আরও দেখুন

19.02.2025 07:17 PM

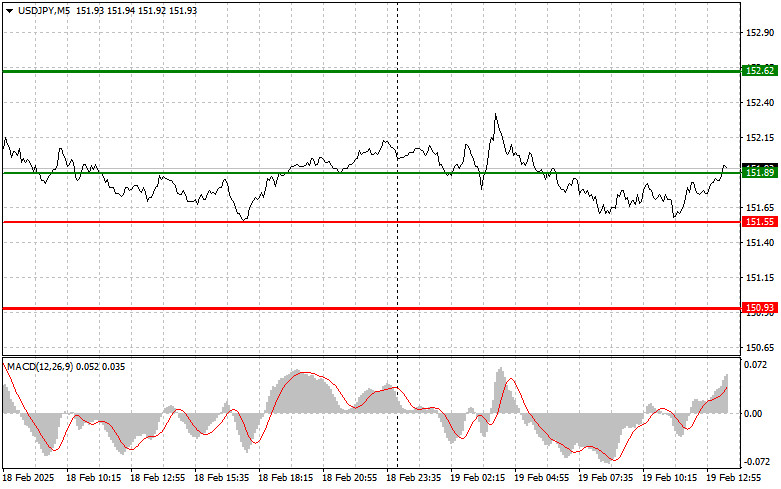

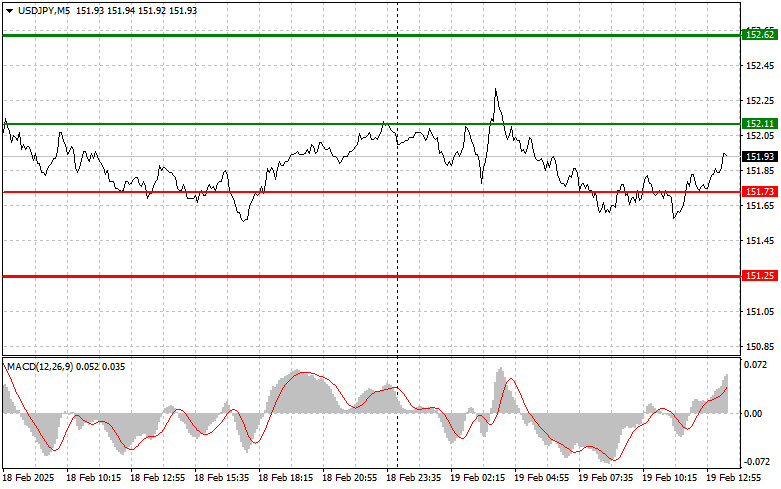

19.02.2025 07:17 PMThe price test at 151.89 occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential—especially in the bearish market environment observed recently. As a result, I did not buy the U.S. dollar.

Later in the session, U.S. housing data on building permits and housing starts could pressure the yen, provided the figures exceed economists' forecasts. Additionally, a hawkish FOMC meeting minutes report would support the dollar's strength, reinforcing expectations that interest rates will remain high for an extended period.

At the same time, domestic factors influencing the yen should not be ignored. Any hints from Bank of Japan officials about continued rate hikes could significantly strengthen the Japanese currency. Investors will closely monitor statements regarding inflation and economic growth prospects in Japan.

For intraday trading, I will focus on executing Scenario #1 and Scenario #2 for both long and short positions.

Scenario #1: Buy USD/JPY at 152.11, targeting an increase to 152.62. At 152.62, I plan to exit long positions and open a short position for a 30-35 point downward correction. A bullish move in the pair is likely only after strong U.S. economic data. Before entering, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: A buy setup is also valid if 151.73 is tested twice, while MACD is in the oversold zone. This would indicate limited downward potential and a likely reversal toward 152.11 and 152.62.

Scenario #1: Sell USD/JPY after a break below 151.73, leading to a quick decline toward 151.25. At 151.25, I will exit short positions and enter a long trade in the opposite direction for a 20-25 point retracement. Selling pressure is expected only if the FOMC minutes indicate a dovish stance. Before selling, confirm that MACD is below the zero mark and beginning to decline.

