See also

11.04.2025 06:04 AM

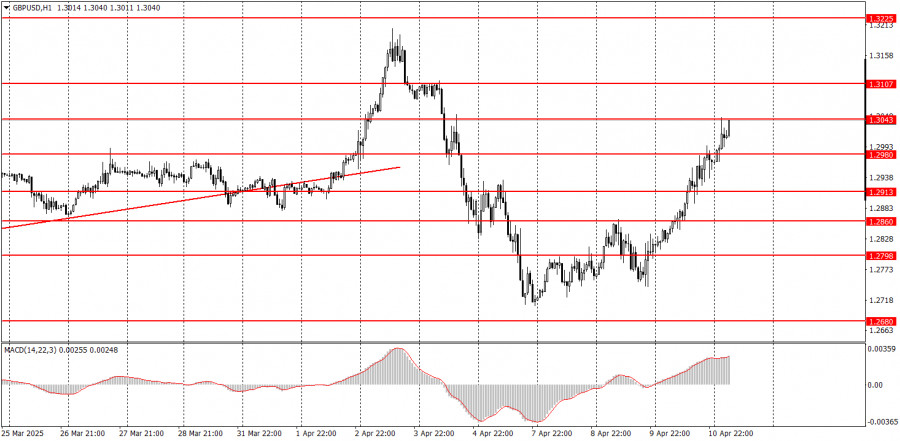

11.04.2025 06:04 AMOver the past 24 hours, the GBP/USD pair moved up by 170 pips. During the night into Friday, the pound sterling continued to rise. A few days ago, we noted that the dollar had significantly strengthened but also mentioned that we wouldn't be surprised if it soon began to depreciate just as quickly. As we can see, Trump's new tariffs on China were more than enough to plummet the U.S. dollar again. As previously stated, the dollar can fall indefinitely because Trump can endlessly raise tariffs on China and other countries. The technical picture on higher timeframes is beginning to shift significantly, so for now, it holds little relevance. We first need to get through Trump's tariff introduction phase. Once things settle down, we can reevaluate the technical situation on the higher timeframes and draw conclusions.

On the 5-minute timeframe Thursday, a fair number of signals were generated, although the movement wasn't as strong as in the euro. As a result, novice traders' profits weren't as large as with the euro, but there were still opportunities to earn. Today is a new day for Donald Trump, which means new opportunities.

On the hourly chart, the GBP/USD pair should have started a downward trend long ago, but Trump continues to do everything possible to drag the dollar down. Since the official start of the global trade war, we've refrained from making long-term predictions about price movements. On Friday, we saw a sharp drop in the pair, which could mark the beginning of a substantial correction. However, the market remains under the control of Trump and his decisions. Trump announces new tariffs—and the dollar falls again.

On Friday, the GBP/USD pair may remain in a state of turbulence. Predicting where the pound and the dollar will go today is virtually impossible. The pair is rising logically, but no one knows what headlines will emerge today from Beijing or Washington.

On the 5-minute timeframe, the following levels can currently be used for trading: 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3145–1.3167, 1.3225, 1.3272.

In the UK, GDP and industrial production reports are scheduled for release on Friday, but we don't believe the market will pay any attention to them. Even if it does, they're unlikely to have any real impact.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The current

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuck

In my morning forecast, I highlighted the 1.3247 level as a reference point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened

In my morning forecast, I highlighted the 1.1341 level as a key point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened there

Analysis of Tuesday's Trades 1H Chart of GBP/USD Throughout Tuesday, the GBP/USD pair continued its upward movement. As we can see, the British currency doesn't need any particular reason

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair pulled back slightly, which can be considered a purely technical correction. Yesterday — and generally —

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.