See also

19.07.2024 10:24 AM

19.07.2024 10:24 AMOn Thursday, all investors' attention was focused on the meeting of the European Central Bank at which the regulator, as expected, kept key interest rates at the same level. This decision coincided with the expectations of analysts and market participants. The ECB press release noted that most economic indicators were either stable or declined in June. The ECB also underscored that the financing conditions remain restrictive. At the same time, inflation in the euro area remains high, service inflation is likely to persist in the medium term. Headline inflation is expected to be above the ECB 2% target both this year and next.

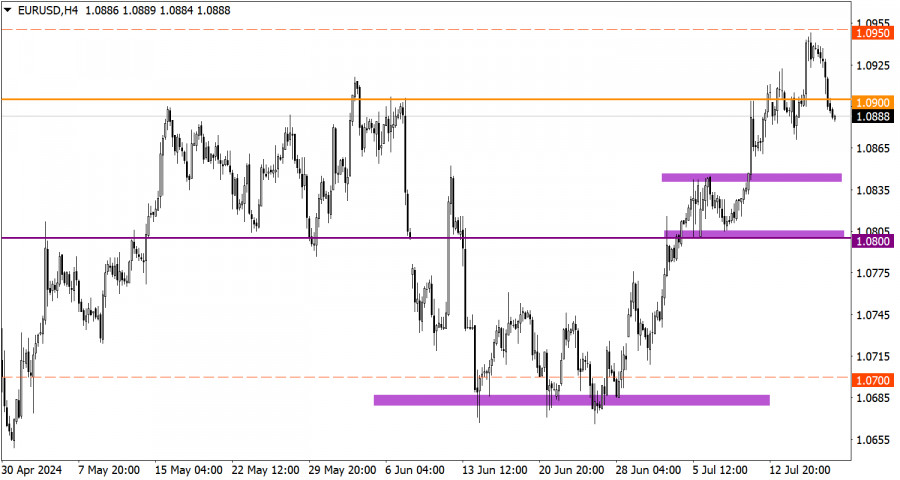

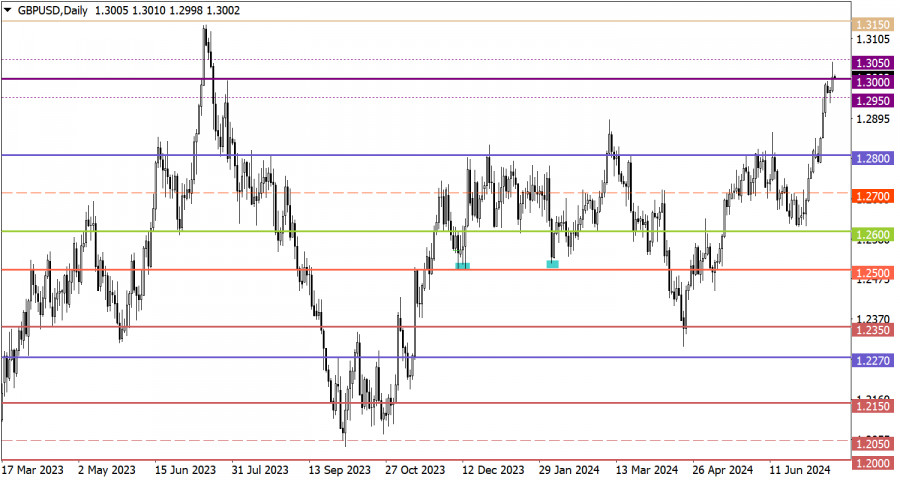

Overview of technical charts on July 18

Traders cut on long positions on the EUR/USD pair within the lower border of the corridor between 1.0950 and 1.1000. As a result, the price pulled back which led to a decline below 1.0900.

The GBP/USD pair also saw a reduction in the volume of long positions when the price touched the psychological level of 1.3000. As a result, the instrument had a pullback, as a result of which the price dropped below 1.2950.

Economic calendar on July 19

During the early European session today, data on retail sales in the UK was published. The retail sales volume shrank by 1.2% in June after growing by 2.9% in May. The reading is worse than forecasts for a fall of 0.4%.

If EUR/USD settles below 1.0900 by the end of the week, the instrument may continue the current pullback. Otherwise, a local weakening of the euro could attract buyers, leading to a new bullish stage.

The ongoing pullback could intensify if the price settles below 1.2950 by the end of the week. However, if the price rebounds above this level, we expect GBP/USD to oscillate in the corridor of 1.2950 to 1.3050.

The candlestick chart type consists of graphic rectangles in white and black with lines at the top and bottom. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time period: opening price, closing price, maximum and minimum price.

Horizontal levels are price coordinates relative to which a price may stop or revered its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price developed. This color highlighting indicates horizontal lines that may put pressure on the price in the future.

Up/down arrows are guidelines for a possible future trajectory.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In my morning forecast, I highlighted the level of 1.2986 and planned to make market entry decisions from that point. Let's take a look at the 5-minute chart and break

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair resumed its upward movement and posted a gain of more than 300 pips. As Friday began

The EUR/USD currency pair showed ultra-strong growth on Thursday—a move that, by now, probably surprised no one. Just as we reported that tariffs on China had been raised to 125%

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair spent the past 24 hours rising, then falling again, and then rising again. As before, it's impossible to identify

Analysis of Wednesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed strong growth and decline on Wednesday. Lately, both moves have been triggered by Donald Trump. First, news

On Wednesday, the GBP/USD currency pair showed mixed movements throughout the day but generally maintained a downward trend — if we can even call the current behavior a "trend." There

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.