Lihat juga

09.07.2022 10:47 AM

09.07.2022 10:47 AMFresh data on the US labor market came out, and the June NonFarm Payrolls turned out to be very good. But not good either. Can June be considered a month of strong hiring? Do the NFP data support the case for another excessive rate hike? Stable or strong June NonFarm Payrolls is a very strong argument for the US central bank in favor of another sharp increase in interest rates. Actually, red-hot inflation leaves no other options for the central bank except to move the base rate up. The only question is how much. Although there is already some clarity here. Two of the most hawkish Federal Reserve representatives, Christopher Waller and James Bullard, called for a 75 basis point increase in July. The central bank's meeting on this issue will be held at the end of the month – on July 26 and 27.

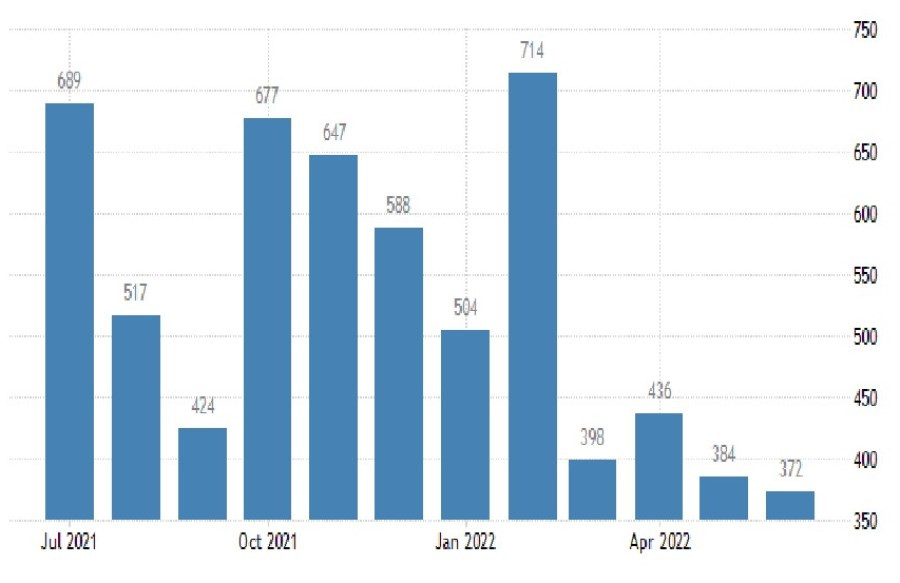

United States NonFarm Payrolls

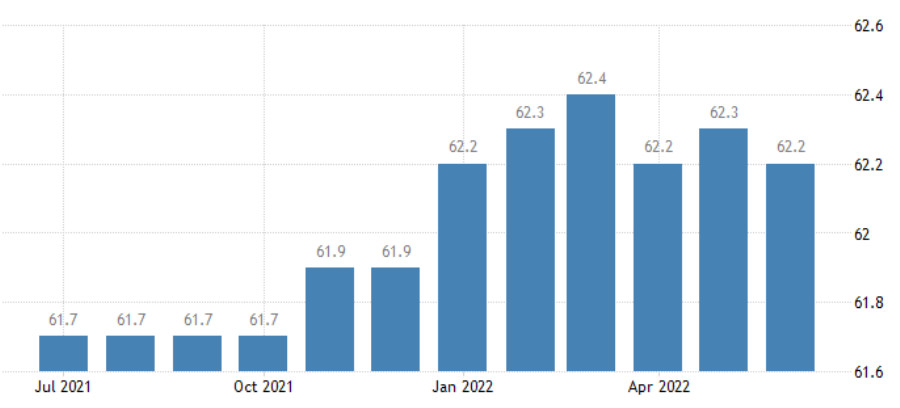

In June 2022, the number of vacancies (outside agriculture) in the United States increased by 372,000 people. This indicator came out lower than the previous one (384,000), but much higher than the forecast (268,000). The figures coincided with an average monthly increase of 383,000 compared to the previous three months, which still indicates a shortage of the labor market. According to June data, employment in the non-agricultural sector decreased by only 524,000 (0.3%) compared to the pre-pandemic level (February 2020).The labor force participation rate remains 1.25% lower to the pandemic level (February 2020). It takes into account everyone who is working or looking for a job. The labor force participation rate in the United States fell to 62.2% in June 2022 from 62.3% in the previous month. Apparently, Americans who lost their jobs or quit before the pandemic are returning to their jobs with a delay.

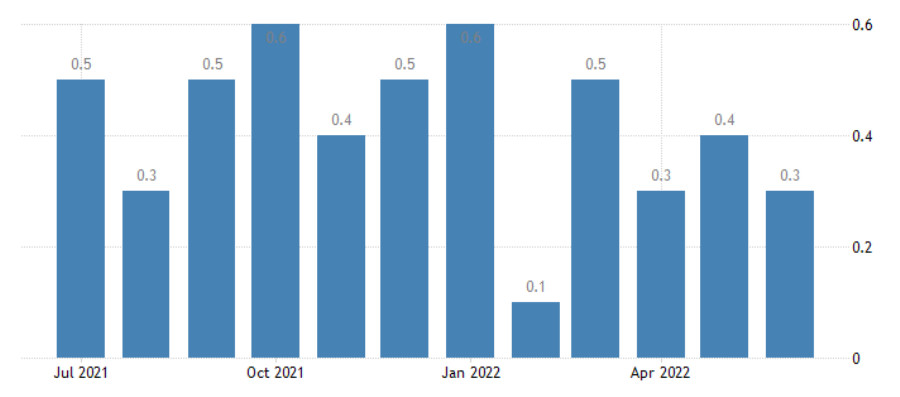

In the data of the June NFP, as well as the previous one, the indicators of hourly wages deserve special attention. They are important for the Fed in its control over inflation and the fight against it. After all, the more money in the pockets of Americans, the more funds that affect a wide basket of goods.

