CHFNOK (Swiss Franc vs Norwegian Krone). Exchange rate and online charts.

Currency converter

20 Mar 2025 00:26

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/NOK is not such a popular currency pair on Forex. CHF/NOK is the cross rate against the US dollar. Although the US dollar obviously does not present in this currency pair, it still has a significant influence on it. This can be seen, if you combine two charts: USDCHF and USDNOK. Thus, you can get an approximate CHF/NOK chart.

The US dollar has a significant influence on both currencies. That is why it is necessary to take into account the major US economic indicators to forecast correctly the course of this financial instrument. These indicators are as follows: the discount rate, GDP, unemployment rate, Non-Farm Payrolls, etc. It is necessary to note that discussed currencies could respond with different speed on changes in the US economy, therefore the CHF/NOK currency pair may be a specific indicator of these currencies changes.

The economic situation in Switzerland has been high for several centuries. For this reason, the Swiss franc has a reputation for one of the world’s most reliable and stable currencies. The Swiss franc, or Swissie, is also a kind of safe haven currency for capital investment during the crisis. Therefore, in times of crisis, when capital is urgently forwarded to Switzerland, the Swiss franc rises sharply against the other currencies. Trading this currency pair, you have to take into account this feature of the Swiss economy.

Norway is one of a highly developed, stable democracies with a modern economy. The country occupies the first positions on such economic indicators as quality of life and personal income level. Norway is the third largest producer and exporter of oil and gas. The main source of income of this Scandinavian country is the export of energy resources. In addition, Norway is the leading country in electrometallurgy, electrical engineering, mechanical engineering, etc. In addition, the Norwegian industry is a leading manufacturer of offshore drilling platforms for oil and gas. Also, Norway is a leader in mining and processing of a great variety of seafood, which are in high demand worldwide, especially in the European countries.

If you trade with CHF/NOK, you should focus on economic indicators of Norway, as well as the oil world price and other minerals needed to support the Norway economy.

This trading instrument is relatively illiquid if we compare it with major currency pairs, such as: EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you make a forecast for the financial instrument, you should focus on those currency pairs that include the US dollar together with each of the considered currencies.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread than for more popular currency pairs, so before you start working with the cross rates, you should carefully read the conditions offered by the broker to trade with specified trade instrument.

See Also

- Type of analysis

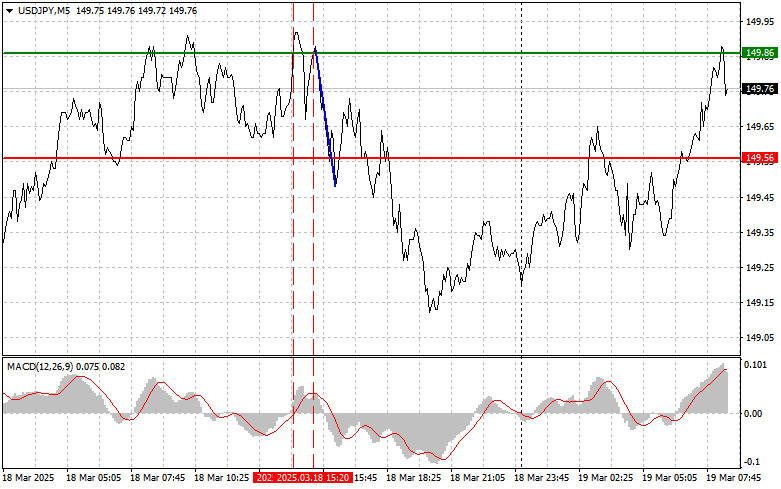

USD/JPY: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:01 2025-03-19 UTC+2

1678

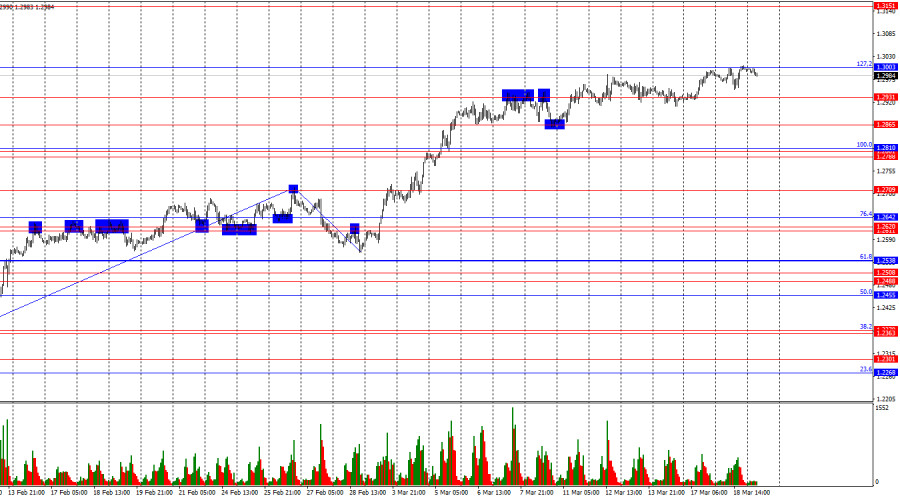

Bulls have been attacking for two weeks, but it's time for a pause.Author: Samir Klishi

