GBPHKD (British Pound vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

18 Mar 2025 07:24

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

GBP/HKD is one of the popular currency pairs on Forex. Hong Kong is actively trading with the UK which is the largest business partner of the region. For this reason, the GBP/HKD pair is preferred by experienced traders who choose this trading instrument as the economies of the euro area and Hong Kong remain stable and predictable.

GBP/HKD is the cross rate against the US dollar. Although the US dollar obviously is not in this currency pair, it still has a significant influence on the rate of the pair. This can be seen if you combine the charts of the GBP/USD and USD/HKD pairs, thus, you can get an approximate GBP/HKD chart.

The US dollar has a significant influence on both currencies. For this reason it is necessary to take into account the major US economic indicators in order to predict correctly a future course of this financial instrument. These indicators are as follows: the discount rate, GDP, unemployment rate, Non-Farm Payrolls, etc. It is necessary to note that discussed currencies could respond with different speed to changes in the US economy. Therefore, the GBP/HKD currency pair may be a specific indicator of these currencies fluctuations.

Hong Kong stock exchange is considered one of the largest stock exchanges. On many indicators Hong Kong leaves behind a number of major European and American stock exchanges. Nowadays, Hong Kong occupies the leading position among the top financial centers all over the globe.

Hong Kong's economy is based on the principle of free market, low taxation, and the policy of neutrality, as the government does not interfere in the region's economy. There are insufficient mineral and food resources, for this reason its economy is heavily dependent on these factors. Most of Hong Kong's income constitute service industries, as well as re-exports from China. In addition, the tourism sector is well developed.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread than on more popular currency pairs, so before you start working with the cross-rates, one should carefully read and understand terms and conditions offered by the broker to trade with specified trading instrument.

See Also

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1003

Wall Street updateAuthor: Andreeva Natalya

15:04 2025-03-17 UTC+2

943

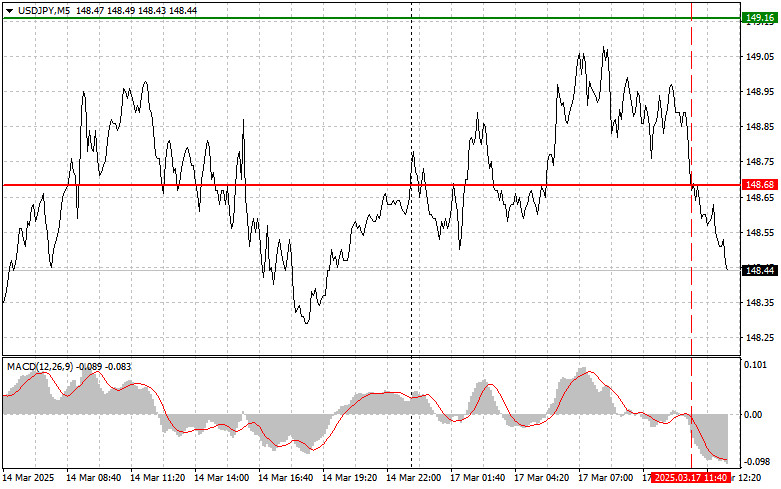

The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero markAuthor: Jakub Novak

