See also

11.03.2025 11:57 AM

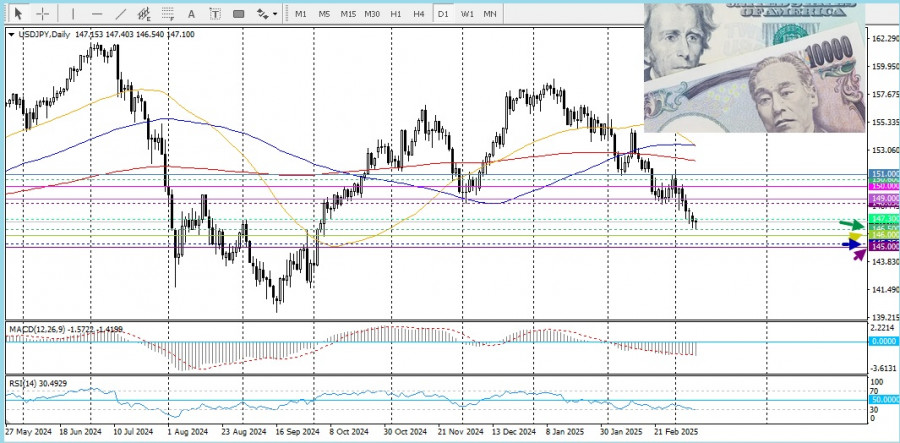

11.03.2025 11:57 AMThe USD/JPY pair continues to decline as investors remain optimistic about the Bank of Japan's potential interest rate hikes, driven by rising inflation in Japan. This expectation narrows the bond yield gap between Japan and other countries, making the yen a more attractive investment.

Additionally, the prevailing risk-off sentiment in global stock markets is supporting the yen's traditional status as a safe-haven asset. Meanwhile, the U.S. dollar remains under pressure, trading near multi-month lows.

Expectations of a slowing U.S. economy, exacerbated by trade tariffs, have fueled speculation that the Federal Reserve may cut interest rates multiple times this year. This weighs on the dollar and limits any intraday recovery in USD/JPY from the 146.00 level, as traders await key U.S. inflation data.

If USD/JPY recovers above 147.30, sellers are likely to re-enter the market before the key psychological resistance at 148.00. Moreover, strong resistance at 148.65 will be a crucial level to watch, as it could cap further upward movement.

On the other hand, a break below the intraday low of 146.50 could accelerate losses toward the round number support at 146.00. If selling pressure persists, the next intermediate support at 145.25 may act as a target before the psychological barrier at 145.00 comes into play.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.