See also

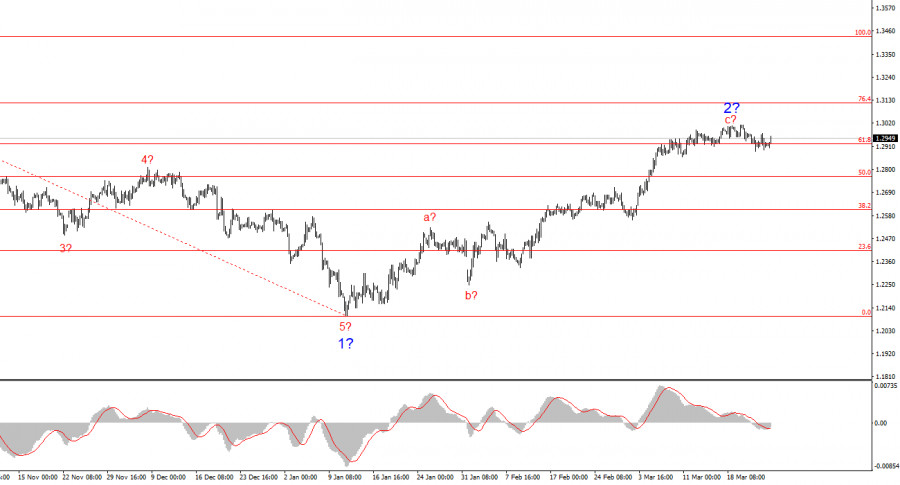

The wave pattern for GBP/USD remains somewhat ambiguous but still manageable. Currently, there is a high probability of a long-term downward trend forming. Wave 5 has taken a convincing shape, so I consider the larger Wave 1 to be complete. If this assumption is correct, the pair is now in the process of forming Wave 2, with targets around the 1.26 and 1.28 levels. The first two subwaves of Wave 2 appear to be complete, and the third could end at any moment.

Demand for the pound has recently grown solely due to the "Trump factor," which remains its main ally. However, over a longer horizon—beyond just a few days—the pound still lacks a fundamental basis for growth. The Bank of England and the Fed have recently shifted their stances in favor of the pound, as the BoE is now also in no rush to cut interest rates. The current wave structure remains intact, but any new price increase could raise serious doubts about its sustainability.

The GBP/USD rate increased by 30 basis points on Tuesday. Of course, it may fall by 50–60 points during the U.S. session, as neither buyers nor sellers have any clear reason to be active in the short term. Yesterday's PMI figures from the U.S. and the UK were mixed, and today there were no news releases, reports, or speeches at all. Therefore, the pound's strengthening in the first half of the day is not fundamentally justified, and the second half may bring a decline—if not today, then likely tomorrow.

Recently, there have been no new announcements from Donald Trump regarding tariffs. More precisely, Trump constantly talks about them, keeping market participants on edge. However, according to insider information from the White House, the president's anger may be softening slightly. This does not imply a complete abandonment of tariffs against the European Union, but they may become more moderate and targeted. The same applies to other countries, including the UK.

At the moment, it doesn't really matter who the U.S. tariffs are targeting. What matters is that demand is falling for the dollar—not necessarily rising for the euro or the pound. Therefore, new tariffs may strengthen both the euro and the pound simply because the dollar is depreciating. I should also note that although tariff tensions have eased slightly in recent days, this hasn't helped the U.S. dollar in any meaningful way. That's why I find it hard to say what exactly needs to happen for the dollar to regain market trust.

The wave pattern for GBP/USD indicates that the downward trend is continuing, as is Wave 2. At this point, I would recommend looking for new entry points to sell, as the current wave structure still suggests the development of the downward movement that began last autumn. However, how—and for how long—Donald Trump's policies will continue to affect market sentiment remains a mystery. The current strengthening of the pound looks excessive within the existing wave structure. The BoE and FOMC meetings could have served as a starting point for Wave 3, but it seems they did not.

On the higher wave scale, the wave structure has changed. We can now assume the formation of a downward trend, as the previous three-wave upward movement appears to be complete. If this assumption is correct, we should expect a corrective Wave 2 or b, followed by an impulsive Wave 3 or c.

Core Principles of My Analysis

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.