Scenario #2: Another short opportunity arises if 152.11 is tested twice, while MACD is in the overbought zone. This would suggest a reversal downward, with a target of 151.73 and 151.25.

Beginner forex traders should be extremely cautious when entering the market. Before major economic releases, it is best to stay on the sidelines to avoid sharp price fluctuations. If trading during news events, always set stop-loss orders to minimize potential losses. Trading without stop-loss protection can lead to rapid account depletion, especially when managing large positions without proper risk management.

For consistent trading success, it is essential to follow a structured plan like the one outlined above. Making impulsive trades based on short-term market movements is a losing strategy for intraday traders.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।

যখন MACD সূচকটি শূন্যের নিচের দিকে নামতে শুরু করেছিল ঠিক তখনই এই পেয়ারের মূল্য 147.11 লেভেল টেস্ট করেছিল, যা ডলার বিক্রির জন্য একটি সঠিক এন্ট্রি পয়েন্ট নিশ্চিত করেছিল। এর ফলে

যখন MACD সূচকটি শূন্যের উপরে উঠতে শুরু করেছিল ঠিক তখনই এই পেয়ারের মূল্য 1.3469-এর লেভেল টেস্ট করেছিল, যা পাউন্ড কেনার জন্য সঠিক এন্ট্রি পয়েন্ট নিশ্চিত করেছিল এবং এর ফলে

যখন MACD সূচকটি শূন্যের উপরে উঠতে শুরু করেছিল তখন এই পেয়ারের মূল্য 1.1679 লেভেল টেস্ট করেছিল, যা ইউরো কেনার জন্য সঠিক এন্ট্রি পয়েন্ট নিশ্চিত করেছিল এবং এর ফলে এই পেয়ারের

যখন MACD সূচকটি ইতোমধ্যেই শূন্যের অনেক উপরে ছিল তখন এই পেয়ারের মূল্য প্রথমবার 147.20 লেভেল টেস্ট করেছিল, যা এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনাকে সীমিত করেছিল। এই কারণেই আমি ডলার

যখন MACD সূচকটি ইতোমধ্যেই শূন্যের উল্লেখযোগ্যভাবে নিচে নেমে গিয়েছিল তখন এই পেয়ারের মূল্য 1.3498 লেভেল টেস্ট করেছিল, যা এই পেয়ারের মূল্যের নিম্নমুখী হওয়ার সম্ভাবনাকে সীমিত করেছিল। এই কারণেই আমি পাউন্ড

ইউরোর ট্রেডের বিশ্লেষণ এবং টিপস যখন MACD সূচকটি ইতোমধ্যেই শূন্যের অনেক উপরে ছিল তখন এই পেয়ারের মূল্য প্রথমবার 1.1674 লেভেল টেস্ট করেছিল, যা এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনাকে সীমিত

যখন MACD সূচকটি সবেমাত্র শূন্যের নিচের দিকে নামতে শুরু করে তখন এই পেয়ারের মূল্য 147.96 লেভেল টেস্ট করেছিল, যা ডলার বিক্রির জন্য সঠিক এন্ট্রি নিশ্চিত করেছে। এর ফলে, এই পেয়ারের

যখন MACD সূচকটি ইতোমধ্যেই শূন্যের বেশ উপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্য প্রথমবার 1.3445 লেভেল টেস্ট করেছিল, যা এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনাকে সীমিত করেছিল। দ্বিতীয়বার 1.3445 লেভেল

যখন MACD সূচকটি সবেমাত্র শূন্যের উপরে উঠতে শুরু করে তখন এই পেয়ারের মূল্য 1.1599-এর লেভেল টেস্ট করেছিল। এটি ইউরো কেনার জন্য সঠিক এন্ট্রি পয়েন্ট নিশ্চিত করেছে। এর ফলে, এই পেয়ারের

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.