See also

19.03.2025 07:44 AM

19.03.2025 07:44 AMOn Tuesday, the GBP/USD pair closely mirrored the movements of the EUR/USD pair. The British pound often follows the euro, and on some occasions, it simply replicates its movements. Yesterday, the euro traded in a highly technical manner, allowing traders to open two profitable trades. However, the pound, while mirroring the euro's actions, applied those movements to its own price levels, which were not identical to those of the euro.

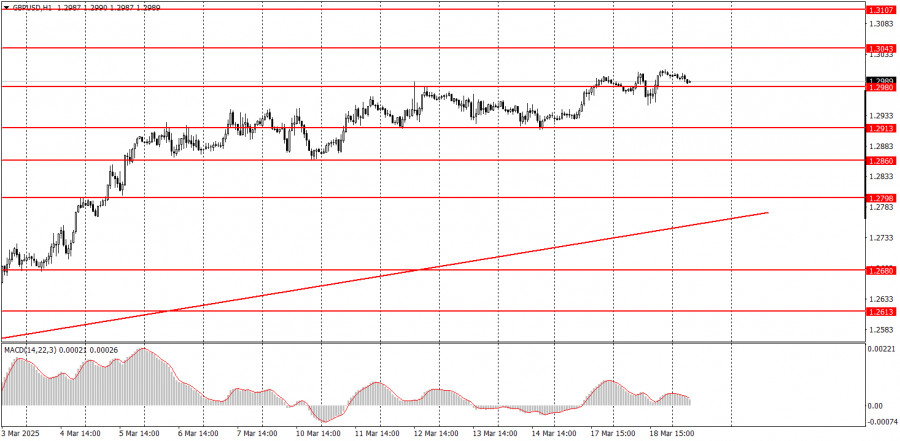

Overall, the British pound continues to rise, despite various factors at play. There were no significant events or reports in the UK on Tuesday, although U.S. reports provided support for the dollar. By the end of the day, however, the pound had risen again—though not significantly. This slow and steady increase has been its recent trend. The market remains hesitant but continues to sell off the U.S. dollar, likely due to the lack of daily tariff announcements from Donald Trump. The uptrend in the pound is clearly visible.

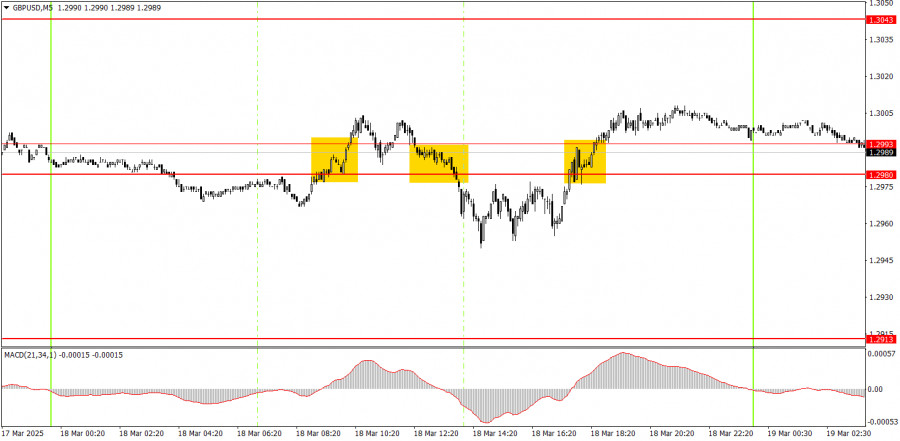

On the 5-minute timeframe, three trading signals were generated on Tuesday, all of which turned out to be false. However, the second short trade could have been closed at breakeven, as the price moved 20 pips in the right direction. The third trade could have even resulted in a small profit if it had been closed manually in the evening.

On the hourly timeframe, the GBP/USD pair should have started a downtrend long ago, but Trump is doing everything to prevent it. In the medium term, we still expect the pound to decline to 1.1800, but it is unclear how long the dollar's decline will last due to Trump's influence. Once this movement ends, the technical picture across all timeframes could change dramatically. For now, long-term trends still point downward. The pound's recent rise was not entirely unjustified, but it was once again excessive and illogical.

On Wednesday, the GBP/USD pair may continue rising as the market no longer needs any fundamental justification to sell the dollar. However, today's Federal Reserve meeting could bring volatility and erratic movements in the evening.

On the 5-minute timeframe, key levels to trade around are 1.2301, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2613, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, and 1.3102-1.3107. No significant events or reports are scheduled for the UK on Wednesday, while in the U.S., the Federal Reserve meeting results will be announced. The dollar is unlikely to receive strong support from the Fed, and market movements could be turbulent.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Friday, the GBP/USD currency pair managed to trade both ways, fully taking advantage of the forming flat. In the first half of the day, the British pound declined

On Friday, the EUR/USD currency pair continued its upward movement, which began on Wednesday evening. Market volatility in recent weeks has been low, and the hourly chart clearly shows

Thursday Trade Review: 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair maintained its bullish bias within a sideways movement that's been underway for about two weeks. This

On Thursday, the GBP/USD currency pair also traded higher, but with minimal volatility. During the past day, only one US report was published: the second estimate

The EUR/USD currency pair continued its upward movement on Thursday, which had started on Wednesday evening. At this point, it's not possible to say for certain that the flat phase

Wednesday Trade Review: 1H Chart of GBP/USD On Wednesday, the GBP/USD pair exhibited movement similar to that of the EUR/USD pair—first an unfounded drop, then a more logical rise. Recall

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.