See also

Bitcoin and Ethereum have continued to receive support from major players, retracing downward from monthly highs over the weekend.

According to the latest polls, Trump's chances of winning the U.S. presidential election are now 50/50, although he was projected for an easy victory just a few days ago. While many market participants say that the election outcome is not critical for the crypto industry, it is clear that a large part of the community prefers Trump over Harris.

At one point, Trump's odds fell to less than 53%, while Harris's increased to over 47%. Following this shift, Bitcoin dropped to $67,600. The broader CoinDesk 20 index fell by 2.3%, with Cardano (ADA) and Avalanche (AVAX) seeing significantly more major sell-offs, losing nearly 6%.

The situation in the cryptocurrency market is unlikely to change dramatically until after the U.S. election results, so I won't rush to buy at the highs. As for the intraday strategy in the crypto market, I will focus on major dips in Bitcoin and Ethereum, expecting the ongoing bullish trend to continue in the medium term.

The short-term trading strategy and conditions are outlined below.

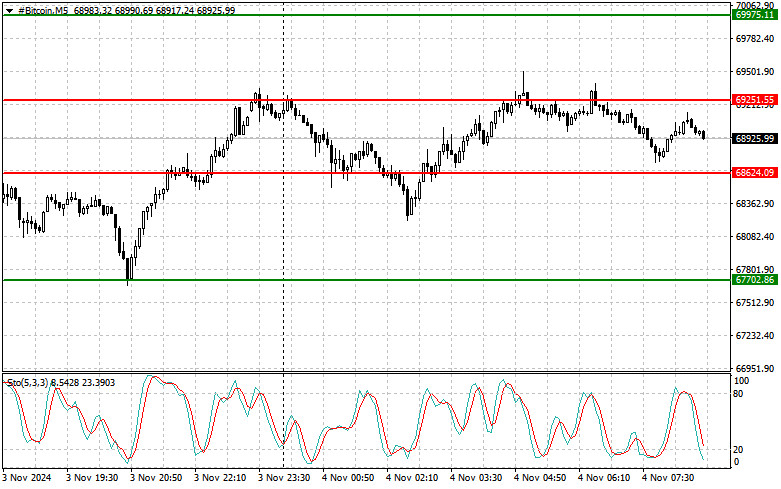

Buy Scenario: I plan to buy Bitcoin today upon reaching the entry point at around $69,250, aiming for a rise to the $69,975 level. I will exit purchases and sell immediately at a bounce in the $69,975 area. Before buying on a breakout, it is best to ensure that the Stochastic indicator is near the lower boundary, around level 20.

Sell Scenario: I plan to sell Bitcoin today upon reaching the entry point at around $68,620, aiming for a decline to the $67,700 level. I will exit sales and buy immediately at a bounce in the $67,700 area. Before selling on a breakout, ensure the Stochastic indicator is near the upper boundary, around level 80.

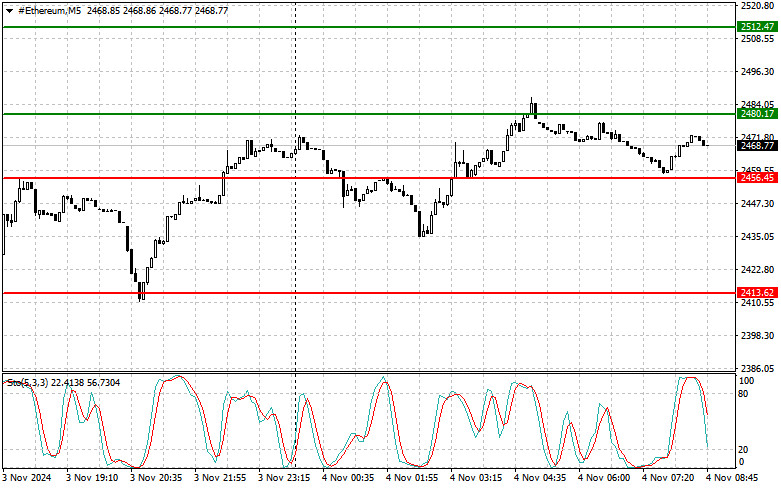

Buy Scenario: I plan to buy Ethereum today upon reaching the entry point at around $2,480, aiming for a rise to the $2,512 level. I will exit purchases and sell immediately at a bounce in the $2,512 area. Before buying on a breakout, ensure the Stochastic indicator is near the lower boundary, around level 20.

Sell Scenario: I plan to sell Ethereum today upon reaching the entry point at around $2,456, aiming for a decline to the $2,413 level. I will exit sales and buy immediately at a bounce in the $2,413 area. Before selling on a breakout, ensure that the Stochastic indicator is near the upper boundary, around level 80.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.