuesday:

* Dow +0%, NASDAQ +0.5%,

* S&P 500 +0.2%,

* S&P 500 now trading at 5,777 in a range of 5,500 to 6,000

The major stock indices closed higher for the third session in a row. This price action pushed the S&P 500 above its 200-day moving average (5,754). However, the movements were modest and mainly driven by growth in the mega-cap stocks.

Overall market sentiment was driven by a negative tilt, as market participants considered concerns about US trade policy and economic growth. The latter was triggered by disappointing morning economic data.

The Consumer Sentiment Index showed a fourth consecutive decline. The Expectations Index fell to its lowest level (65.2) in 12 years on the back of concerns about future employment and inflation prospects, setting the pace for this decline.

In a separate report, new home sales rose a modest 1.8% month-over-month in February, but more expensive homes made up a smaller percentage of sales compared to the previous month. In housing market-related news, disappointing earnings and guidance from KB Home (KBH 58.57, -3.22, -5.2%) contributed to the downward tilt yesterday.

KB Home's stock reached a 52-week low after the builder reported first-quarter earnings below consensus estimates and lowered its housing revenue forecast for the 2025 fiscal year, which fueled concerns about the intensifying slowdown in the housing market. This came less than a week after their competitor, Lennar (LEN 117.74, +0.18, +0.2%), released a soft EPS and delivery forecast for 2Q 2025.

Treasury bonds went up in another sign of concerns about growth. The 10-year bond yield dropped by two basis points to 4.31%, while the 2-year bond yield fell by three basis points to 4.00%. As a result, yesterday's $69 billion sale of 2-year bonds saw strong demand.

Year-to-date: Dow Jones Industrial Average: +0.1% S&P 500: -1.8% S&P Midcap 400: -3.6% Nasdaq Composite: -5.4% Russell 2000: -6.0%

Economic calendar on Tuesday

* FHFA House Price Index for January: 0.2%; previous revised from 0.4% to 0.5%* S&P Case-Shiller Home Price Index for January: 4.7% (consensus 4.6%); previous 4.5%* Consumer Sentiment Index for March: 92.9 (consensus 94.2); previous revised from 98.3 to 100.1

The key takeaway from the report is that the decline in confidence was mainly driven by a worsening outlook for consumers, fueled by concerns about inflation and future employment prospects, the latter of which reached a 12-year low. This could result in a reduction in discretionary spending.

* New home sales in February: 676k (consensus 680k); previous revised from 675k to 664k

The key takeaway from the report is that February new home sales benefited from lower mortgage rates, but affordability constraints continued to limit growth, as more expensive homes accounted for a smaller percentage of new home sales than the previous month.

Economic calendar on Wednesday

* 7:00 AM ET: MBA Mortgage Weekly Index (previous -6.2%)* 8:30 AM ET: February durable goods orders (consensus -1.2%; previous 3.1%) and durable goods orders excluding transportation (consensus 0.1%; previous 0.0%)* 10:30 AM ET: Weekly crude oil inventories (previous +1.75M)

Energy market

Brent Crude oil is now trading at $73.20. The price has risen by $2 in two days, fueled by some optimism in the US market.

Conclusion

Despite clear signs of weakness in the US economy, the market is likely to make an attempt at a growth wave. Our target is 6,000 for the S&P 500 index. Keep on buying on dips.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.