CHFHUF (Swiss Franc vs Hungarian Forint). Exchange rate and online charts.

Currency converter

01 Sep 2025 17:41

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

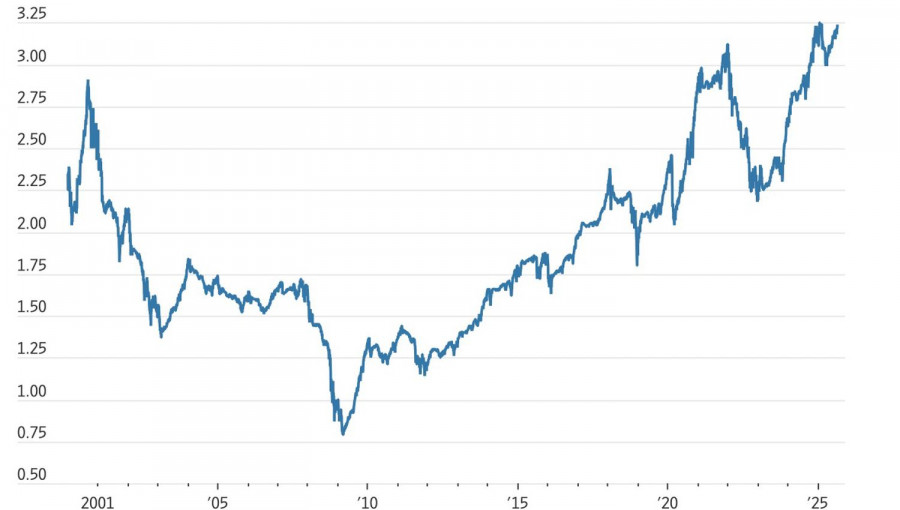

The CHF/HUF currency pair, which is the cross rate against the U.S. dollar, is not very popular on Forex market. Although there is no U.S. dollar in this currency pair, it falls under the greenback’s powerful influence. To make it clear, just combine the USD/CHF and USD/HUF charts in the same price chart, and you will get the approximate CHF/HUF chart.

The U.S. dollar extends the strong influence over the Swiss franc and the Hungarian forint. So for a better prognosis for the future rate movement of this financial instrument you should take into account the main economic indicators of the United States. There are such indicators as the interest rate, GDP, unemployment, new workplaces indicator and many others. Please remember that these currencies can react differently to the changes in the economic situation of the U.S.A.

The Swiss economy has been highly developed for several centuries. Thus, the Swiss franc is known as the most reliable and stable currency in the world and as the safest currency for the capital investment. At the time of crisis, when the world capital is urgently goes to Switzerland, the Swiss franc rate rises sharply against other currencies. This peculiarity of the Swiss economy should be considered while trading currency pair.

The rate of this financial instrument was tied to euro since it had been introduced as the currency of the most European Union’s countries. However, in 2008 the further attachment of its national currency to the euro became unprofitable to this country and Hungary denied it.

The great amount of the foreign companies and organizations do their businesses in Hungary. Therefore, the Hungarian economy is entirely dependent on their commercial activity.

This country of the Central Europe has both developed industry and agricultural sectors. The main industrial sectors of Hungary are engineering, metallurgy and chemical industry. As for agriculture, gardening and wine-making industries that mostly goes on export, they occupy the significant part of this sector. The beautiful Hungarian nature, its ancient culture and architecture attract millions of tourists every year, so this country has also developed tourism. The major trading partners of Hungary are EU countries and Russia. Therefore, keep in mind the economic indicators of these regions while forecasting the future rate of the Hungarian forint.

Comparing to the major currency pairs such as EUR/USD, USD/CHF, GBP/USD and USD/JPY this one is relatively illiquid. So when you make a forecast of the future movement of this currency pair, you should pay special attention to the currency pairs that consist of the Swiss franc and the Hungarian Forint in tandem with the U.S. dollar.

