EURSGD (Euro vs Singapore Dollar). Exchange rate and online charts.

Currency converter

18 Mar 2025 07:23

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The EUR/SGD currency pair is the cross rate against the U.S. dollar. There is no U.S. dollar in this currency pair, but the euro and the Singapore dollar are under its great influence. To make it clear, just combine EUR/USD and USD/SGD charts in the same price chart, and you will get the approximate EUR/SGD chart.

The U.S. dollar extends an enormous influence over both currencies. So for better prediction of the future rate movement of this currency pair, you should consider the main indicators of the U.S. economy. There are such indicators as the interest rate, GDP, unemployment, new workplaces indicator and many others. Remember that the currencies listed above may react in a different way to the changes in the economic situation of the U.S.A.

This pair is not a very popular one on Forex market. Moreover, its rate fluctuation is not large. Currently, the Singapore dollar is one of the most stable currencies in the world. The country's economy is characterized by very low inflation, predominance of exports over imports, and high living standards. Furthermore, the country possesses the large foreign exchange reserves.

Singapore is industrial and economically developed country, which has a great advantage of its geographical location at the crossroads of the main shipping routes. Thanks to this location Singapore can actively trade with all the most developed countries in the world. Singapore exports home electronics and information technology products, pharmaceuticals, and shipbuilding products. Thus, export hardly affects both economy of the country and its national currency. Besides, Singapore provides financial services.

Singapore belongs to group of the four most developed countries in Asia, that is also known as "Asian tigers" or “Asian dragons”. The rapid development of its economy allows the country to get the same level of economic growth as the most developed countries like the U.S.A., Germany, France, Great Britain, etc.

Comparing to the major currency pairs such as EUR/USD, USD/CHF, GBP/USD and USD/JPY, this one is relatively illiquid. So when you make a prognosis of the future pair movement, you should pay special attention to the currency pairs that consist of the euro and the Singapore dollar in tandem with the U.S. dollar.

Keep in mind that spread for this cross currency pair can be higher than for more popular ones. So before you start dealing with the cross rates, learn carefully the broker’s conditions for this specified trade instrument.

See Also

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1003

Wall Street updateAuthor: Andreeva Natalya

15:04 2025-03-17 UTC+2

943

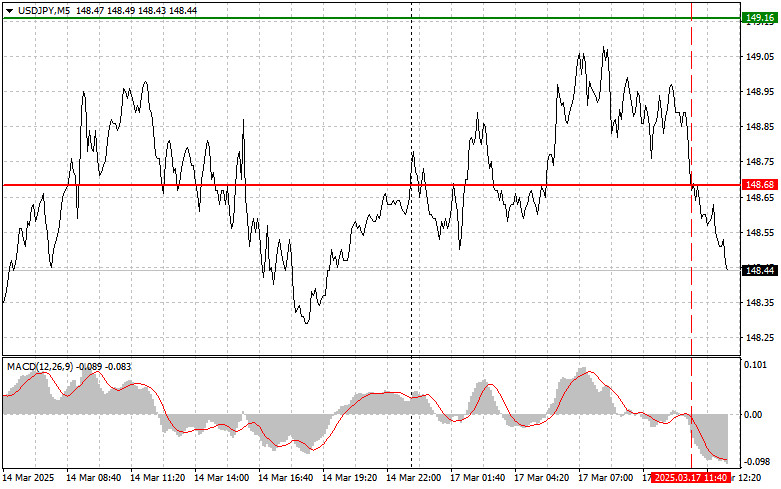

The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero markAuthor: Jakub Novak

