See also

GOLD

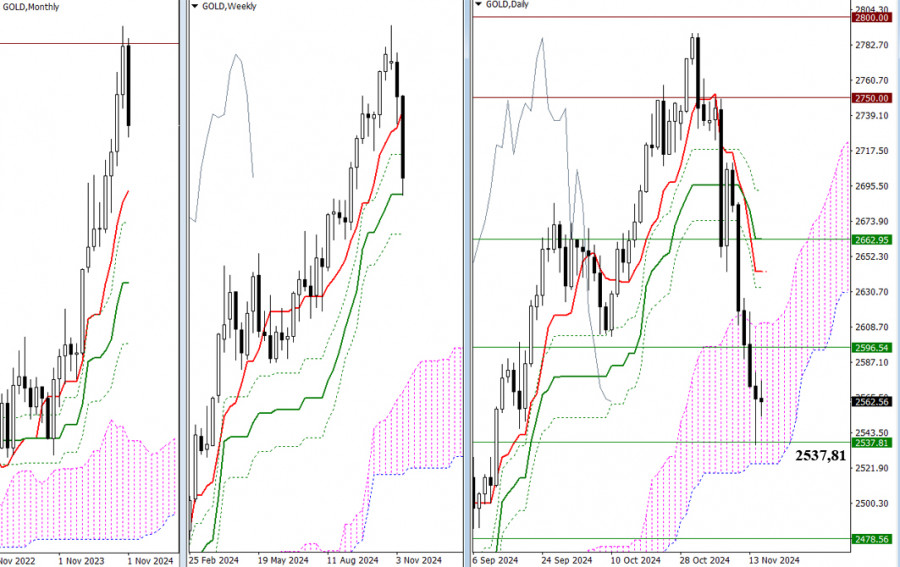

Last week, bearish players extended the downward trend, reaching the support of the weekly medium-term trend at 2537.81. The immediate outcome of this interaction will now be determined. A slowdown and consolidation are possible. If the bulls aim to rebound from this support, their first task is to reclaim the weekly level at 2596.54 and exit the daily Ichimoku cloud at 2611.32. Beyond this, bullish players will encounter resistance at the daily Ichimoku cross levels: 2642.89 (Tenkan) and 2662.95 (Kijun), followed by the weekly short-term trend resistance at 2662.95. Should the decline continue and the bears manage to break through the weekly medium-term support at 2537.81, along with exiting into the bearish zone below the daily Ichimoku cloud at 2524.45, their next goal will be to eliminate the weekly Ichimoku golden cross at 2478.56.

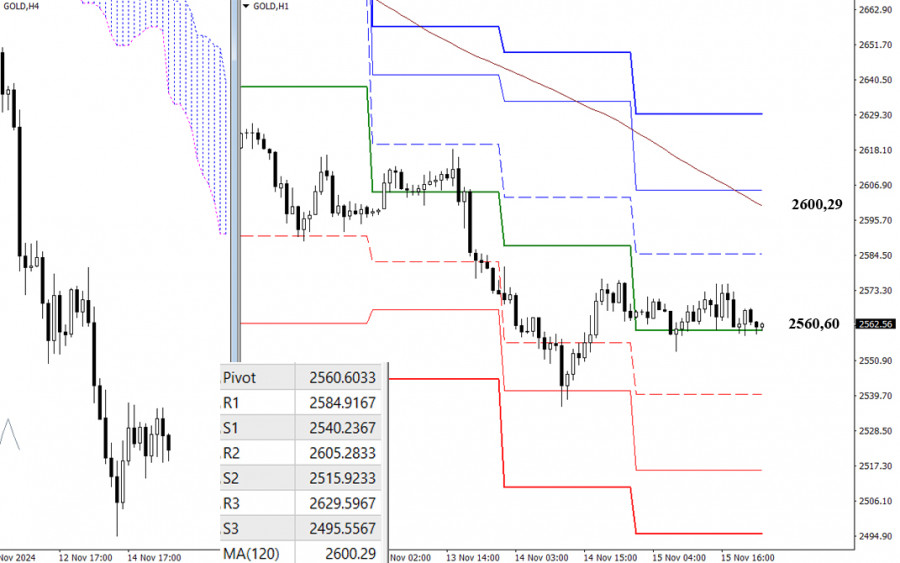

H4 – H1 Analysis

On lower timeframes, the pair remains in a corrective zone. On Friday, the central Pivot level of the day served as support. If the bulls continue developing the upward correction, they aim to test the weekly long-term trend at 2600.29, the main level for lower timeframes. Securing a position above this level and reversing the trend could shift the balance of power, favoring further bullish momentum. Conversely, maintaining positions below the trend could enable the bears to regroup and attempt to break through the higher timeframe support at 2537.81.

Within the day, directional movement targets are defined by the supports and resistances of the classic Pivot levels, which are recalculated daily. New levels for the upcoming trading day will become available shortly after market opening.

Technical Analysis Tools:

Higher timeframes: Ichimoku Kinko Hyo (9.26.52) + Fibonacci-based Kijun levels

H1 – Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.