Please remember that the spread for the cross currency pairs is usually higher than for the more popular ones. Therefore, before trading the cross rate pairs learn properly the broker’s conditions for this specified financial instrument.

See Also

- Technical analysis / Video analytics

Forex forecast 01/09/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and BitcoinAuthor: Sebastian Seliga

15:13 2025-09-01 UTC+2

2113

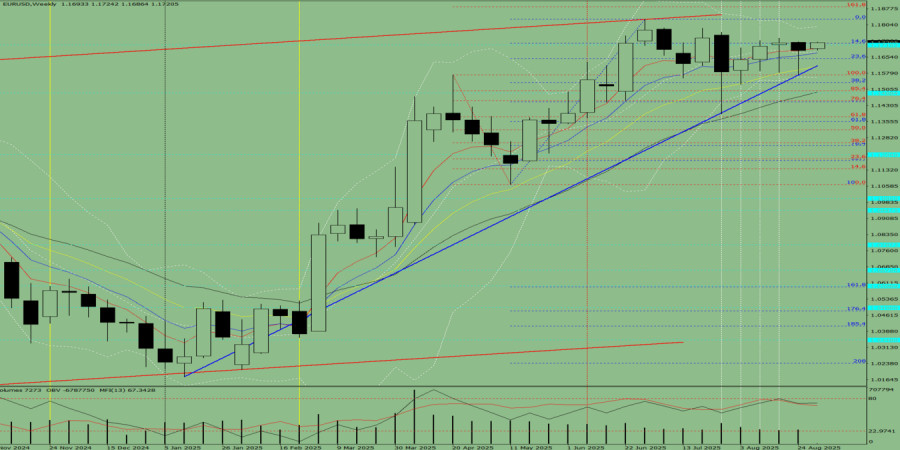

In August, the pair, moving upward, tested the historical resistance level of 1.1710 (blue dotted line) and then pulled back slightly, closing the monthly candle at 1.1685. In September, the price is expected to move downward.Author: Stefan Doll

09:53 2025-09-01 UTC+2

1528

The most expensive companies within the S&P 500 are the large caps.Author: Marek Petkovich

09:27 2025-09-01 UTC+2

1393

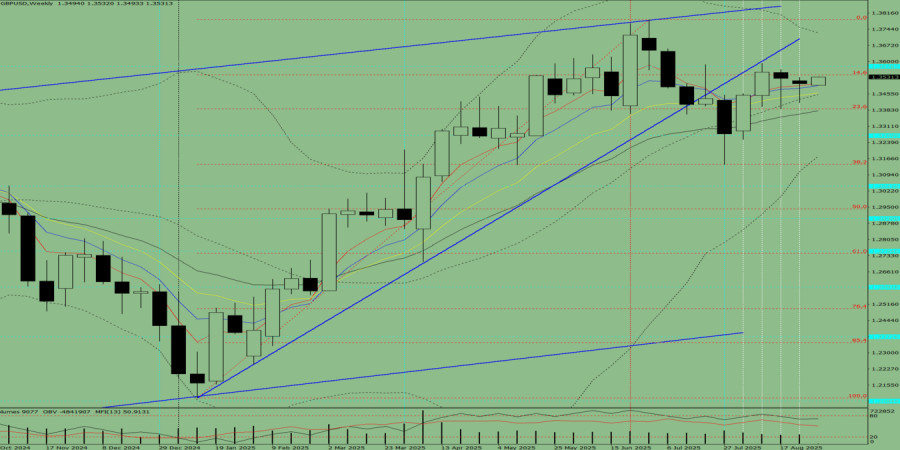

- Last week, the pair moved downward, tested the 21-period simple moving average at 1.3428 (black dotted line), and then turned upward, closing the weekly candle at 1.3502. In the upcoming week, the price may continue moving downward.