18:32 2025-03-17 UTC+2

703

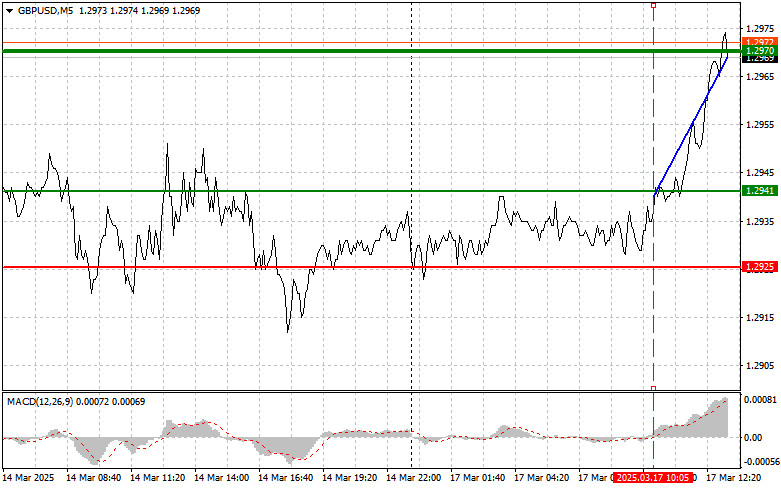

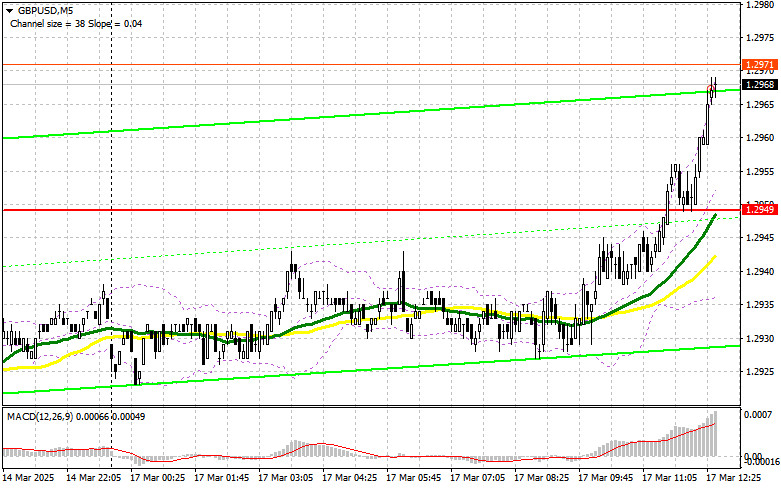

- The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark

Author: Jakub Novak

18:27 2025-03-17 UTC+2

688

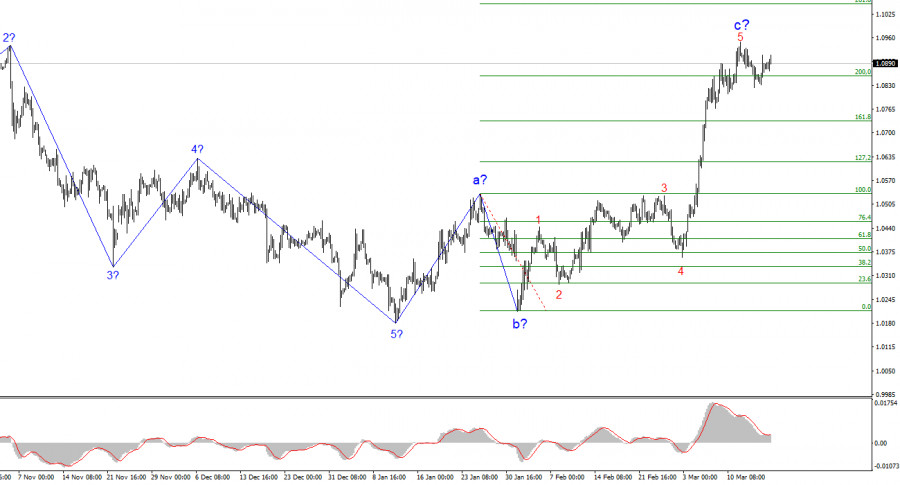

The euro is aiming for 1.1027 ahead of the Fed meeting.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

The yen's target is 151.30.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

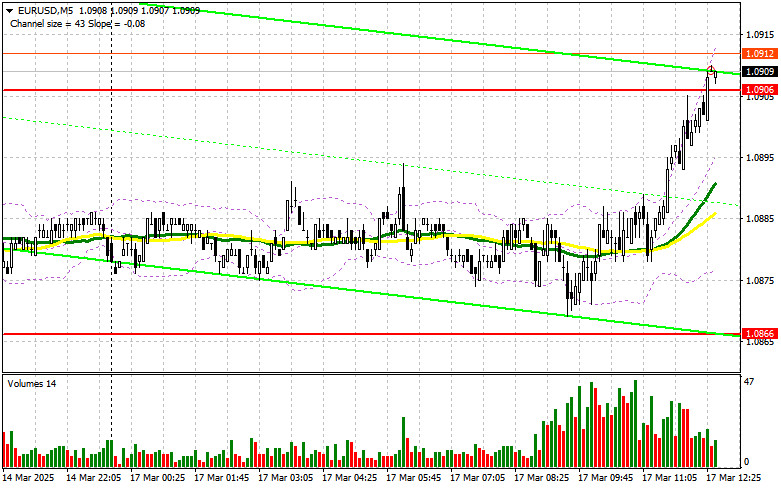

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

688

In my morning forecast, I highlighted the 1.0866 level as a key point for making entry decisionsAuthor: Miroslaw Bawulski

18:17 2025-03-17 UTC+2

673

In my morning forecast, I highlighted 1.2949 as a key level for making market entry decisionsAuthor: Miroslaw Bawulski

18:20 2025-03-17 UTC+2

673

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1003

- The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero mark

Author: Jakub Novak

18:32 2025-03-17 UTC+2

703

- The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark

Author: Jakub Novak

18:27 2025-03-17 UTC+2

688

- The euro is aiming for 1.1027 ahead of the Fed meeting.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

- The yen's target is 151.30.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

688

- In my morning forecast, I highlighted the 1.0866 level as a key point for making entry decisions

Author: Miroslaw Bawulski

18:17 2025-03-17 UTC+2

673

- In my morning forecast, I highlighted 1.2949 as a key level for making market entry decisions

Author: Miroslaw Bawulski

18:20 2025-03-17 UTC+2

673