See also

Today, the EUR/USD pair is attempting to recover its recent losses from the previous session, trading around 1.0420.However, it remains within a descending channel despite efforts to improve the situation.

The key momentum indicator, RSI (14-day Relative Strength Index), remains below the 50 level, confirming the bearish trend for the EUR/USD pair. Furthermore, the 9-day Exponential Moving Average (EMA) is below the 14-day EMA, indicating weak short-term price momentum.

On the other hand, the two-year low at 1.0332, recorded on November 22, serves as the primary support for the EUR/USD pair. A successful break below this level would reinforce bearish positions, exerting additional downward pressure on the pair.

Regarding resistance, the first hurdle for the EUR/USD pair is the 9-day EMA, which has already been tested, followed by the 14-day EMA. Breaking above these EMAs would bring the pair closer to the upper boundary of the descending channel at the 1.0500 level, and subsequently to the monthly high with some intermediate obstacles along the way.

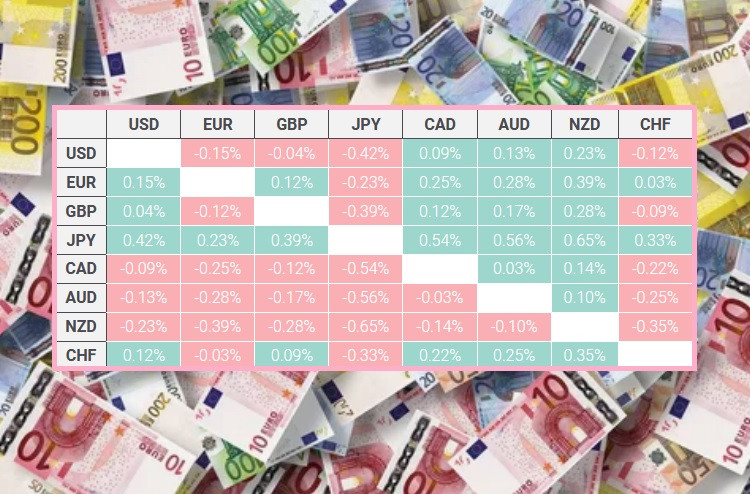

The table below shows the percentage change of the euro against the listed major currencies for today.

The euro was strongest against the New Zealand dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.