Author: Stefan Doll

09:50 2025-09-01 UTC+2

1393

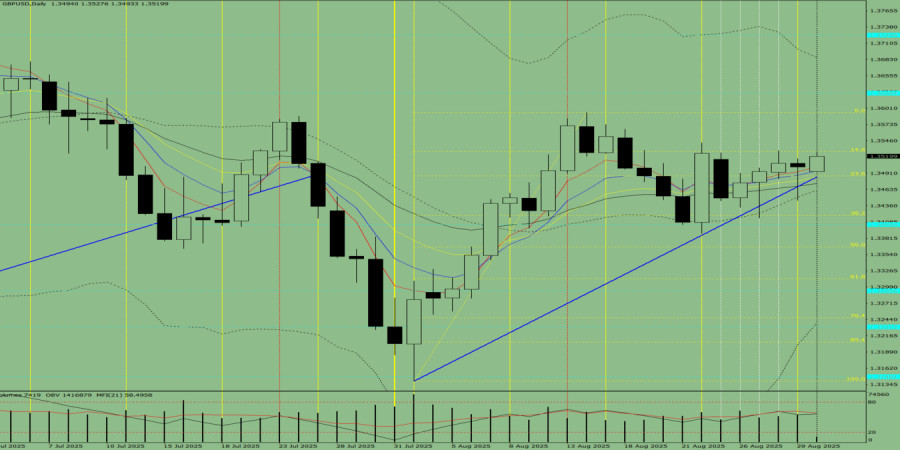

On Friday, the pair moved downward, tested the 21-period simple moving average at 1.3449 (black dotted line), and then turned upward, closing the daily candle at 1.3502. Today, the price may attempt to continue its upward movement. No major calendar news is expected on Monday.Author: Stefan Doll