11:46 2025-03-19 UTC+2

1438

Gold has halted its upward movement as it attempts to consolidate at new all-time highs around $3,045Author: Irina Yanina

10:41 2025-03-19 UTC+2

1423

- Market overview on March 19

Author: Jozef Kovach

11:57 2025-03-19 UTC+2

1408

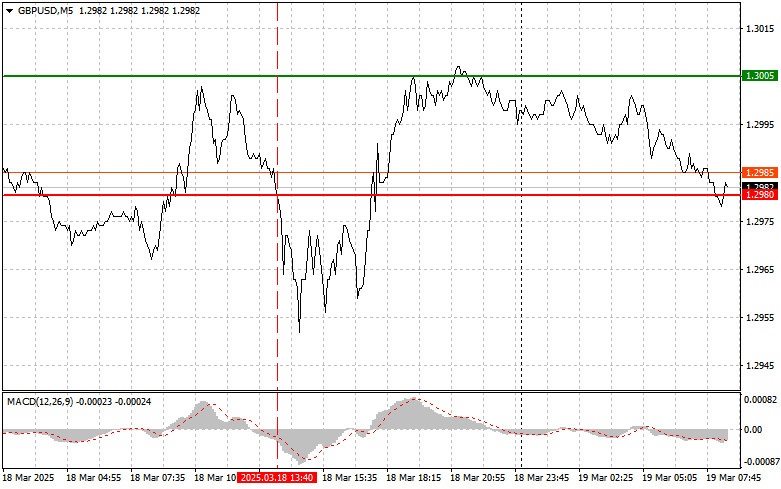

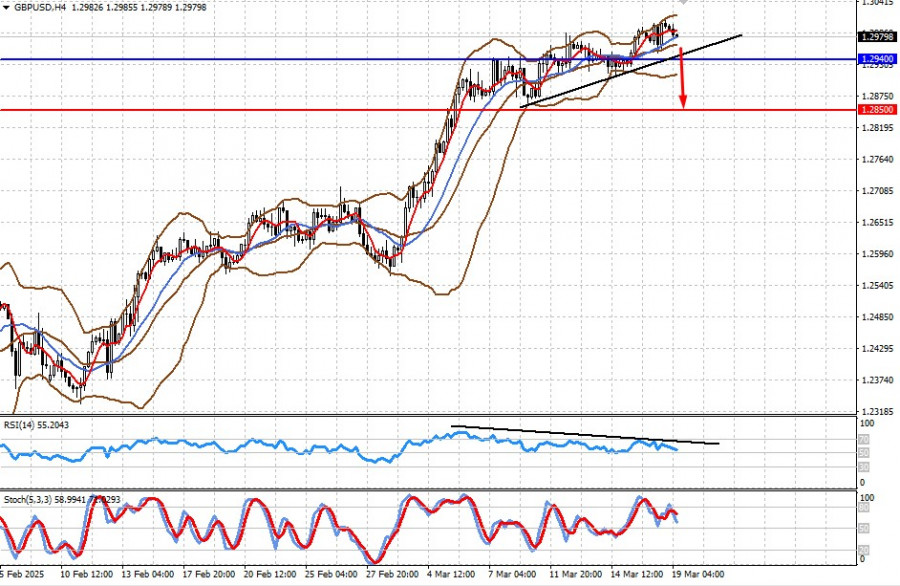

Type of analysisGBP/USD: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:01 2025-03-19 UTC+2

