See also

The GBP/USD pair continued its upward movement on Wednesday. After the Federal Reserve kept its key interest rate unchanged and downgraded U.S. economic growth forecasts, the dollar fell again, within reasonable limits. The decline could have been much sharper. However, the uptrend has visibly slowed in recent weeks, with traders buying at their last strength.

That strength is fading, as Trump's tariffs have been the only reason for the dollar's decline in the past three weeks. While this is a significant factor, it cannot drive the dollar lower indefinitely. Moreover, the market is ignoring all other news, including positive data for the U.S. dollar. Therefore, we believe that a correction is overdue.The Bank of England meeting today could spark another rally in the British pound, but it is important to note that the BoE and the U.K. economy have played no role in this recent pound rally.

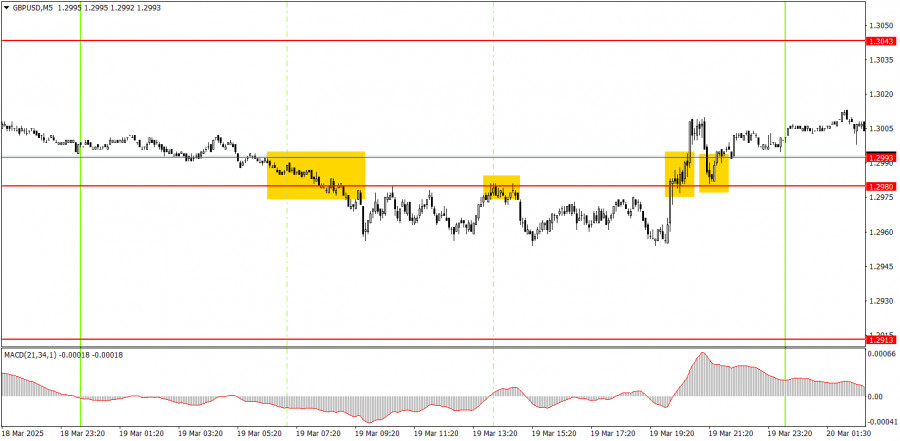

On the 5-minute timeframe, four trading signals formed on Wednesday. However, the two evening signals should have been ignored for obvious reasons. This left two sell signals in the 1.2980-1.2993 zone. In both cases, the pair failed to move down even 20 pips. These signals were duplicates, meaning novice traders could have entered only one short position. Even that trade could have been closed at a profit, as the pair remained below the entry point for the rest of the day.

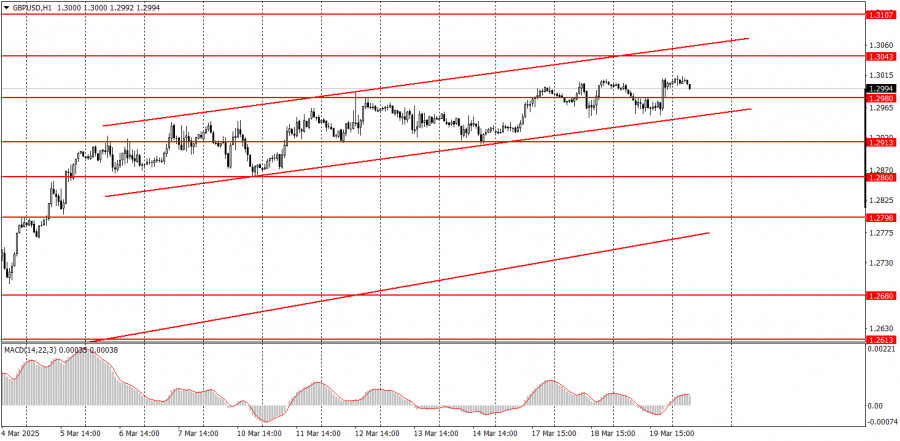

On the hourly timeframe, GBP/USD should have already started a downtrend, but Trump is preventing this from happening. In the medium term, we still expect a decline in GBP/USD towards 1.1800. However, how long Trump's policies will continue pushing the dollar lower is unclear. Once this movement ends, the technical picture on all timeframes could change dramatically. For now, the long-term trend still points downward. The British pound's recent rally was not baseless but too strong and irrational.

On Thursday, GBP/USD could continue rising, as the market does not need a reason to sell the dollar. However, we are anticipating a downward correction.

Key levels on the 5-minute timeframe to consider are 1.2301, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2613, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, and 1.3102-1.3107. Thursday's key events in the U.K. include the BoE meeting, a speech by BoE Governor Andrew Bailey, and reports on unemployment and wage growth. Given the scheduled events, high market volatility is expected. However, we believe that U.K. macroeconomic data and the BoE meeting have little chance of supporting the pound in the long run.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.