09:42 2025-09-01 UTC+2

1378

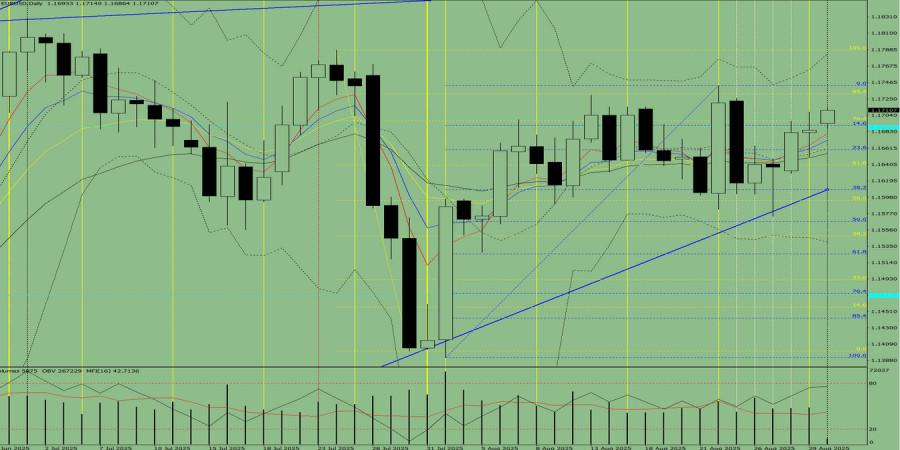

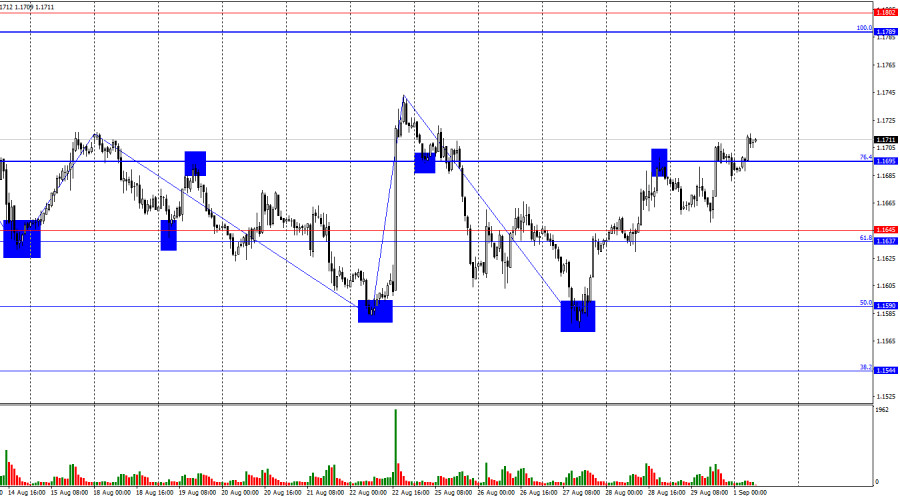

On Friday, the pair, moving downward, tested the retracement level of 23.6% – 1.1659 (blue dotted line) and then turned upward, closing the daily candle at 1.1685. Today, the price may attempt to continue its upward movement. No major calendar news is expected on Monday.Author: Stefan Doll

09:38 2025-09-01 UTC+2

1363

- Last week, the pair moved downward, tested the upper fractal at 1.1571 (red dotted line), and then turned upward, closing the weekly candle at 1.1685. In the upcoming week, the price may continue moving downward.

Author: Stefan Doll

09:46 2025-09-01 UTC+2

1348

In August, the pair, moving upward, tested the historical resistance level at 1.3579 (blue dotted line) and then pulled back slightly, closing the monthly candle at 1.3502. In September, the price is expected to move downward.Author: Stefan Doll

11:15 2025-09-01 UTC+2

1318

EUR/USD. September 1st. The Week Begins with Lagarde's SpeechAuthor: Samir Klishi

12:17 2025-09-01 UTC+2

1288

- Technical analysis / Video analytics

Forex forecast 01/09/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and BitcoinAuthor: Sebastian Seliga

15:13 2025-09-01 UTC+2

2113

- In August, the pair, moving upward, tested the historical resistance level of 1.1710 (blue dotted line) and then pulled back slightly, closing the monthly candle at 1.1685. In September, the price is expected to move downward.

Author: Stefan Doll

09:53 2025-09-01 UTC+2

1528

- The most expensive companies within the S&P 500 are the large caps.

Author: Marek Petkovich

09:27 2025-09-01 UTC+2

1393

- Last week, the pair moved downward, tested the 21-period simple moving average at 1.3428 (black dotted line), and then turned upward, closing the weekly candle at 1.3502. In the upcoming week, the price may continue moving downward.

Author: Stefan Doll

09:50 2025-09-01 UTC+2

1393

- On Friday, the pair moved downward, tested the 21-period simple moving average at 1.3449 (black dotted line), and then turned upward, closing the daily candle at 1.3502. Today, the price may attempt to continue its upward movement. No major calendar news is expected on Monday.

Author: Stefan Doll

09:42 2025-09-01 UTC+2

1378

- On Friday, the pair, moving downward, tested the retracement level of 23.6% – 1.1659 (blue dotted line) and then turned upward, closing the daily candle at 1.1685. Today, the price may attempt to continue its upward movement. No major calendar news is expected on Monday.

Author: Stefan Doll

09:38 2025-09-01 UTC+2

1363

- Last week, the pair moved downward, tested the upper fractal at 1.1571 (red dotted line), and then turned upward, closing the weekly candle at 1.1685. In the upcoming week, the price may continue moving downward.

Author: Stefan Doll

09:46 2025-09-01 UTC+2

1348

- In August, the pair, moving upward, tested the historical resistance level at 1.3579 (blue dotted line) and then pulled back slightly, closing the monthly candle at 1.3502. In September, the price is expected to move downward.

Author: Stefan Doll

11:15 2025-09-01 UTC+2

1318

- EUR/USD. September 1st. The Week Begins with Lagarde's Speech

Author: Samir Klishi

12:17 2025-09-01 UTC+2

1288