See also

24.02.2025 08:57 AM

24.02.2025 08:57 AMclear directional trend. However, this is not a traditional flat market with a well-defined sideways channel but rather a limited price range where liquidity is continuously being removed from both sides. Given that liquidity is being absorbed on both ends, it is difficult to determine an imminent trend direction. At this stage, no distinct patterns are forming beyond liquidity grabs.

Meanwhile, the cryptocurrency market was shaken by a major security breach, in which one of the largest crypto exchanges was hacked, leading to $1.46 billion in crypto assets being stolen. According to exchange officials, only one wallet was compromised, while all other accounts remained unaffected, and withdrawals continued as usual. Nonetheless, this is another serious blow to the crypto industry, highlighting the persistent security risks associated with digital assets. Unlike traditional financial systems, cryptocurrencies lack full protection against such attacks, especially when large amounts are stored in centralized locations.

The market reacted with a sharp drop, reinforcing the bearish outlook for Bitcoin. Notably, BTC/USD has removed bearish liquidity four times recently, meaning that stop-loss orders above key highs have been triggered.

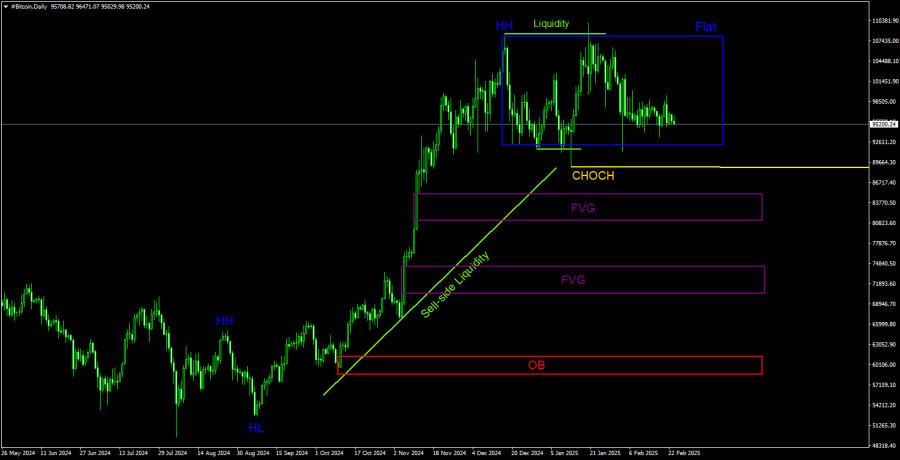

On the daily timeframe, Bitcoin's uptrend remains intact, as each new higher high (HH) is formed after a higher low (HL). However, the latest HH was not confirmed, leading to what is known as a fake BOS (Break of Structure). This suggests that the market merely collected liquidity from stop-loss orders above the previous high without establishing a new bullish impulse. As a result, a deeper correction or even a trend reversal could be developing.

For now, Bitcoin remains in a consolidation phase, with liquidity being removed at both the upper and lower boundaries of the $92,100 - $108,000 range. The CHOCH (Change of Character) level, marked on the chart, represents the critical support, below which the uptrend would be broken. Bitcoin has not yet tested this level, meaning that a confirmed downtrend has not officially begun.

Nonetheless, a move toward $92,100 seems increasingly likely in the coming weeks, though further declines are uncertain at this stage. According to Wyckoff methodology, consolidation phases can be interpreted as re-accumulation zones, where market makers accumulate positions before another potential rally. However, if the CHOCH level is breached, trend-following liquidity below this support level would be targeted, leading to a long-term bearish move.

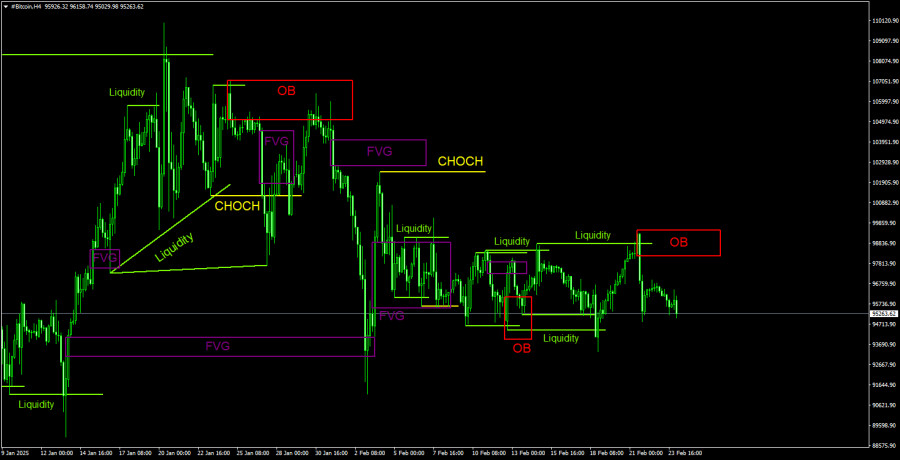

On the 4-hour timeframe, Bitcoin is forming some identifiable trading patterns. Recently, a bearish order block (OB) was established, and multiple liquidity sweeps have occurred. These liquidity grabs are marked on the chart.

So far, Bitcoin has not yet revisited the newly formed OB, but if the price returns to this area, it could present a short-selling opportunity. However, it is important to remember that Bitcoin remains within a restricted range, meaning that even after retesting the OB, the subsequent drop may not be particularly strong.

Bitcoin Trading Recommendations (BTC/USD):

Currently, we maintain a bearish outlook for Bitcoin over the next few months. The recent bounce from the lower boundary of the daily range led to a short-term rally, but this movement lacked momentum. On both the 4-hour and daily charts, Bitcoin remains in a consolidation phase.

A potential short-term upside move within the range is possible, but overall, the market remains more inclined toward a deeper correction.

Key Terms and Explanations:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ethereum remain within their sideways channels, and the inability to break out of these ranges could jeopardize the prospects for a broader recovery in the cryptocurrency market. However

After successfully exiting the Ascending Broadening Wedge pattern on the 4-hour chart of the Litecoin cryptocurrency followed by the appearance of Divergence between the Litecoin price movement and the Stochastic

Pressure on the cryptocurrency market returned yesterday after traders and investors triggered a sell-off in the U.S. stock market. As I've noted repeatedly, the correlation between these two markets

Over the past weekend, Bitcoin and Ethereum demonstrated decent resilience, maintaining a chance for further recovery. While from a technical standpoint, those chances may appear rather slim, trading within

Bitcoin and Ethereum dropped in value toward the end of Thursday's U.S. session but recovered during today's Asian trading hours. It has become common practice that the crypto market declined

With the appearance of divergence between the price movement of the Polkadot cryptocurrency and the Stochastic Oscillator indicator on its 4-hour chart, as long as there is no weakening correction

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.