18:32 2025-03-17 UTC+2

703

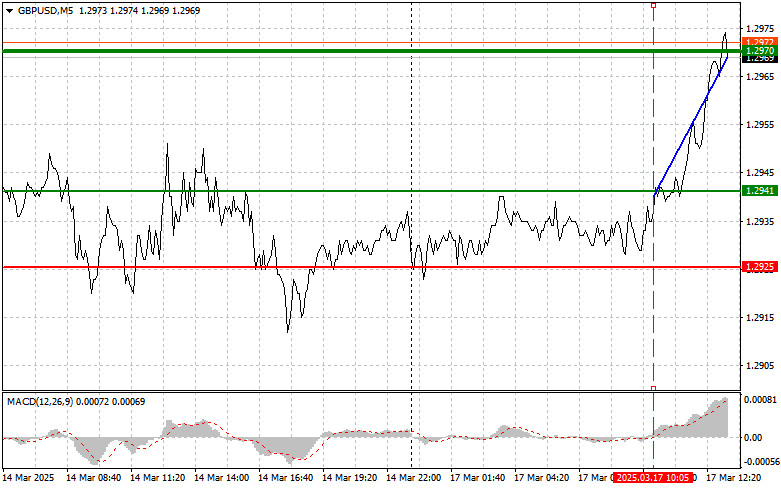

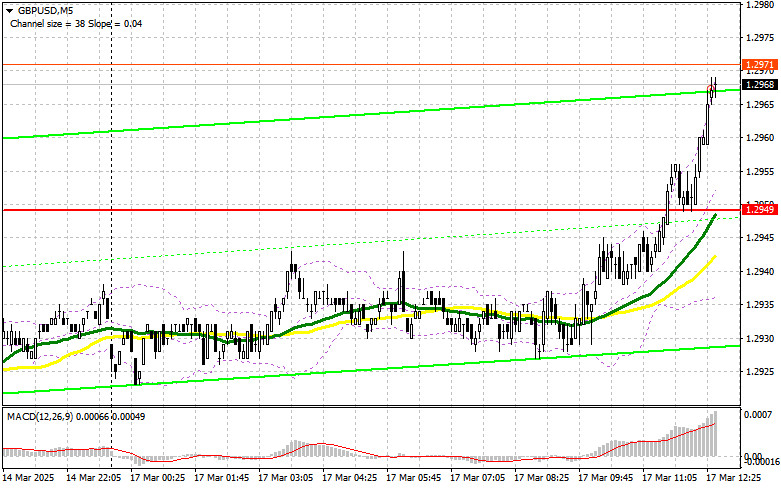

- The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark

Author: Jakub Novak

18:27 2025-03-17 UTC+2

688

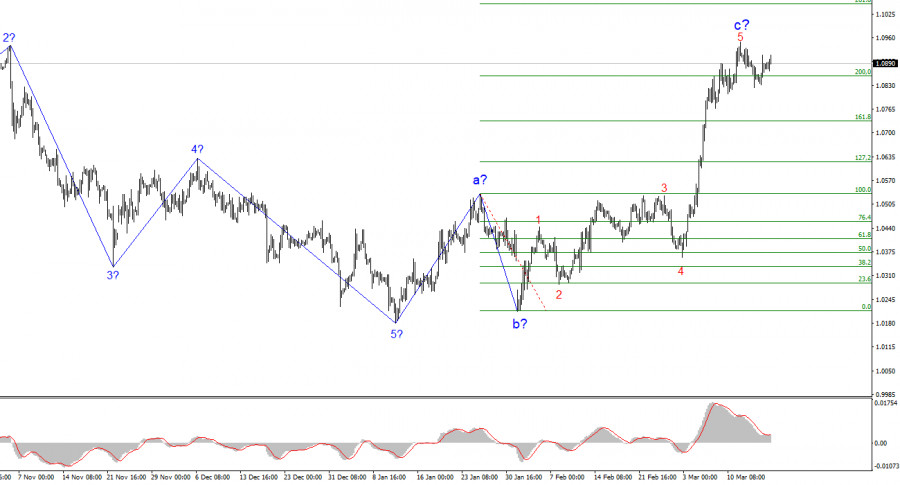

The euro is aiming for 1.1027 ahead of the Fed meeting.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

The yen's target is 151.30.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

688

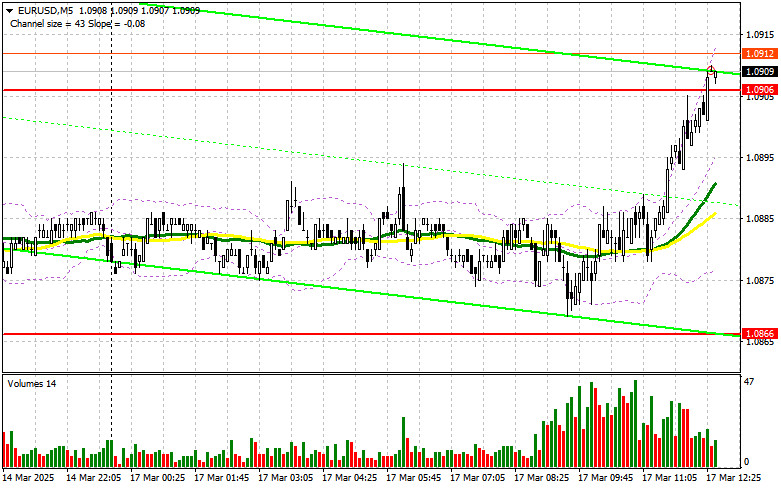

In my morning forecast, I highlighted the 1.0866 level as a key point for making entry decisionsAuthor: Miroslaw Bawulski

18:17 2025-03-17 UTC+2

673

In my morning forecast, I highlighted 1.2949 as a key level for making market entry decisionsAuthor: Miroslaw Bawulski

18:20 2025-03-17 UTC+2

673

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1003

- The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero mark

Author: Jakub Novak

18:32 2025-03-17 UTC+2

703

- The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark

Author: Jakub Novak

18:27 2025-03-17 UTC+2

688

- The euro is aiming for 1.1027 ahead of the Fed meeting.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

- The yen's target is 151.30.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

688

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

688

- In my morning forecast, I highlighted the 1.0866 level as a key point for making entry decisions

Author: Miroslaw Bawulski

18:17 2025-03-17 UTC+2

673

- In my morning forecast, I highlighted 1.2949 as a key level for making market entry decisions

Author: Miroslaw Bawulski

18:20 2025-03-17 UTC+2

673