NZDDKK (New Zealand Dollar vs Danish Krone). Exchange rate and online charts.

Currency converter

18 Mar 2025 07:43

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

NZD/DKK is not very popular currency pair on Forex market. It represents a cross rate against the U.S. dollar, that is why the dollar has a significant influence on the pair. By combining NZD/USD and USD/DKK price charts, it is possible to get an approximate NZD/DKK price chart.

As the U.S. dollar has a great impact on NZD/DKK, it is necessary to monitor such U.S. economic indicators as the discount rate, GDP growth, unemployment rate, new jobs and others to correctly predict the future dynamics of the currency pair. However, it should be noted that the currencies can respond differently to the changes in the U.S. economy.

When trading NZD/DKK, some indicies of the New Zealand's economy should be considered: GDP, interest rate, economic activity, trading with other countries, etc. New Zealand is one the largest producer of wool and products made of it in the world. The country's economy is highly dependent on its main trading partners: USA, Australia, and the Asia-Pacific region. Thus, major economic indicators of the country's business partners should also be taken into account.

Denmark is highly developed agro-industrial country demonstrating good performance in relation to other economies. Denmark has large oil reserves in the southern part of Jutland as well as on the shelves of the North Sea, but it is poor in other minerals. That is why the country greatly depends on the exports. Denmark has strong economic relations with the EU countries: they export and import machinery, electronics, agriculture, mining, etc with them.

Denmark has one of the strongest economies in the world that allows its currency to be stable against the other opponents on Forex. The country's economy can boast of low inflation and unemployment rates, huge oil and gas reserves in the North Sea shelf and in the south of Jutland, advanced sector of high technologies and availability of competent professionals in all areas of the economy.

However, high taxes and low competitiveness on the global markets can be named as the key disadvantages of the Denmark's economy. To trade NZD/DKK, one should focus on country's major economic indicators and watch the prices for oil and other minerals required for goods production in the country.

This trading instrument is relatively illiquid compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when analyzing this financial instrument, focus primarily on those currency pairs that include the U.S. dollar in tandem with each of the considered currencies.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for crosses, so before you start working with them, read and understand the terms and conditions offered by the broker.

See Also

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1048

Wall Street updateAuthor: Andreeva Natalya

15:04 2025-03-17 UTC+2

988

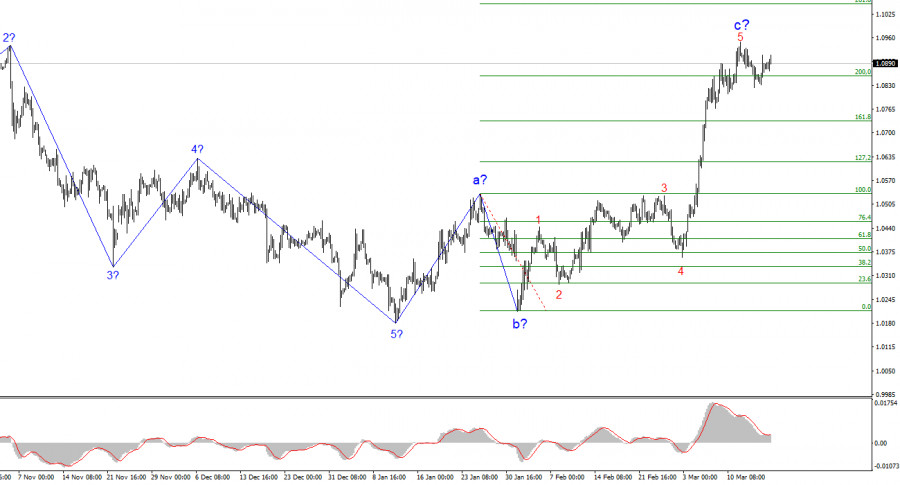

The euro is aiming for 1.1027 ahead of the Fed meeting.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

733

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

718

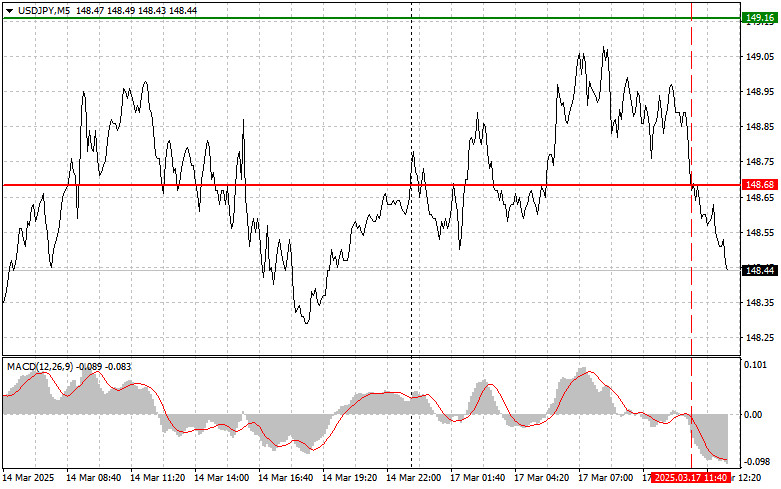

The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero markAuthor: Jakub Novak

18:32 2025-03-17 UTC+2

718

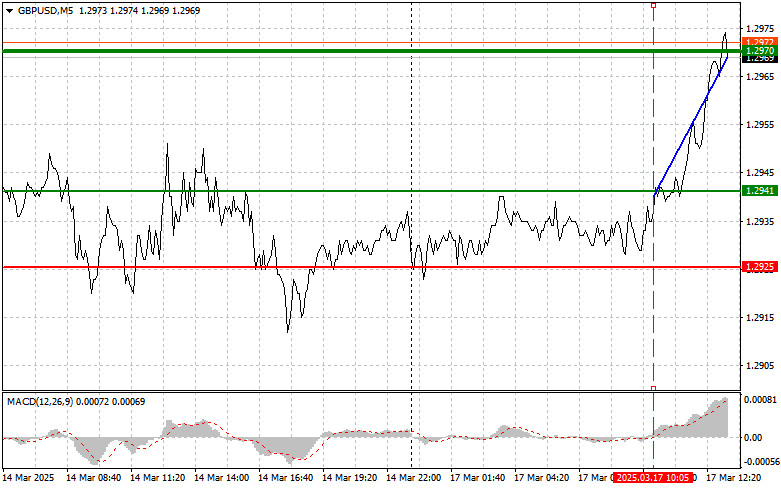

The pound's target is 1.3101.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

- The yen's target is 151.30.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero markAuthor: Jakub Novak

18:27 2025-03-17 UTC+2

703

Trading planTrading Recommendations and Analysis for EUR/USD on March 18: A New Increase, But Within Reasonable Limits

The EUR/USD currency pair continued to trade higher on Monday but within a confined range that can be considered a sideways channelAuthor: Paolo Greco

03:35 2025-03-18 UTC+2

688

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1048

- The euro is aiming for 1.1027 ahead of the Fed meeting.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

733

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

718

- The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero mark

Author: Jakub Novak

18:32 2025-03-17 UTC+2

718

- The pound's target is 1.3101.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

- The yen's target is 151.30.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

- The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark

Author: Jakub Novak

18:27 2025-03-17 UTC+2

703

- Trading plan

Trading Recommendations and Analysis for EUR/USD on March 18: A New Increase, But Within Reasonable Limits

The EUR/USD currency pair continued to trade higher on Monday but within a confined range that can be considered a sideways channelAuthor: Paolo Greco

03:35 2025-03-18 UTC+2

688