See also

20.01.2022 09:10 AM

20.01.2022 09:10 AMThe US dollar has noticeably strengthened its position over the past few days, which was bound to end in a local rebound. And apparently, this is exactly what happened yesterday. Nevertheless, it should be noted that the scale of growth of the euro with the pound turned out to be extremely insignificant. This suggests that the process is far from over.

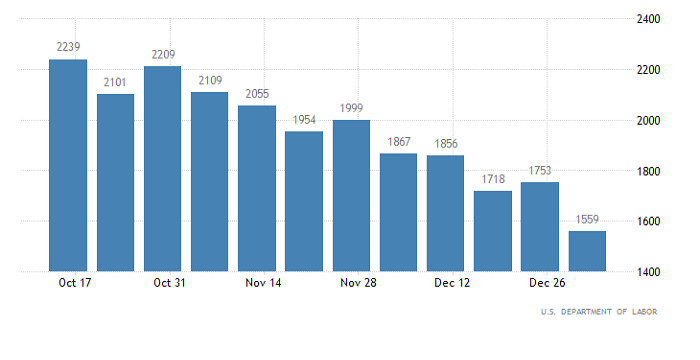

Moreover, the US dollar may continue to weaken today due to only one reason – US statistics. The fact is that the forecasts for applications for unemployment benefits are extremely negative, although the number of initial requests may increase by 2 thousand, that is, remain unchanged. On the other hand, the number of repeated requests should increase by as much as 91 thousand, which is quite a lot.

From the point of view of the market, this is a serious deterioration in the situation in the labor market, which is quite a negative factor. Therefore, there is no reason for the US dollar to rise today.

Number of repeated applications for unemployment benefits (United States):

At the same time, European statistics will be ignored, although inflation data is extremely important. The fact is that the final data being published should confirm the preliminary estimate, which showed an increase in inflation from 4.9% to 5.0%. The market has already taken into account this fact.

Inflation (Europe):

The EUR/USD pair is in a pullback stage from the variable pivot point of 1.1315, which led to the euro's slight strengthening. In this situation, variable turbulence is possible within the upper border of the previously broken flat (1.1230/1.1370). If the downward cycle is still relevant in the market, the 1.1370 level may act as a resistance level, thereby reducing the volume of long positions.

The GBP/USD pair returned to the level of 1.3600, where a pullback was formed at first, then stagnation. In this situation, a variable swing is possible in the area of 1.3590/1.3655, which is likely to become a lever for subsequent speculation in the market.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The current

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuck

In my morning forecast, I highlighted the 1.3247 level as a reference point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened

In my morning forecast, I highlighted the 1.1341 level as a key point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened there

Analysis of Tuesday's Trades 1H Chart of GBP/USD Throughout Tuesday, the GBP/USD pair continued its upward movement. As we can see, the British currency doesn't need any particular reason

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair pulled back slightly, which can be considered a purely technical correction. Yesterday — and generally —

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.