USDNOK (US Dollar vs Norwegian Krone). Exchange rate and online charts.

Currency converter

18 Mar 2025 07:51

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USDNOK stands for the United States dollar vs. the Norwegian krone currency pair. The Norwegian krone is among the most popular non-major currencies. In 2000, the pair got significantly stronger, mostly because of oil prices flying higher. Moreover, the economic policy of Norway added much to the pair reputation, as during the global economic crisis the country got the less damage in the sector of economy due to wise investments of the country’s monetary policy makers. The following factors are of chief importance for the Norwegian krone: the oil prices, the country’s credit rating and the overall stance of the currency market.

It should be noted that Norway is one of the largest oil exporters in the Western Europe, and is strongly dependent on the energy market climate.

The rate of the Norwegian krone versus the United States dollar has demonstrated a steady climb over the last decade. For example, in 2001 the correlation between the currencies was as follows: one American dollar cost nine Norwegian kroner. However, in ten years one dollar was bought for less than 6 kroner.

The dynamics of the American dollar rate is mainly determined by the macroeconomic indicators of the country. The greenback’s unpredictable and strong fluctuations make it the most often used currency on Forex, especially by speculators who prefer short trades with the purpose of getting high yield within a narrow time.

The USDNOK pair fundamental analysis is based on the American dollar rate. If the USD confidence is low, the pair is to move downwards.

See Also

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1048

Wall Street updateAuthor: Andreeva Natalya

15:04 2025-03-17 UTC+2

988

The euro is aiming for 1.1027 ahead of the Fed meeting.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

733

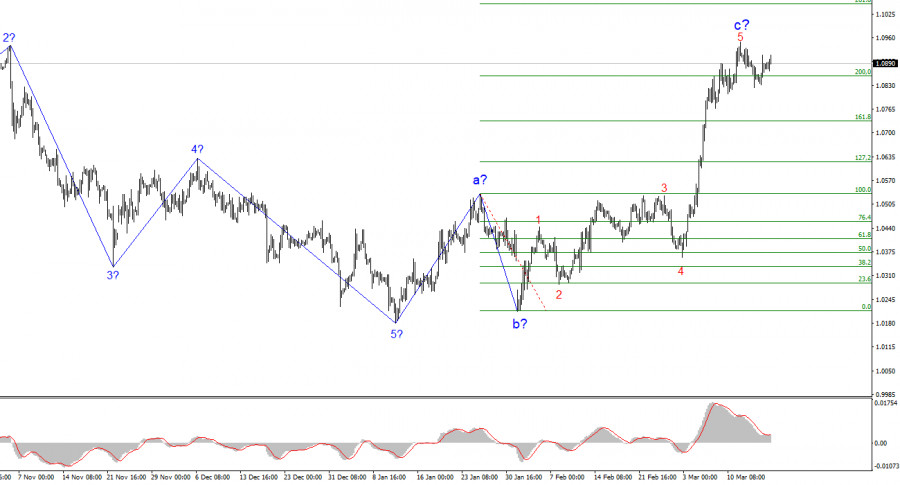

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

718

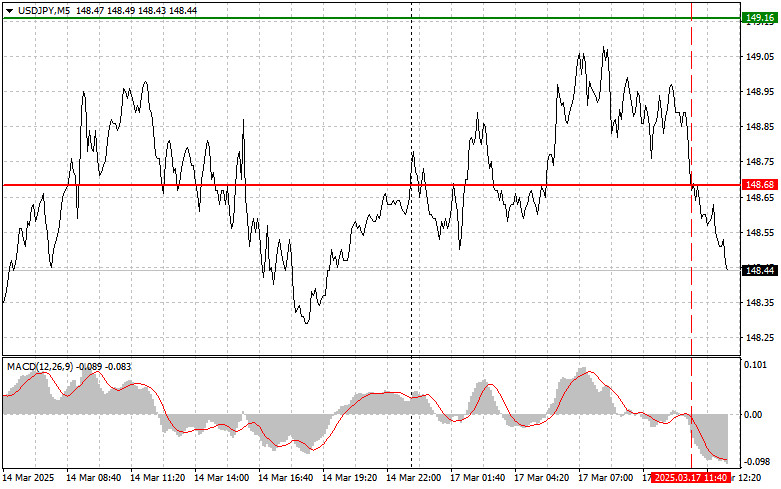

The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero markAuthor: Jakub Novak

18:32 2025-03-17 UTC+2

718

The pound's target is 1.3101.Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

- The yen's target is 151.30.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

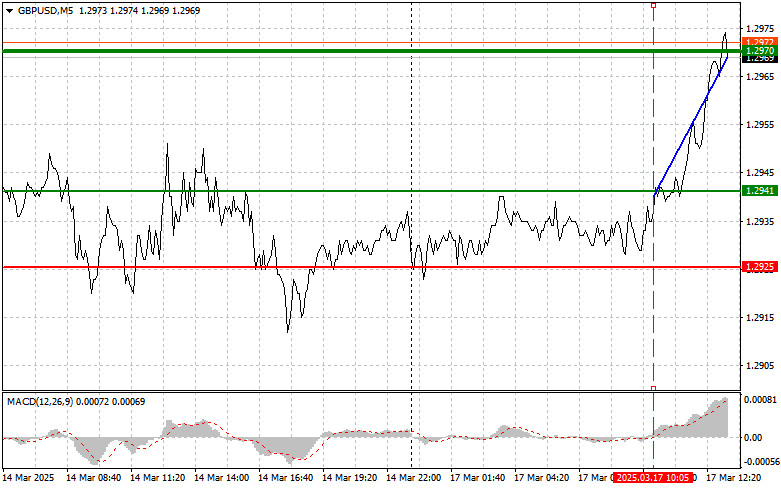

The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero markAuthor: Jakub Novak

18:27 2025-03-17 UTC+2

703

Trading planTrading Recommendations and Analysis for EUR/USD on March 18: A New Increase, But Within Reasonable Limits

The EUR/USD currency pair continued to trade higher on Monday but within a confined range that can be considered a sideways channelAuthor: Paolo Greco

03:35 2025-03-18 UTC+2

688

- Stock market analysis on March 17: S&P 500 and Nasdaq remain under pressure

Author: Jakub Novak

14:49 2025-03-17 UTC+2

1048

- The euro is aiming for 1.1027 ahead of the Fed meeting.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

733

- EUR/USD Analysis – March 17th

Author: Chin Zhao

18:34 2025-03-17 UTC+2

718

- The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero mark

Author: Jakub Novak

18:32 2025-03-17 UTC+2

718

- The pound's target is 1.3101.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

- The yen's target is 151.30.

Author: Laurie Bailey

04:37 2025-03-18 UTC+2

703

- The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark

Author: Jakub Novak

18:27 2025-03-17 UTC+2

703

- Trading plan

Trading Recommendations and Analysis for EUR/USD on March 18: A New Increase, But Within Reasonable Limits

The EUR/USD currency pair continued to trade higher on Monday but within a confined range that can be considered a sideways channelAuthor: Paolo Greco

03:35 2025-03-18 UTC+2

688