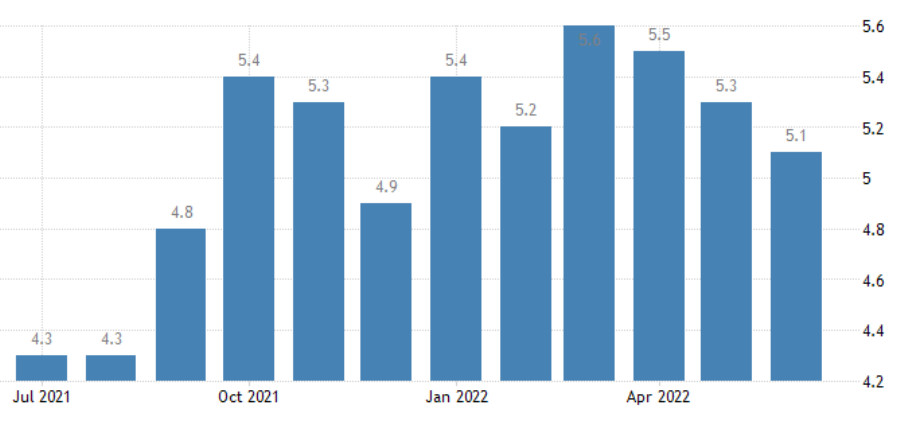

The average hourly wage increased by 0.3% in May against 0.4% (M/M), and in annual recalculation fell from 5.5% to 5.2%. Approximately the same picture emerges in June. The average hourly wage in the United States increased by 0.3% (to $32.08). Moreover, the previous 0.3% (in May) was also revised upward to 0.4% in the previous month and in line with market estimates. Overall, over the past 12 months, average hourly wages have increased by 5.1% after an upwardly revised increase of 5.3% and slightly above market forecasts for a 5% increase.

Average hourly wage (Y/Y)

"We will do everything possible to achieve full employment and price stability," – such goals, according to the head of the US central bank, are set by the Fed. And although Fed Chairman Jerome Powell considers the fight against red-hot inflation to be the main priority, the second important area of attention is full employment in the labor market. If the labor market shrinks, then the central bank will have an opportunity for a softer policy. Moreover, this will not necessarily lead to a decline in the dollar.

So now the markets are likely to focus on what the Fed is also worried about – inflation and rising interest rates. And higher interest rates will lead to a rise in the US dollar. The June NonFarm Payrolls data has already caused a lot of volatility in the markets, especially in the currency markets. As uncertainty about the Fed's rate hike persists, investors have recently been very sensitive to any economic news.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pasar AS menunjukkan tanda-tanda ketidakstabilan yang baru. Sinyal positif tentang potensi de-eskalasi dalam konflik perdagangan dengan Tiongkok memicu harapan, tetapi para ahli memperingatkan agar tidak terlalu optimis. Skenario "jebakan pasar

Pasar saham Asia akhirnya mendapatkan jeda pada hari Rabu, berkat serangkaian pernyataan yang menggembirakan dari Donald Trump. Presiden AS tersebut menghilangkan kekhawatiran bahwa Ketua Fed Jerome Powell mungkin akan dipecat

S&P 500 dan Nasdaq 100 terus mengalami penurunan seiring dengan meningkatnya kekhawatiran terhadap perlambatan pertumbuhan ekonomi dan dampak tarif trading yang memengaruhi sentimen. Pasar tetap bergejolak, dengan investor menyesuaikan strategi

S&P 500 dan Nasdaq kembali tergelincir setelah Donald Trump melontarkan kritik terhadap Federal Reserve. Komentarnya memunculkan keraguan terhadap independensi bank sentral, memperkuat kekhawatiran inflasi di seluruh pasar. Sebagai respons, dolar

Investor Khawatir Tentang Independensi Fed di Era Trump Aset AS Turun, Dolar Mencapai Titik Terendah Tiga Tahun Terhadap Euro Yen dan Franc Swiss Menguat Sebagai Safe-Haven Emas Mencapai Rekor Tertinggi

Pernyataan terbaru Jerome Powell memicu penjualan besar-besaran pada saham AS. Baik S&P 500 maupun Nasdaq mencatat kerugian yang signifikan setelah ketua Fed mengatakan bahwa suku bunga kemungkinan akan tetap tidak

Powell mengatakan ekonomi melambat pada Q1, mungkin menunggu kejelasan lebih lanjut Saham Eropa turun menjelang keputusan kebijakan ECB Nvidia memperingatkan dampak pembatasan ekspor chip AS ke Tiongkok Emas kembali mencapai

Ferrari F8 TRIBUTO

dari InstaTrade

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.