#AMD (Advanced Micro Devices, Inc.). Exchange rate and online charts.

Currency converter

21 Mar 2025 21:59

(-0.04%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

#AMD is the shares of the U.S. company Advanced Micro Devices Inc. which was established in 1969 in Sunnyvale, California. The starting capital of the company was USD100 thousand. The company’s operations involve the production of microprocessors, flash memory devices, and other products for telecoms and computing units worldwide.

In 1972 the company was reorganized to a joint stock company. Thirteen years later AMD became a corporation.

Such companies as Hewlett-Packard, Dell, Acer, Fujitsu Technology Solutions, IBM are strategically important partners of AMD on the PC market. In the field of networking products, AMD cooperates with Bay Networks, Cabletron Systems and Cisco. In the area of telecoms, Alcatel-Lucent, AT&T, Ericsson, NEC, Siemens AG, Sony act as partners. The main competitors of AMD are Intel and Nvidia.

In 2013, the company’s revenue came in at USD5.3 billion. Such a high result was achieved primarily due to the release of the game consoles such as Xbox One and PlayStation 4 with processors developed by AMD. The corporation’s profit for the fourth quarter last year was USD89 million. The income increased 38% immediately and equaled to USD1.59 billion. However, the net loss amounted to about USD83 million year-on-year. Nevertheless, AMD shows a positive dynamics indicating the overcoming of difficulties which followed the company in recent years.

Currently, AMD’ stock price has strengthened due to the development and release of company’s new products.

Shares are securities representing the exclusive ownership in the company. Such a trading tool as contract for difference on shares gives the opportunity to investors to earn from quotations’ change of the company’s liquid shares while not having a stake in ownership. However, dividend adjustment is added to or debited for client’s account. Usually, it equals to the value of the dividend itself depending on positions direction based on completed contracts.

The risk is compensated by a high yield.

