See also

23.07.2024 06:02 AM

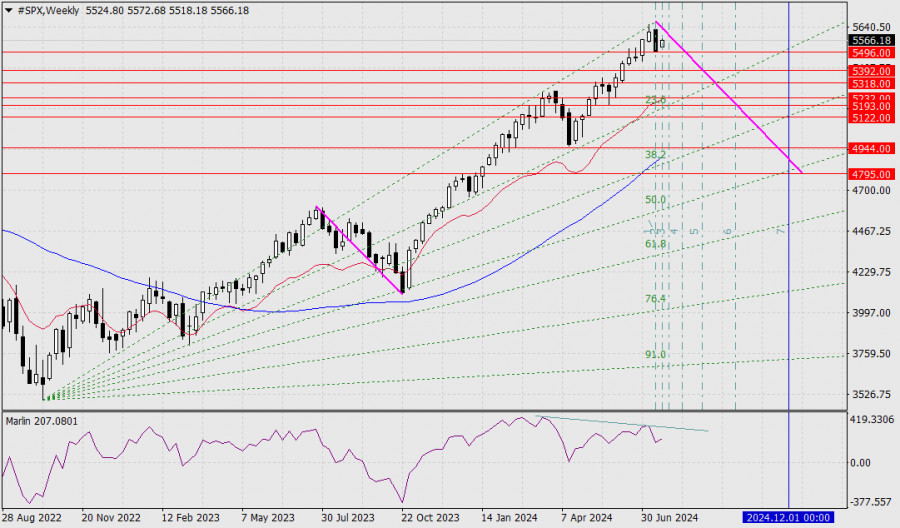

23.07.2024 06:02 AMLast week, the S&P 500 fell by 2.95% from its record peak, forming a divergence with the Marlin oscillator on the weekly chart. Fibonacci rays indirectly confirm the peak and reversal. Our task is to determine the timing and depth of the ongoing correction.

On the weekly chart, there is a magnetic point at the intersection of four lines: the 50% Fibonacci ray, the target level of 4795 – the peak of December 2023, the trendline from the July-October 2023 correction, and the Fibonacci timeline of order number 7. This gives us a timeframe of late November to early December of the current year. This period will coincide with the conclusion of the U.S. presidential elections and the announcement of the new president's plans, whoever that may be. Therefore, the index could hit new record highs when the S&P 500 falls 15.4% from its all-time high at 4795.

Intermediate targets on the way to 4795:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

US major stock indices closed the regular North American session on Friday in the green. The S&P 500 rose by 1.81%, while the Nasdaq 100 gained 2.06%. The industrial

Graphical patterns

indicator.

Notices things

you never will!

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.