1378

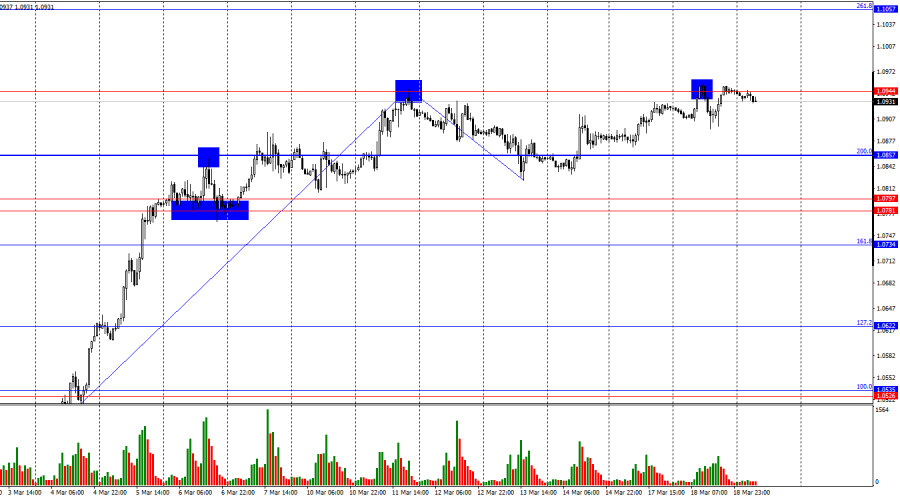

Technical analysisTrading Signals for EUR/USD for March 19-21, 2025: sell below 1.0900 (+2/8 Murray + 21 SMA)

If the euro falls and consolidates below 1.09 and below the 21 SMA in the coming hours, this could be seen as an opportunity to sell with targets at 1.0830, the Murray 8/8 level, around 1.742, and finally 1.0642.Author: Dimitrios Zappas

15:01 2025-03-19 UTC+2

1318

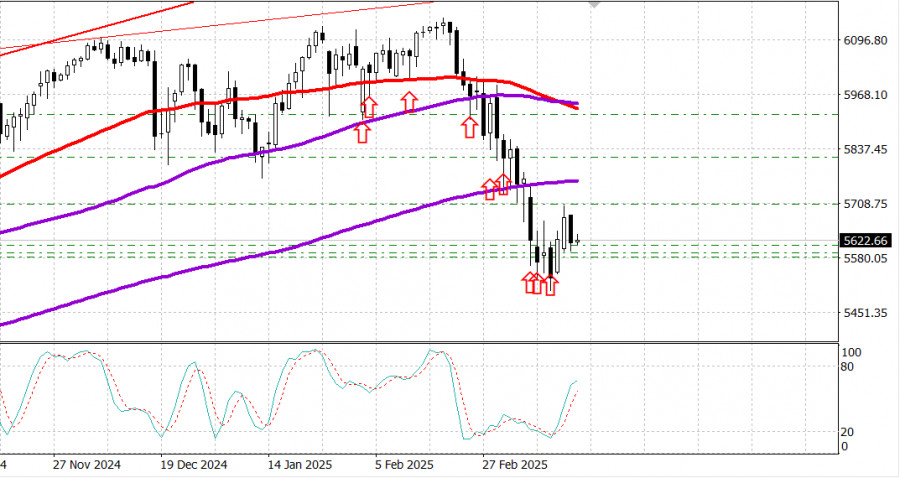

- The latest news from the US srock market

Author: Andreeva Natalya

11:52 2025-03-19 UTC+2

1288

Bearish traders await support from the Fed and the Bank of EnglandAuthor: Samir Klishi

11:43 2025-03-19 UTC+2

1243

Fundamental analysisHow Might Markets React After the Fed Meeting? (Expecting a Sharp Decline in GBP/USD and a Drop in #SPX)

Today, the market will focus on the Federal Reserve's final decision on monetary policy. It is expected to bring nothing new, so the main topic will remain the same as in recent months—the impact of Trump's policies on the U.S. economyAuthor: Pati Gani

09:27 2025-03-19 UTC+2

1228

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:01 2025-03-19 UTC+2

1678

- Bulls have been attacking for two weeks, but it's time for a pause.

Author: Samir Klishi

11:46 2025-03-19 UTC+2

1438

- Gold has halted its upward movement as it attempts to consolidate at new all-time highs around $3,045

Author: Irina Yanina

10:41 2025-03-19 UTC+2

1423

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 19. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:01 2025-03-19 UTC+2

1378

- Technical analysis

Trading Signals for EUR/USD for March 19-21, 2025: sell below 1.0900 (+2/8 Murray + 21 SMA)

If the euro falls and consolidates below 1.09 and below the 21 SMA in the coming hours, this could be seen as an opportunity to sell with targets at 1.0830, the Murray 8/8 level, around 1.742, and finally 1.0642.Author: Dimitrios Zappas

15:01 2025-03-19 UTC+2

1318

- The latest news from the US srock market

Author: Andreeva Natalya

11:52 2025-03-19 UTC+2

1288

- Bearish traders await support from the Fed and the Bank of England

Author: Samir Klishi

11:43 2025-03-19 UTC+2

1243

- Fundamental analysis

How Might Markets React After the Fed Meeting? (Expecting a Sharp Decline in GBP/USD and a Drop in #SPX)

Today, the market will focus on the Federal Reserve's final decision on monetary policy. It is expected to bring nothing new, so the main topic will remain the same as in recent months—the impact of Trump's policies on the U.S. economyAuthor: Pati Gani

09:27 2025-03-19 UTC+2

1228