See Also

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1108

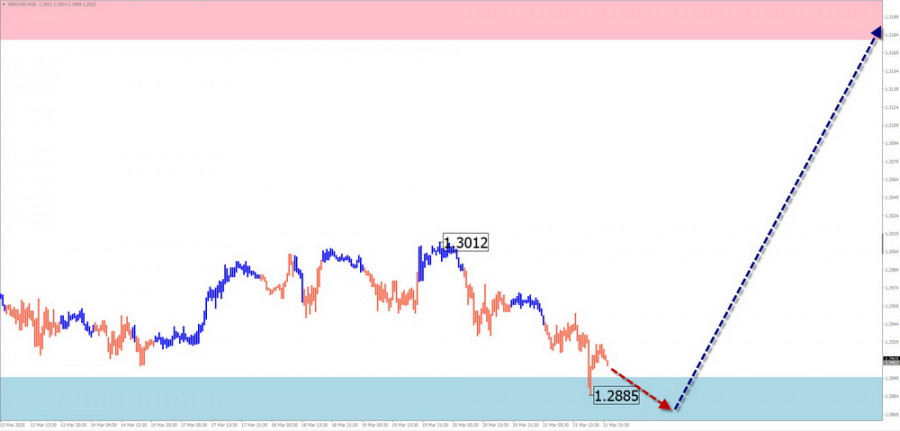

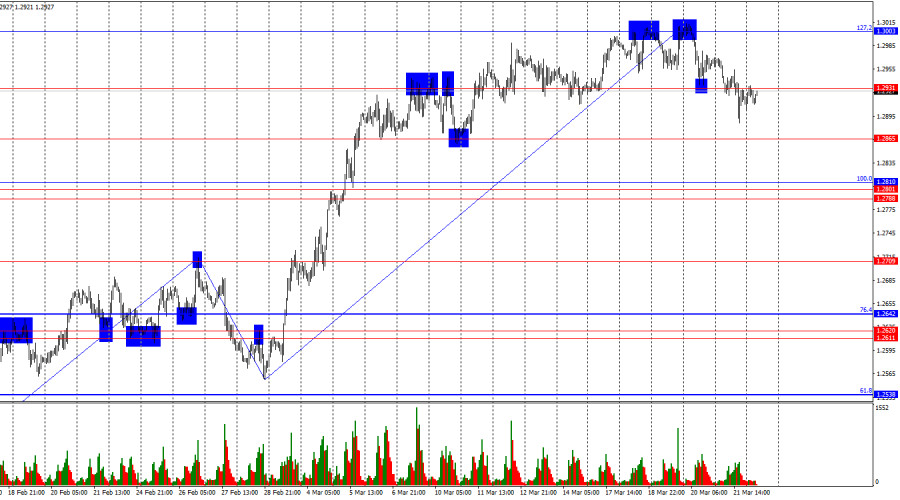

Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:24 2025-03-24 UTC+2

988

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

703

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

688

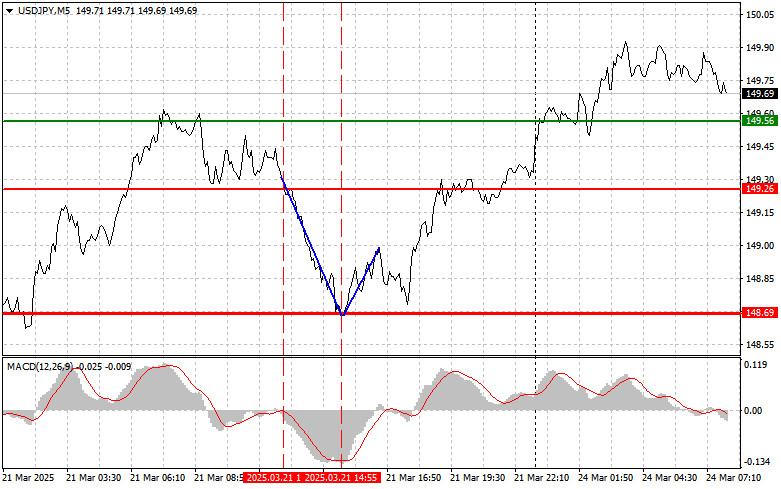

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

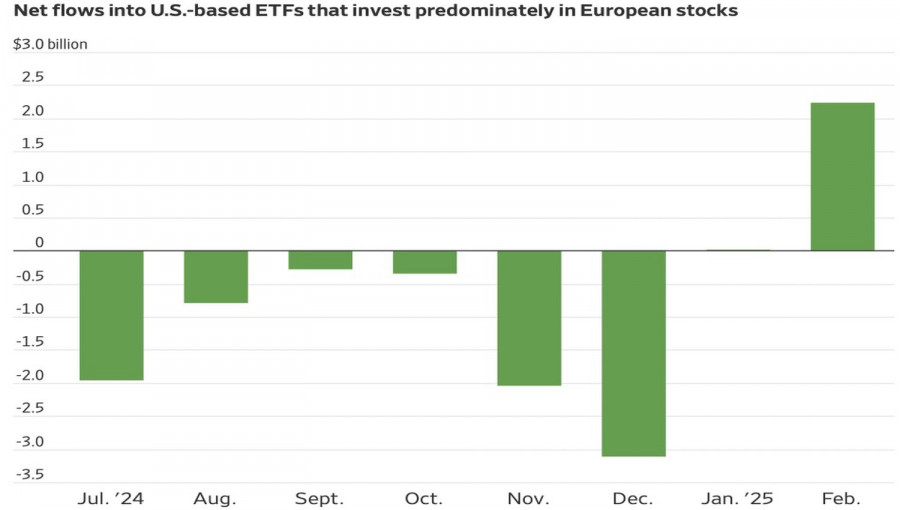

White House tariffs bring more pain to the U.S. than to other regionsAuthor: Marek Petkovich

10:23 2025-03-24 UTC+2

643

- Trading Recommendations for the Cryptocurrency Market on March 24

Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643

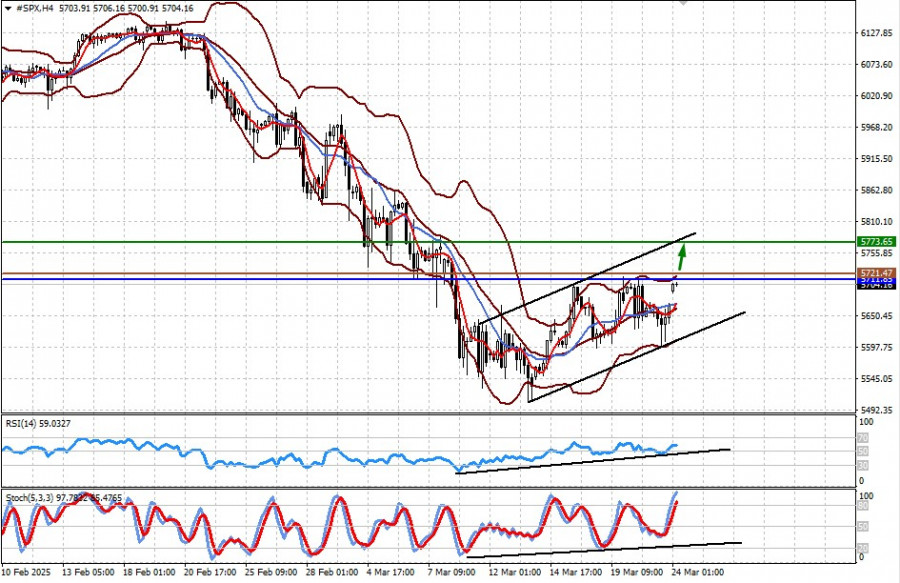

Fundamental analysisMarkets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

628

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

628

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1108

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

988

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

703

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

688

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-03-24 UTC+2

658

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

- Trading Recommendations for the Cryptocurrency Market on March 24

Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643

- Fundamental analysis

Markets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

628

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

628